Water Ways Technologies Inc. (TSXV:WWT) (“Water Ways” or the “Company”) reports today its financial and business results and is pleased to provide highlights and comments on the results for the three months ended June 30, 2019.

Water Ways Technologies Inc. (TSXV:WWT) (“Water Ways” or the “Company”) reports today its financial and business results and is pleased to provide highlights and comments on the results for the three months ended June 30, 2019. The Company’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”).

Ohad Haber, President, CEO and Chairman of the Board of Water Ways, commented: “The Company continues to witness development and expansion upon our listing on the TSX-V in the last quarter. We continue to increase our global footprint in the cannabis industry with the launch of CANNAWAYS with the intention of position Water Ways as a key technology provider to cannabis cultivators around the world.” Mr. Haber continued: “Completion of the Heartnut Grove acquisition provides us the platform to build a presence in the North American farming community and irrigation market. Simultaneously, we are entering new markets in Central Asia and South America and strengthening our existing markets such as Ethiopia with various new project delivered and to be delivered in the following months.” Mr. Haber continued: “While our revenue was slightly lower, compared to the same period in 2018, our project pipeline and new commercial accounts continue to expand, and we expect to recognize the revenue from the projects sourced in the first half of 2019 in subsequent quarters. We have never in the past had the level of activity we are witnessing and caution that as a cyclical agri-based business, it will take time for revenue from current activity to be recognized. We look forward to providing more exciting updates as the Company continues to expand its global footprint.”

Financial Highlights for the second quarter ended June 30, 20191

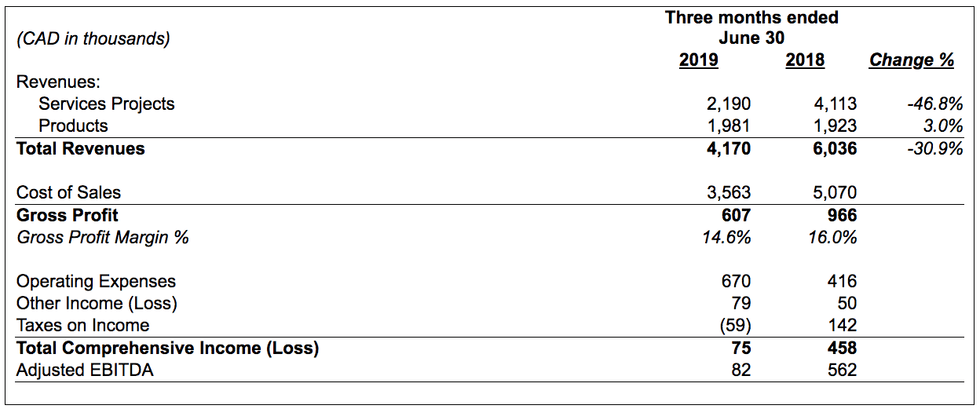

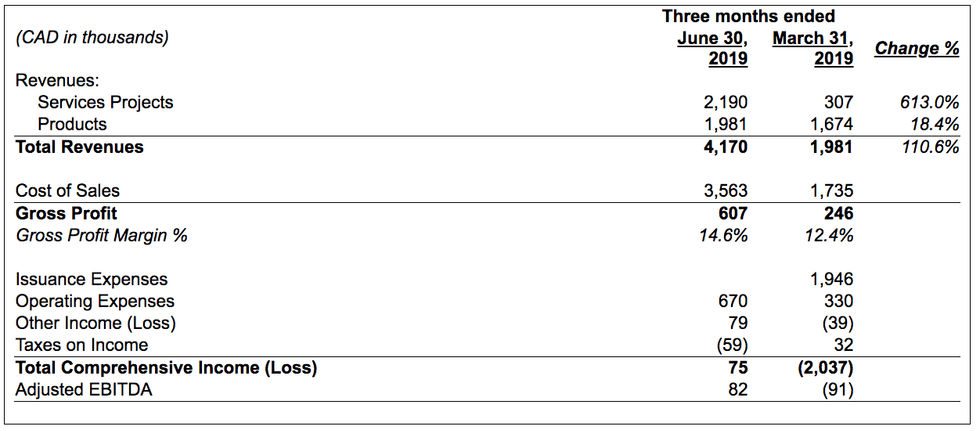

The following are financial highlights of Water Ways’ operating results for the three months ended June 30, 2019, compared to the three months ended June 30, 2018 and the first quarter ended March 31, 2019:

- Revenue was C$4.17 million for the three months ended June 30, 2019 as compared to C$6.04 million for the three months ended June 30, 2018 and compared to C$1.98 million for the three months ended March 31, 2019.

- The recognized revenues from service projects amounted to C$2.19 million for the three months ended June 30, 2019 as compared to C$4.11 million for the three months ended June 30, 2018 and compared to C$0.31 million for the three months ended March 31, 2019. The decrease compared to the same quarter in 2018 was mainly due to the shift in revenue recognized for the projects being completed the first half of 2019 to the second half of 2019. In addition, the Company is currently in the process of finalizing a substantial number of irrigation projects in China, Colombia, Israel and other countries, which are expected to be signed up in the second half of 2019, at which point the Company will begin recognizing the revenue once they are formally onboarded by the Company and are in the process of being completed. The Company estimates that the total value of pipeline of these projects irrigation projects will exceed C$5.3 million, of which two projects are in the final stages of signing (representing the value of approximately C$2.0 million) and the balance expected to be derived from projects in China that the Company has been in developing and onboarding since the end of 2018.

- The revenues from sales of products amounted to C$1.98 million for the three months ended June 30, 2019, up approximately 18.4% from C$1.65 million for the three months ended March 31, 2019, and in-line with the C$1.92 million for the three months ended June 30, 2018. The Company’s major focus in 2019 has been preparation and business development efforts to do a sales push in South America, which has resulted in new relationships with the distributors that the Company expects to result in additional re-order business in 2019 and beyond. The increase in revenue in the second quarter of 2019 from the first quarter of 2019 was mainly as a result of these efforts and specifically as a result of increase in sales in Peru, as well as a large order received from one of the leading flower growers in South America.

- Overall gross profit for the three months ended June 30, 2019 was C$607 thousand, which represents a gross margin of approximately 14.6%), compared to C$966 thousand for the three months ended June 30, 2018 (which represents a gross margin of 16%) and up from C$246 thousand for the three months ended March 31, 2019 (which represents a gross margin of approximately 12.4%). The decrease in gross profit from the previous year was primarily associated with the decrease in revenues from service projects over the period in 2018, due to recognition of certain projects being pushed into the second half of 2019. The decrease in the overall gross margin was primarily due to a decrease in the gross margin from the project services division, associated with higher costs entering new markets and mainly being attributed to the Company’s recent projects in Uzbekistan, which was the Company’s first project in Central Asia. Furthermore, the Company incurred commission expenses to its Chinese agent for the projects in China and the Company’s plans to establishing a new subsidiary in China in the next six months, in the effort to secure new business and increase sales growth in that region next year.

- Operating expenses were C$670 thousand for the three months ended June 30, 2019 as compared to C$416 thousand for the three months ended June 30, 2018 and compared to C$330 thousand for the three months ended March 31, 2019. The increase in selling, general and administrative expenses in Q2 2019 was due to an increase in wages in first half of 2019, as the Company hired additional staff to support accelerating sales efforts worldwide and the entry into the cannabis irrigation business. The Company had also incurred additional expenses in connection with the financings and its “going public” process.

- Total comprehensive income for the Company was C$75 thousand for the three months ended June 30, 2019 compared to total comprehensive income of C$458 thousand for the three months ended June 30, 2018 and compared to a total comprehensive loss of C$2,037 thousand in the first quarter of 2019. The Company believes that a lot of one time and new market entry costs have been incurred in the first half of 2019 and as the Company realizes the fruits of growth efforts that it has undertaken in the last 18 months and continues to scale its business in various units across the globe the financial performance metrics will become better reflect its profitability.

- The Company had cash and cash equivalents of C$812 thousand as of June 30, 2019, as compared to C$317 thousand as of December 31, 2018.

Water Ways Technologies Financial Results Summary

The following tables set forth consolidated statements of financial information of Irri-Al-Tal Ltd. (“Irri-Al-Tal”) and Heartnut Grove WWT Inc. (“Heartnut”), wholly owned subsidiaries of the Company, since the reverse-takeover transaction between Irri-Al-Tal and the Company has occurred during the first quarter ended March 31, 2019.

Financial Highlights for the second quarter ended June 30, 2019 in YoY comparison to the second quarter ended June 30, 2018

Financial Highlights for the second quarter ended June 30, 2019 in QoQ comparison to the first quarter ended March 31, 2019

Business Highlights for the first quarter ended June 30, 2019

- Cannabis Sectors Expansion

Launch of CANNAWAYS

In July 2019, the Company announced the launch of CANNAWAYS, an Internet of Things controlled irrigation and fertilization system for cannabis cultivators and growers, which is one of the first systems in the world that is designed specifically for cannabis growers and cultivators. The CANNAWAYS system was developed in Israel and had been already successfully tested at one cannabis cultivation site.The CANNAWAYS system will be sold and marketed first in Canada via the Company’s recently established Canadian subsidiary, Heartnut Grove WWT Inc. (see details below). The Company also intends to showcase the CANNAWAYS technology in the coming months at several cannabis shows internationally.

Canada

Following the successful implementation of a Cannabis project in Israel and one in Colombia, the Company has put a substantial amount of effort to penetrate the Canadian cannabis and hemp cultivation markets. Through its recent established subsidiary Heartnut Grove WWT Inc., the Company intends to penetrate the market by establishing ongoing distribution relationship with buyers of irrigation and cultivation equipment throughout the country.Europe and Latin America

The Company is currently in negotiations to deliver turnkey irrigation solutions to cannabis and hemp cultivators in several European and Latin American countries and in Israel. The Company has entered an understanding with a veteran of the cannabis growing business and a former CEO of one of the first licensed producers in South America to single-source commercial cannabis and CBD Hemp cultivation solutions including dehumidification, lighting technologies, irrigation, fertigation and benching.Israel – Medical Cannabis

The Company gained experience through its delivery of an irrigation, fertigation and Internet of Things control system to an Israeli subsidiary of Cronos Group (TSX: CRON), which is a greenhouse cultivation project located at Kibbutz Gan Shmuel, approximately 50km north of Tel Aviv. Hence, the Company is currently in the process of submitting bids for similar projects to a number of future licensed producers in the Israeli market. The Company expects to receive at least one additional project in Israel by the end of 2019.

- Canadian Acquisition

In June 2019, the Company closed the acquisition of certain assets of Heartnut Grove Inc. (“Heartnut”), a Canadian distributor of irrigation and agriculture components, established in 2004 and based in Mount Brydges, Ontario.

Heartnut reported its year ended October 31, 2018 with sales of approximately C$3.74 million and associated costs of approximately $C3.07 million2, which include the cost of goods sold and operating costs.

Water Ways intends to leverage Heartnut’s business relationships with the Canadian farming community to market and sell irrigation projects and components to the growing needs of Canadian cannabis licensed producers.

Water Ways established a wholly owned Canadian subsidiary named Heartnut Grove WWT Inc. that acquired certain of Heartnut’s assets including its customer base, inventory, certain equipment and goodwill for total consideration of C$500 thousand.

The Heartnut acquisition provides Water Ways exposure to the Canadian irrigation market by utilizing the established network and relationships that Heartnut’s management has built over the years and provide a point of entry into Canadian irrigation and cannabis irrigation market. While the Company has done business on four continents, this acquisition provides it the first permanent base of operations in North America.

- Business Development

Central Asia – Uzbekistan

In July 2019, the Company completed its first irrigation project in Uzbekistan, which valued approximately C$480 thousand and was recognized in Q2 2019. The project irrigates via drip irrigation technology servicing a field of 160 hectares of cotton and includes a 20 km3 reservoir for sedimentation. The irrigation solution has been fully delivered to the client after a completion of the quality assurance inspection, and the operation of the system will start in Q3 2019 with agronomic and technical assistance from the Company. Water Ways believes that drip irrigation for cotton will be part of the Uzbekistan government’s national plan for water and soil conservation.East Africa – Ethiopia

In July 2019, the Company signed two new irrigation projects in Ethiopia. The first project consists of the installation of advanced irrigation technology assembled at a 3,000-hectare sugar cane field and the supply of various components. The value of this project is approximately C$600 thousand and the Company expects it to be delivered and installed in the next several months. The second project consists of the upgrade of an existing 25-hectare herb greenhouse, valued approximately C$200 thousand. Both projects are guaranteed by letter of credits and the payments to the Company are expected in Q4 2019.South America

In August 2019, Water Ways received a purchase order, from one of the South America’s leading flower growers, to deliver over 30 high tech water treatment solutions. The purchase order is valued at approximately C$1.5 million with the first systems to be delivered in Q4 2019 and the balance over a course of a few following months. The system would be tested by the client for over a year in field tests and once fully accepted, the Company will receive the full order for over 30 systems.

- Appointment of Market Maker: In May 2019, the Company engaged the services of Lakeshore Securities Inc., a member of the Investment Industry Regulatory Organization of Canada (“IIROC”) and the Canadian Investor Protection Fund (“CIPF”), to provide services as a market maker for an initial term of three months.

- Change of Auditors: In June 2019, the Company announced that it had appointed BDO – Ziv Haft Consulting and Management Ltd., the pre Securities Exchange auditor of Irri-Al-Tal Ltd., as the Company’s new auditor, replacing UHY McGovern Hurley LLP., Sagittarius Capital Corp.’s pre Securities Exchange auditor.

Additionally, the Company wishes to provide notification of a correction to its press release dated June 21st, 2019 (the “June PR”). The June PR inadvertently stated that the Company granted a total of 3,723,527 stock options when in fact the Company granted a total of 3,973,527 stock options (“Participant Options”) to directors, employees and consultants pursuant to the terms of the Company’s stock option plan. Of this amount 1,000,000 were granted to directors vesting in eight equal amounts at the end of every quarter over the next two years. 2,750,000 of the Participant Options were granted to employees, and shall vest in equal installments over the next three years, with one third having vested on June 19th, 2019, a third to vest on June 19, 2020 and the remaining amount on June 19, 2021 The remaining 223,527 of the Participant Options, were awarded to a consultant and vested on June 19th, 2019. All Participant Options shall have an exercise price of CAD$0.25.

A comprehensive discussion of Water Ways’ financial position and results of operations is provided in the Company’s Management Discussion & Analysis (“MD&A”) for the three months ended June 30, 2019 filed on SEDAR and can be found at www.sedar.com.

About Water Ways Technologies

Water Ways is the parent company of Irri-Al-Tal Ltd. (“IAT”) which is an Israeli based agriculture technology company that specializes in providing water irrigation solutions to agricultural producers. IAT competes in the global irrigation water systems market with a focus on developing solutions with commercial applications in the micro and precision irrigation segments of the overall market. At present, IAT’s main revenue streams are derived from the following business units: (i) Projects Business Unit; and (ii) Component and Equipment Sales Unit. IAT was founded in 2003 by Mr. Ohad Haber with a view of capitalizing on the opportunities presented by micro and smart irrigation, while also making a positive mark on society by making these technologies more widely available, especially in developing markets such as Africa and Latin America. IAT’s past projects include vineyards, water reservoirs, fish farms, fresh produce cooling rooms and more, in over 15 countries.

For more information, please contact

Ronnie Jaegermann

Director

+972-54-4202054

ronnie@irri-altal.com

https://www.water-ways-technologies.com/

Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking information” as such term is defined in applicable Canadian securities legislation. The words “may”, “would”, “could”, “should”, “potential”, “will”, “seek”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions as they relate to Water Ways. All statements other than statements of historical fact may be forward-looking information. Such statements reflect Water Ways’ current views and intentions with respect to future events, and current information available to Water Ways, and are subject to certain risks, uncertainties and assumptions. Material factors or assumptions were applied in providing forward-looking information. Many factors could cause the actual results, performance or achievements that may be expressed or implied by such forward-looking information to vary from those described herein should one or more of these risks or uncertainties materialize. Should any factor affect Water Ways in an unexpected manner, or should assumptions underlying the forward-looking information prove incorrect, the actual results or events may differ materially from the results or events predicted. Any such forward-looking information is expressly qualified in its entirety by this cautionary statement. Moreover, Water Ways does not assume responsibility for the accuracy or completeness of such forward-looking information. The forward-looking information included in this press release is made as of the date of this press release and Water Ways undertakes no obligation to publicly update or revise any forward-looking information, other than as required by applicable law. Water Ways’ results and forward-looking information and calculations may be affected by fluctuations in exchange rates. All figures are in Canadian dollars unless otherwise indicated.

Click here to connect with Water Ways Technologies (TSXV:WWT) for an Investor Presentation.

Source: www.globenewswire.com