Drill Tracker Weekly: Geopacific Reports High-grade Results at Prospect 150

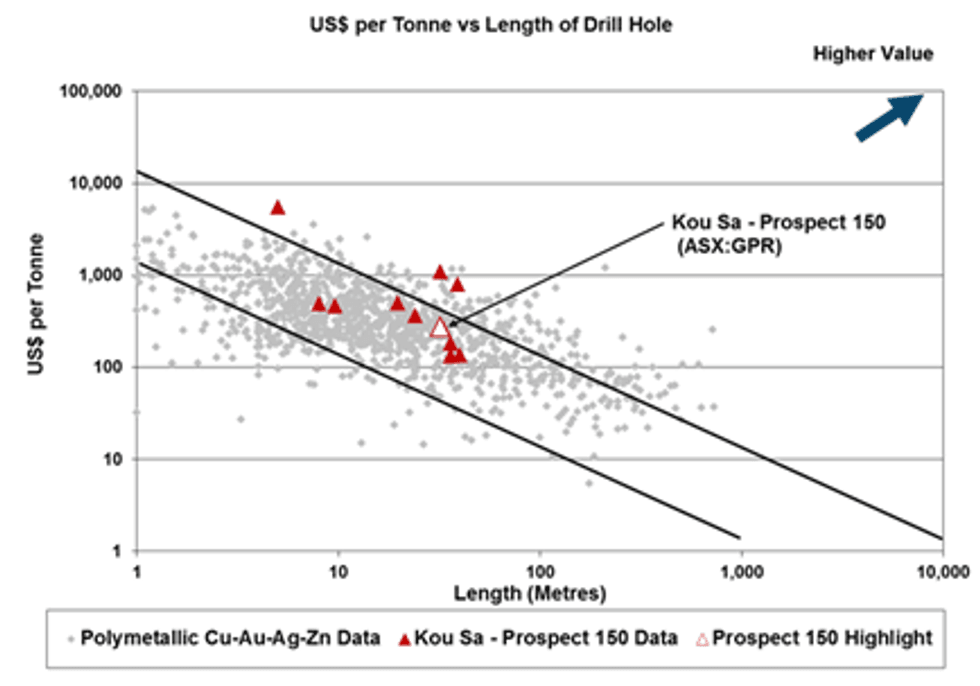

Geopacific Resources announced additional reverse-circulation drill results from its Kou Sa project in Cambodia. Highlights include 36 meters grading 15.71 g/t gold, 49.52 g/t silver, 1.18% copper and 0.34% zinc starting at a depth of 8 meters.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Geopacific Resources (ASX:GPR)

Price: $0.06

Market cap: $23 million

Cash estimate: $2 million

Project: Kou Sa

Country: Cambodia

Ownership: 100 percent

Resources: N/A

Project status: Exploration, resource in late 2015

- Geopacific Resources announced additional reverse circulation (RC) drilling results from its 100% owned Kou Sa project in Cambodia. The project was initially discovered in the 1960’s by the BGRM (French Geological Survey) and was left abandoned since the Vietnam conflict. The Company acquired the project from a private Korean investor for an initial January 2015 payment of US$ 1.4 after the due diligence period (which included drilling) and subsequent US$14 payments over 18 months to July 2016.

- Highlights from the recent RC drilling includes 36 metres grading 15.71 g/t Au, 49.52 g/t Ag, 1.18% Cu and 0.34% Zn starting at a depth of 8 metres. An additional hole intersected 32 metres of 4.26 g/t Au, 20.81 g/t Ag, 1.25% Cu and 0.34% Zn from 4 metres depth. True widths of the zones vary due to the prosed multi-stage mineralization as noted below.

- The Company believes the high-grade mineralization may be related to rising fluids from a buried copper-gold porphyry body. As the fluids rise to surface, they may have been trapped by impermeable layers (silica alteration in the volcanic rocks) thus forming flat layers of copper rich material. As the pressure builds below the silicified barrier, cracks appear and gold rich fluids enter to close the fracture along the feeder system. Prospect 150 is typical of the sealed model with flat mineralized zones and later higher-grade gold mineralization. Prospect 160 to the south appears to be typical of narrow high-grade feeder structures without the flat lying mineralized zone beneath the impermeable seal.

- The Company has very effectively used surface IP to target the shallow mineralization and has recently completed a deep dipole-dipole IP geophysical survey to target depth extensions to the current mineralized zones as well as a possible porphyry at depth.

- A March 2015 metallurgical report predicts a clean concentrate with good recoveries up to 98.4% for Cu, 94.1% Au and 91.1% Ag.

Development history and key intervals: Discovered by BGRM (French government) in 1960′s. Abandoned during Vietnam war. Acquired from Korean investment group in March 2013.

Discovery hole prospect 150 (April 4, 2014): 3.9 metres @ 16.47 g/t Au, 4.95% Cu

Current holes (prospect 150): 36 metres @ 15.71 g/t Au, 49 g/t Ag, 1.18% Cu, 0.34% Zn; 32 metres @ 4.26 g/t Au, 20 g/t Ag, 1.25% Cu, 0.34% Zn

Risks Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

1. The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following company: Balmoral Resources Ltd. (TSX.BAR).

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.