Northern Lights Announces Acquisition of the Secret Pass Gold Project in Arizona

Northern Lights Resources Corp. (CSE:NLR) (the “Company” or “Northern Lights”) is pleased to announce that it has entered into a definitive agreement to acquire a 100% interest in the Secret Pass Gold Project (“Secret Pass Gold Project” or the “Property”) located in Mohave County, northwestern Arizona (the “Transaction”)

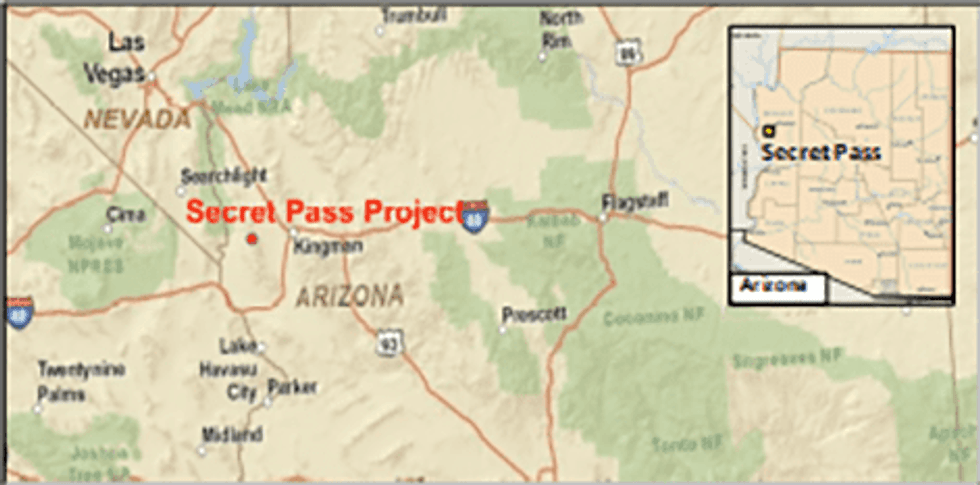

Northern Lights Resources Corp. (CSE:NLR) (the “Company” or “Northern Lights”) is pleased to announce that it has entered into a definitive agreement to acquire a 100% interest in the Secret Pass Gold Project (“Secret Pass Gold Project” or the “Property”) located in Mohave County, northwestern Arizona (the “Transaction”) as shown on Figure 1.

Secret Pass consists of 84 unpatented lode mining claims comprising 655.6 hectares (1,620 acres) of claims under the administration of the US Bureau of Land Management (“BLM”) and 212.4 hectares (524.9 acres) for a total of 868 hectares (2,145 acres).

Figure 1: Location Map Secret Pass Gold Project

The Transaction

Northern Lights entered into a definitive agreement, executed on July 12, 2019, with a private Arizona resident (the “Seller”) to acquire 100% interest in the Secret Pass Gold Project (the “Agreement”).

Under the terms of the Agreement, Northern Lights holds an exclusive option to acquire the Project (the “Option”) up until midnight Pacific daylight time on August 21, 2019 (the “Option Expiry Date”). Northern Lights is planning to complete its due diligence on the project prior to the Option Expiry Date. Company management is planning to be on site at the Project during the week beginning July 15, to conduct due diligence.

Upon exercise of the Option, Northern Lights Resources agrees to make the following consideration payments:

- a)Within 5 working days following the exercise of the Option, Northern Lights will pay the Seller a cash consideration of US$75,000;

- b)Within 30 days following the exercise of the Option, Northern Lights will issue 2,000,000 common shares of Northern Lights to the Seller; and

- c)Under the terms of the Agreement Northern Lights will make the following additional payments:

- i)On or before August 28, 2019, a payment of US$150,000; plus

- ii)On or before October 15, 2019, a final payment of US$125,000.

Upon completion of the final payment on or before October 15, 2019, 100% ownership of the Project will be transferred to Northern Lights or its nominee free of any third party royalties.

Other than the applicable Arizona State and BLM mineral production royalties there are no third party royalties payable on revenues produced from the Secret Pass Gold Project.

Completion of the Transaction is subject to approval of the CSE and other regulatory bodies as required.

In summary, Northern Lights has the option to acquire the 100% ownership of the Secret Pass Gold Project for total consideration payments of US$350,000 cash and 2,000,000 million shares of Northern Lights.

Northern Lights Chief Executive Officer, Jason Bahnsen commented: “The Secret Pass Gold Project Transaction represents an excellent opportunity for Northern Lights to acquire a high value exploration gold project at a very attractive price. The property will be 100% owned by Northern Lights and is free of third party royalties. Only 10% of the license area has been explored. There are over 13 km of gold bearing structures offering significant exploration potential for the project. Management believes this acquisition will generate significant value for Northern Lights shareholders.”

The Secret Pass Gold Project

- 1)The Oatman-Katherine Gold District – a Prolific Historic Gold Mining District

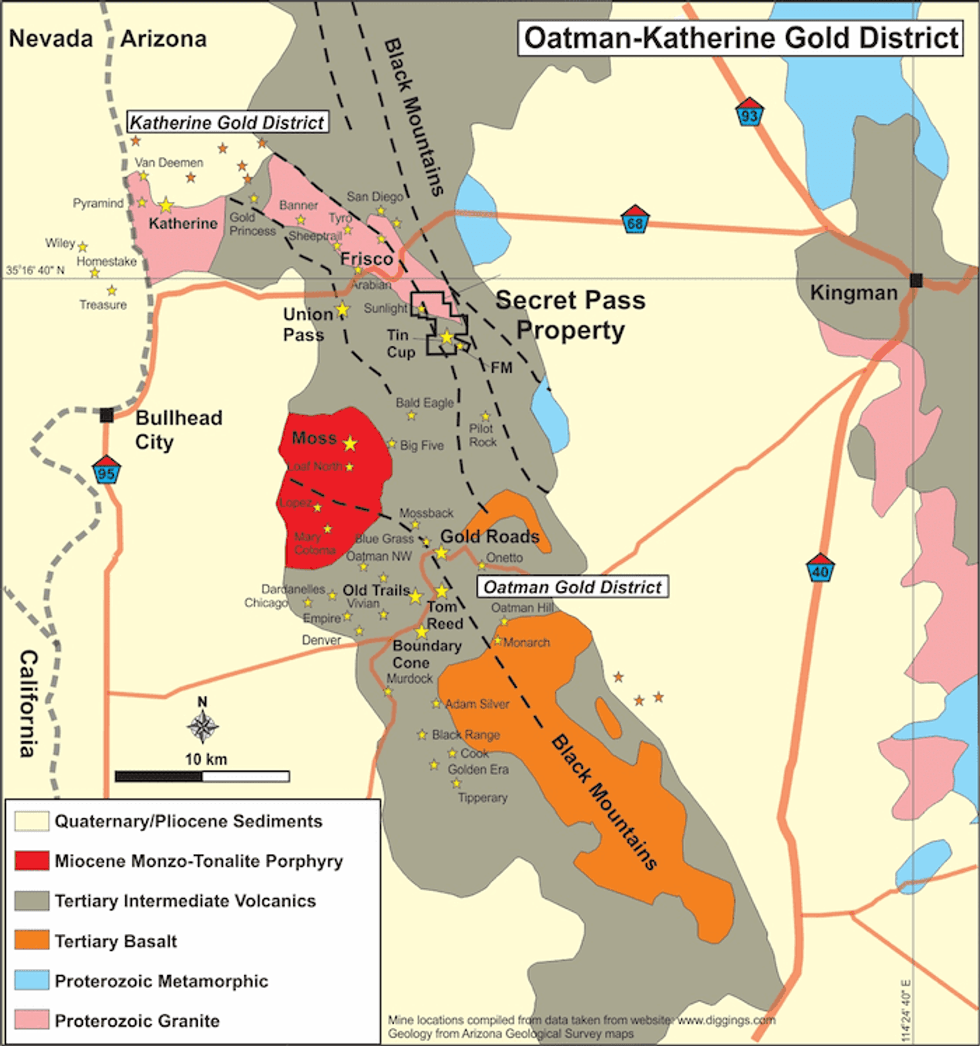

As illustrated on Figure 2, the Secret Pass Project is located in the famous Oatman-Katherine Gold District of northwestern Arizona, close to the Nevada and California State borders. The Oatman-Katherine Gold District was established in 1863 and historically is Arizona’s third largest gold producing area. Between 1870 and 1980 it is estimated the district produced over two million ounces of gold and one million ounces of silver. The district includes many historic mines and workings with over 80 separate mines reporting production. Current operating mines in the area include the Moss mine owned by Northern Vertex Corp., an open pit heap leach operation that reached commercial production in September 2018, and Para Resources Inc. that reported starting underground production at its Gold Roads Project in February 2019.

Figure 2: Oatman-Katherine Gold District, Arizona

- 2)Geology, Previous Production and Exploration Work

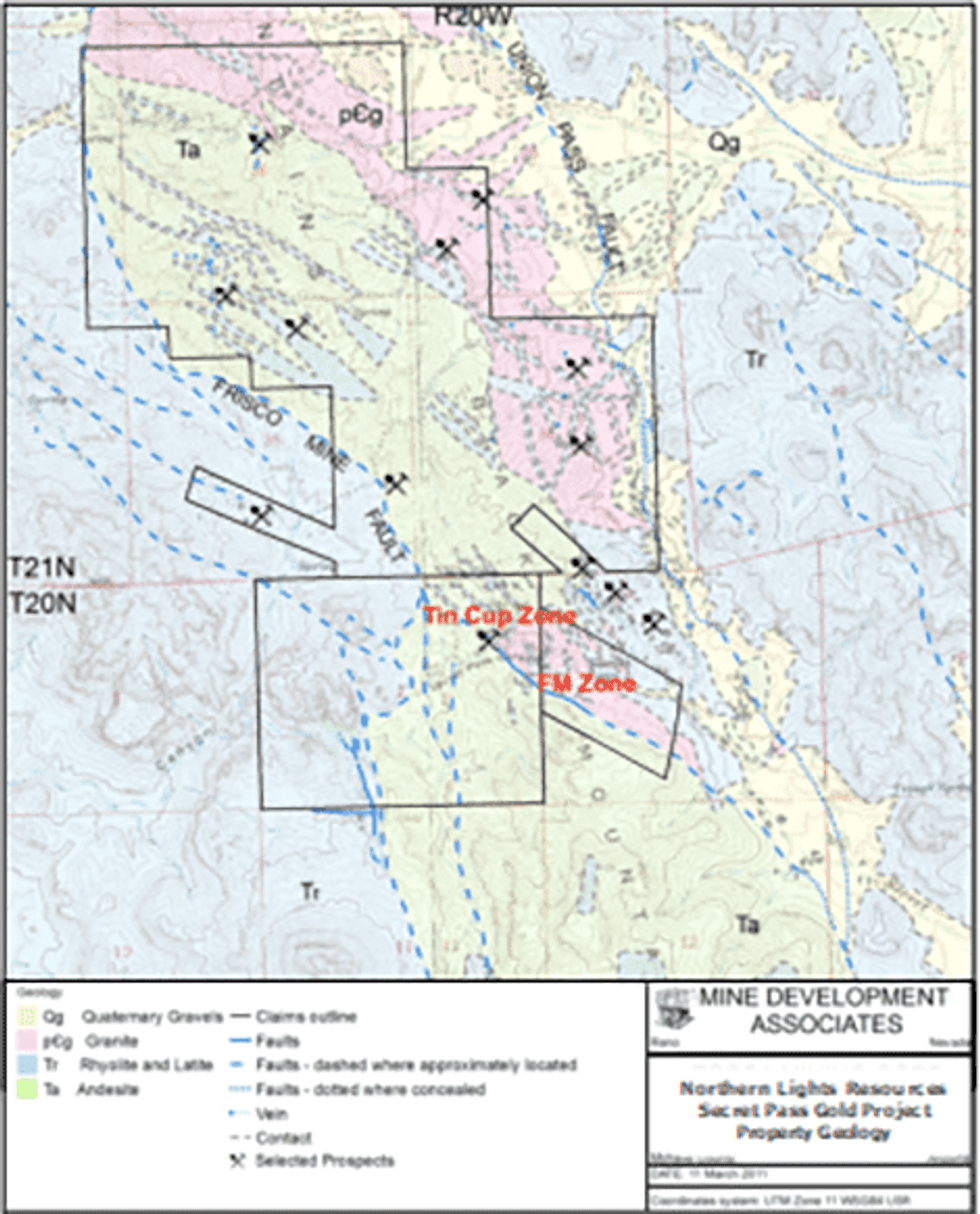

The main structural feature in the region is an imbricated system of shallow to steeply dipping faults that trend north-northwest. With reference to Figure 2 this fault system has been traced for approximately 65 km extending from the Oatman District in the south, through the Secret Pass-Frisco Mine area, into the Katherine Gold District. As illustrated on Figure 3, two regional structures, the Union Pass and the Frisco Mine faults, transect the Secret Pass property. Numerous gold showings and prospects are associated with the Union Pass and Frisco Mine faults, and some have reported limited gold production. The Oatman District is located approximately 13 km south of Secret Pass property, and has produced over two million ounces of gold.

Figure 3: Secret Pass Project Geology and Historic Mine Workings

Mining records indicate that there are 10 historic mine workings located in the Secret Pass license area. The Tin Cup and the FM gold prospects were extensively explored and drilled by Santa Fe Mining and Fischer-Watt from 1984 to 1991. A total of 14,000 metres of drilling was completed in 126 holes including 114 reverse circulation and 12 core holes.

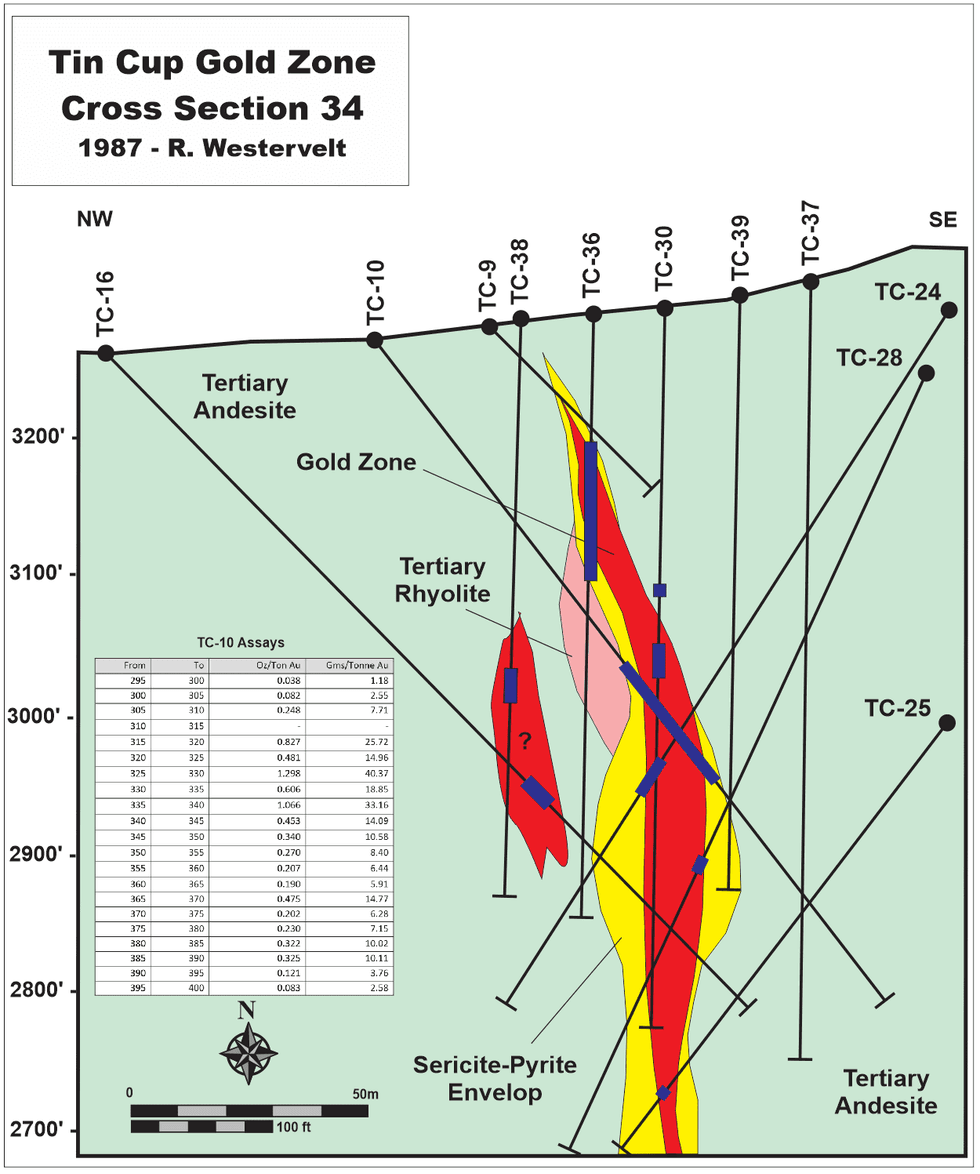

The Tin Cup Gold Zone is localized along the steeply northeast-dipping Frisco Mine Fault. The gold mineralization is hosted by Tertiary andesite and associated with the margins of rhyolite dykes that occur as lenses within the Frisco Mine Fault. A few of the deepest drill holes intersect gold mineralization in the Proterozoic basement granite.

The mineralized zone has a strike length of approximately 245 metres and a drill-indicated depth of up to 180 metres, both open along strike and depth. High-grade mineralization greater than 3 g/t Au, is localized in a 3.0 to 7.6 metres wide, steeply northeast-dipping structure that occurs within a much wider mineralized fault zone that ranges from 30 to 45 metres in width. The mineralization has a northwest plunge and is considered to be open at depth. Surface oxidation extends to a depth of up to approximately 120 metres.

The FM Gold Zone is also controlled by the northwest-trending Frisco Mine Fault that dips steeply to the southwest. Gold mineralization at the FM zone is hosted exclusively by granite and rhyolite and has a strike length of approximately 200 metres and extends to a depth of up to 120 metres, open along strike and depth.

The zone of mineralization ranges from 13 to 30 metres in width at the surface and then transitions into distinct 3.0 to 8.0 meter near-vertical, low-grade (<1.5 g/t Au) structures at depth. Depth of oxidation is variable but is generally extends to a depth of 75 to 100 metres.

Two geological models have been proposed for the Secret Pass gold mineralization. The first model is the epithermal bonanza style veining and hanging wall stockwork setting, with gold mineralization the result of repeated boiling events. This style of mineralization is prevalent in the Oatman Gold District. The second model is a low-angle detachment fault setting, with gold deposition occurring at an oxidation-reduction boundary. This style of mineralization is present at the Union Pass located approximately 6.4 km to northwest of the Secret Pass Gold Project.

Tin Cup Mine

The Tin Cup mine reportedly produced several hundred tons of mineralized material grading 15 g/t (0.5 oz/t) to 31 g/t (1 oz/t) of gold. Historic workings from the 1930’s included an open pit and an inclined shaft to a depth of 21 metres (70 ft) with minor underground level workings. There has been no known production from the Tin Cup Mine since the 1930’s.

During the period from 1984 to 1991 drilling program, significant gold mineralization was intersected in a number of holes in the Tin Cup Gold Zone. As illustrated in Figure 4, gold assays ranging as high as 40 g/t Au over significant widths at depths ranging from 30 to 180 metres below surface. These results are historical in nature and a qualified person has not done sufficient work to verify these previous drilling intersections.

Figure 4: Historical Cross Section of Tin Cup Gold Zone

(Modified from Arrowstar Resources NI 43 – 101 Report, May 4, 2016. Note this information is historical and has not been verified by a qualified person under the guidelines of NI 43-101)

In summary, the Secret Pass property is transected by two major gold bearing regional structures, the Frisco Mine and Union Pass faults. These faults have combined strike length in excess of 13 km on the property. The last exploration program was completed on the Secret Pass property was in 1991 and was entirely focused on the Tin Cup and FM gold zones which accounts for less than 10% of the total license area. Only the area between Tin Cup and FM gold zones has been drill tested over a strike length of 1.2 km. and very limited surface exploration was conducted on the structures located outside of Tin Cup and FM gold zones.

The scientific and technical data contained in this news release was reviewed and approved by Gary Artmont (Fellow Member AUSIMM #312718), Head of Geology and qualified person to Northern Lights Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Or

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth oriented exploration and development company that is advancing the Medicine Springs Project located in Nevada. Northern Lights is earning a 100% equity interest in the Medicine Springs Project, a prospective silver – zinc – lead property located in southeastern Elko County, Nevada.

Northern Lights Resources trades under the ticker of “NLR” on the CSE. This and other Northern Lights Resources news releases can be viewed at www.sedar.comand www.northernlightsresources.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Click here to connect with Northern Lights Resources (CSE:NLR) for an Investor Presentation.

Source: www.thenewswire.com