Copper Fox Metals and its wholly owned subsidiary, Desert Fox Van Dyke Co., are pleased to report that it has filed a technical report on Sedar, which includes an updated resource estimation for the Van Dyke copper project.

Copper Fox Metals Inc. (“Copper Fox” or the “Company”) (TSXV:CUU) (OTC Pink:CPFXF) and its wholly owned subsidiary, Desert Fox Van Dyke Co., are pleased to report that it has filed on SEDAR a National Instrument 43-101 (“NI 43-101”) Technical Report (the “Technical Report”) which includes an updated resource estimation for the Van Dyke copper project located in the Globe-Miami mining district of Arizona.

The Technical Report is titled “Technical Report and Updated Resource Estimate for the Van Dyke Copper Project” dated May 4, 2020 and was prepared by Moose Mountain Technical Services (“MMTS”). The effective date of the Technical Report is January 9, 2020 and the resource estimate was disclosed in a news release dated March 25, 2020. Highlights are:

Highlights:

- The exploration potential for additional resources is extensive to the south and at depth.

- Metallurgical testwork indicates that the deposit is amenable to recovery using in-situ leaching (ISL) with an estimated metallurgical recovery of 90%.

- Recommendations include a combined eight-hole (4,500m) drilling, metallurgical, geotechnical and hydrogeological program estimated to cost US$2.13 million.

- Additional engineering studies to update the PEA.

Elmer B. Stewart, President and CEO of Copper Fox stated, “The 2019 work has significantly changed the understanding of the origin and mineral potential of the Van Dyke project. The highlighted results of the updated resource estimate include: 1) an upgrade of a portion of the resource to the Indicated category; 2) an overall 50% increase in soluble copper content; and 3) a potentially 2km long extension of the Van Dyke deposit to the southwest. The Technical Report recommends a drilling program and additional engineering studies which highlights the exploration potential to add value by expanding the limits of the Van Dyke project.”

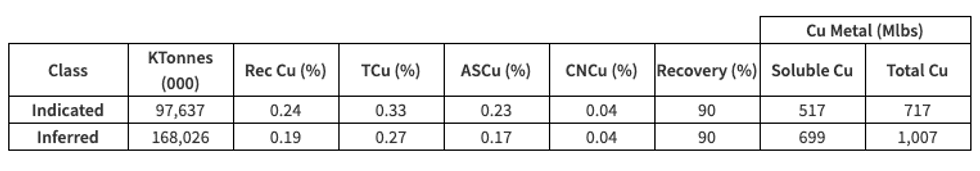

The updated Resource Estimate for the Van Dyke project is summarized in the table below (see news release dated March 25, 2020 for details):

Resource Estimate for the Van Dyke Deposit, effective date January 9, 2020:

M(lbs)=millions of pounds, (%)=percent, ASCu=acid soluble copper, CNCu=cyanide soluble copper, Rec Cu(%)=estimated recoverable copper grade, Soluble Cu=sum of ASCu + CNCu, Total Cu=total copper

Notes for Table:

- The “reasonable prospects for eventual economic extraction” shape has been created based on a copper price of US$2.80/lb, employment of in-situ leach extraction methods, processing costs of US$0.60/lb copper, and all in operating and sustaining costs of $US1.25/tonne, a recovery of 90% for total soluble copper and an average Specific Gravity of 2.6t/m3.

- Approximate drill-hole spacings is 80m for Indicated Mineral Resources

- The average dip of the deposit within the Indicated and Inferred Mineral Resource outlines is 20 degrees. Vertical thickness of the mineralized envelope ranges from 40m to over 200m.

- Numbers may not add due to rounding.

Cautionary Note to Investors:

While the terms “measured (mineral) resource”, “indicated (mineral) resource” and “inferred (mineral) resource” are recognized and required by National Instrument 43-101 – Standards of Disclosure for Mineral Projects, investors are cautioned that except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic viability. Investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded into mineral reserves. Additionally, investors are cautioned that inferred mineral resources have a high degree of uncertainty as to their existence, as to whether they can be economically or legally mined, or will ever be upgraded to a higher category.

Investors are advised that current Mineral Resources are not current Mineral Reserves and do not have demonstrated economic viability.

Recommended Exploration Program:

The recommended program is estimated to cost $US2.13 million; the main components of which are outlined below:

- Diamond Drilling & Analysis: an 8-hole (4,500m) program to test the extension of the Van Dyke deposit to the southwest and collect whole core samples for additional metallurgical testwork.

- Down-Hole Geophysics: Downhole acoustic televiewer survey to collect geotechnical data on rock mass characteristics such as fracture orientations and density.

- Metallurgical Testwork: 6-8 pressure leach tests on whole core from select areas of the deposit to obtain additional data on copper recoveries, leach time, reagent consumption and solution chemistry.

- Hydrogeology: Installation of piezometers to obtain additional data on water level fluctuations and sampling points for ground water geochemical analyses.

Recommendations for Ongoing Engineering Studies:

Recommendations for ongoing engineering studies include: run a pilot ISL test; update the Cost Estimate, Geotechnical and Water Management Studies; and then revise the Van Dyke ISL PEA project dated December 18, 2015 using the updated resource estimate. The estimated cost for this work is $US10 million.

Exploration Potential:

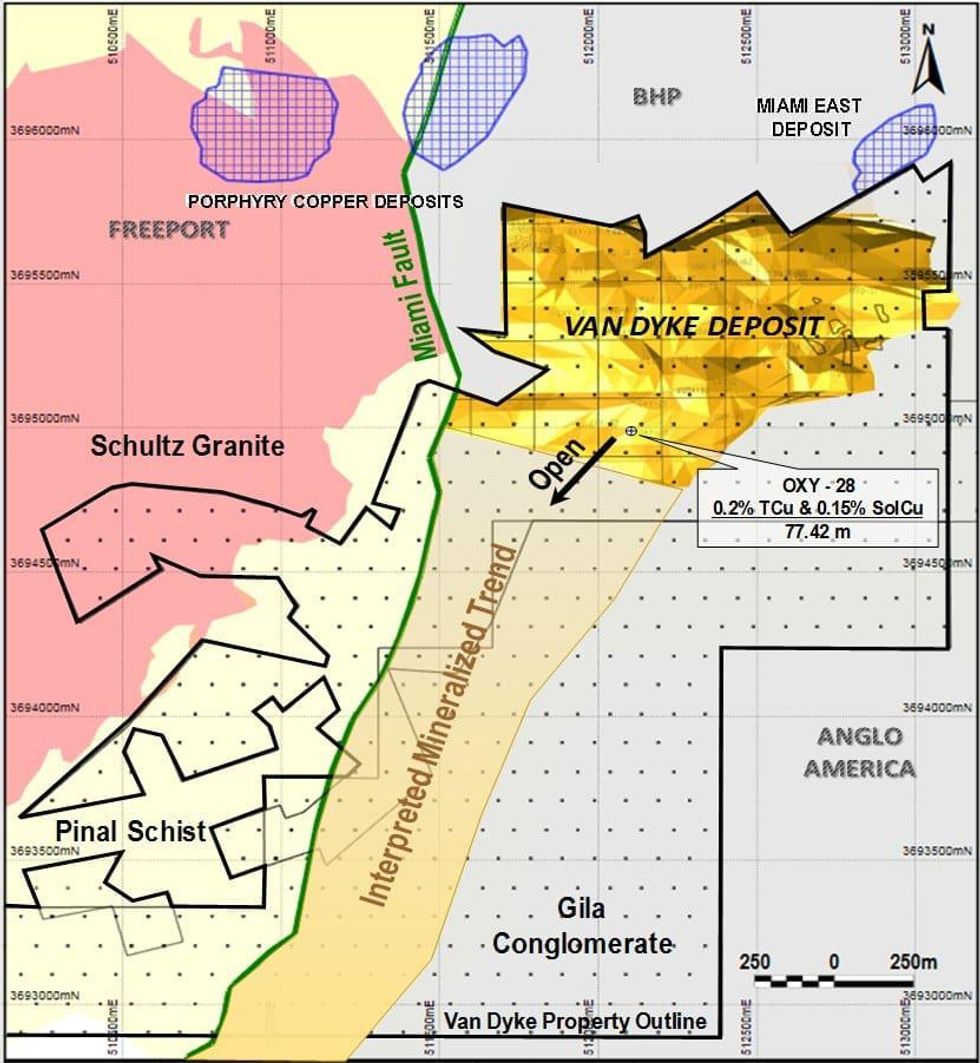

Updating the geological model for the Van Dyke deposit included the review and compilation of all available historical geological, geophysical and drilling reports on work completed on the Van Dyke project since the late 1960s. In 1970, Occidental Minerals identified the Azurite target approximately 2km south of the Van Dyke deposit.

The review completed in 2019 did not locate any reports on activities completed on the Azurite target, however, several maps showing the results of an Induced Potential survey and exploration activities for this target were reviewed. Historical exploration activities include:

- three drill holes;

- several long surface trenches; and

- nine outcrops containing secondary (azurite) copper mineralization.

The updated resource estimate combined with historical exploration results suggests that the area of the project extending from the southwest edge of the Van Dyke deposit to the Azurite target is a high priority exploration target, see map below:

Figure 1: Van Dyke exploration potential

Qualified Persons:

Sue Bird – P.Eng. of MMTS is the Qualified Person (“QP”) who prepared the mineral resource estimate, T. Meintjes – P.Eng., of MMTS is the QP who completed the metallurgical review and analyses and R. Lane – P.Geo., of MMTS is the QP who compiled and reviewed the QA/QC for the resource estimate disclosed in this news release. Ms. Bird, as the QP, has approved the scientific and technical content of this news release. Elmer B. Stewart, MSc. P. Geol., President of Copper Fox, is the Company’s nominated QP pursuant to National Instrument 43-101, Standards for Disclosure for Mineral Projects, and has reviewed the scientific and technical information disclosed in this news release. Mr. Stewart is not independent of Copper Fox.

About Copper Fox:

Copper Fox is a Tier 1 Canadian resource company listed on the TSX Venture Exchange (TSXV: CUU) focused on copper exploration and development in Canada and the United States. The principal assets of Copper Fox and its wholly owned Canadian and United States subsidiaries, being Northern Fox Copper Inc. and Desert Fox Copper Inc., are the 25% interest in the Schaft Creek Joint Venture with Teck Resources Limited on the Schaft Creek copper-gold-molybdenum-silver project located in northwestern British Columbia and a 100% ownership of the Van Dyke oxide copper project located in Miami, Arizona. For more information on Copper Fox’s other mineral properties and investments visit the Company’s website at https://www.copperfoxmetals.com.

For additional information contact: Investor line 1-844-464-2820 or Lynn Ball, at 1-403-264-2820.

On behalf of the Board of Directors

Elmer B. Stewart

President and Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and forward-looking information within the meaning of the Canadian securities laws (collectively, “forward-looking information”). Forward-looking information is generally identifiable by use of the words “believes,” “may,” “plans,” “will,” “anticipates,” “intends,” “budgets”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release include statements regarding: the exploration potential for additional resources; anticipated metallurgical recoveries and methods; recommendations for future work on the Van Dyke project; potential components and estimated costs of future exploration and studies; expanding the limits of the Van Dyke project; and statements about Copper Fox’s strategy, future operations, prospects and the plans of management. Information concerning mineral resource estimates also may be deemed to be forward-looking information in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Information concerning indicated and inferred mineral resource estimates also may be deemed to be forward-looking information in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined.

In connection with the forward-looking information contained in this news release, Copper Fox and its subsidiary have made numerous assumptions regarding, among other things: the geological, metallurgical, engineering, financial and economic advice that Copper Fox has received is reliable and is based upon practices and methodologies which are consistent with industry standards; and the stability of economic and market conditions. While Copper Fox considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which could cause Copper Fox’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include among others: the recommended additional metallurgical testwork on the Van Dyke copper deposit may not result in copper recoveries as favorable as presented in the metallurgical testwork or recover any copper at all; uncertainties relating to interpretation of the previous drill results and the geology, continuity and grade of the Van Dyke deposit; the recommendations of the Technical Report may not be completed as suggested, or at all; the actual mineralization in the Van Dyke deposit may not be as favorable as suggested by the resource estimate; the indicated and inferred resource estimate for the Van Dyke deposit may not be reliable or indicative of any commercial benefit to Copper Fox; the possibility that future drilling on the Van Dyke project may not occur on a timely basis, or at all; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects; the uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; fluctuations in copper prices and demand; currency exchange rates; and conditions in the financial markets and the overall economy may deteriorate.

A more complete discussion of the risks and uncertainties facing Copper Fox is disclosed in Copper Fox’s continuous disclosure filings with Canadian securities regulatory authorities at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Copper Fox disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.