Tilray Enters Retail Market with Store Owner Acquisition

Tilray has signed a deal to acquire FOUR20, an adult-use cannabis retail operator based in Calgary, Alberta, in an all-share agreement valued at C$110 million

Tilray (NASDAQ:TLRY) is one of the latest cannabis companies to push into the retail space.

On Thursday (August 29), the BC-based cannabis firm announced it had signed a deal to acquire all of the issued and outstanding securities of 420 Investments (FOUR20) in an all-share agreement valued at C$110 million.

FOUR20 is an adult-use cannabis retail operator based in Calgary, Alberta, and currently has six active brick-and-mortar locations in the province.

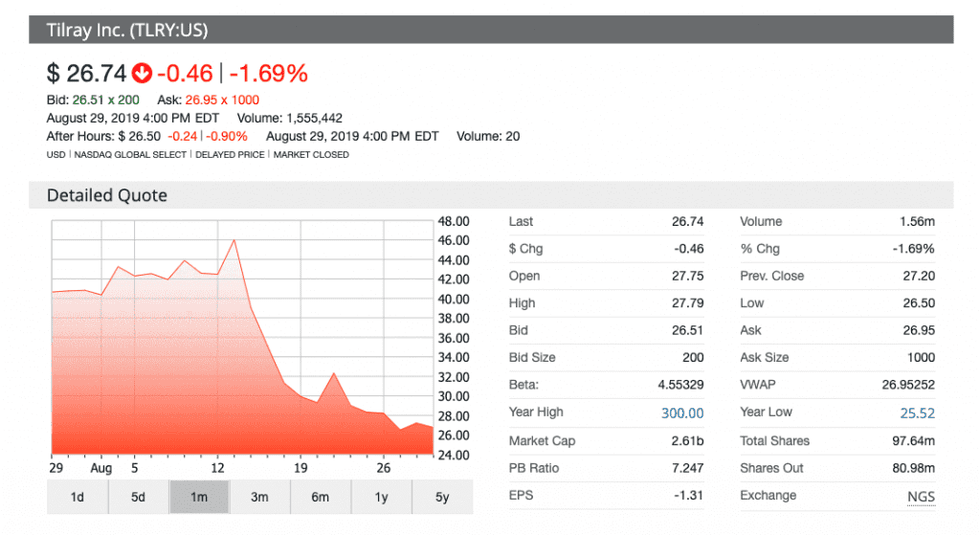

Shares of the company opened at US$27.61 on Thursday. Tilray prices saw a bit of fluctuation over the trading day eventually closing at US$26.74, representing a price decrease of 1.69 percent for the day

Tilray shares have slumped sharply in August following its Q2 2019 earnings report, in which the company posted a net loss of US$35.1 million, or US$0.36 per share, for the quarter. The company reached a year-high of US$100.15 in mid-January, since then the value of its shares has dropped by 73 percent.

Tilray will give FOUR20 C$70 million in class 2 common shares when the deal is completed and an additional C$40 million in common shares with the achievement of certain performance milestones.

The deal is set to be completed by the end of the first quarter of 2020.

In addition to its current lineup of stores, FOUR20 is also bringing 16 secured locations across Alberta as part of the transaction. These stores are planned to open in Canmore, Calgary and Edmonton, according to Tilray.

In February, FOUR20 reported it had reached C$5 million in sales, an amount based off of two operating locations in Calgary.

While the retailer only holds assets in Alberta, the marijuana producer said it plans on using FOUR20’s retail expertise to expand into other provincial markets in Canada.

Tilray’s chief corporate development officer Andrew Pucher said his company aims to enhance the purchasing experience for consumers as the market prepares for the legalization of edibles and infused products later this year.

Tilray will be completing the deal through its subsidiary, High Park Holdings, which will be subject to regulatory, shareholder and court approval.

Once the transaction is completed, FOUR20 will operate as a wholly-owned subsidiary of Tilray. The producer also indicated the store would offer branded products under the High Park name.

FOUR20’s current stores are minimalist in their style and boast teams of experts to help consumers with their purchases.

Alberta’s marijuana market has been highly active since Canada legalized the recreational use of cannabis. Between October 2018 and June 2019, the western Canadian province spent the most on recreational cannabis in the country at C$123.7 million, recent data from Statistics Canada shows.

Ontario and Quebec came in second and third place with C$121.6 million and C$119.2 million spent, respectively. The Northwest Territories spent the least at C$14.7 million.

Alberta also has the most retail locations for legal marijuana in the country, totaling at 277 stores. Ontario is a distant second with 75 stores having just given out 42 retail licenses as part of its recent second lottery.

Tilray’s results for its Q2 2019 period noted a 371.1 percent increase in revenue to US$45.9 million compared with the same earnings report from last year. The company attributed the increase, in part, to the acquisition of Manitoba Harvest in February. According to the press release, Manitoba Harvest is the world’s largest producer of hemp food products and distributes a variety of hemp-based consumer goods in over 16,000 stores across Canada and the US.

While total revenue was at US$42 million excluding excise tax, the producer still reported net losses of US$35.1 million, or US$0.36 per share, for the quarter.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.