The Flowr Corporation Announces Results for the Fourth Quarter and Full Year 2018

Records Revenues on First Sales of Cannabis

Company to Host Conference Call and Webcast Today at 5PM ET

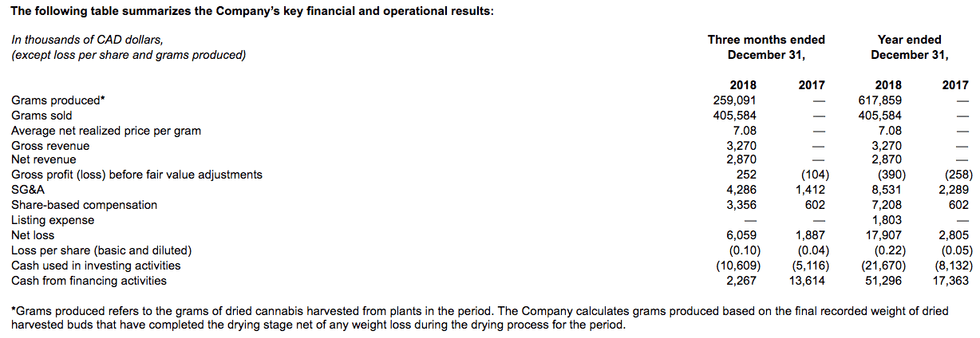

- Sold nearly 406 kgs of premium cannabis despite having only 20% of the grow rooms in Kelowna 1 operational in Q4 18

- Gross revenue of C$3.3 million, net revenue of C$2.9 million, with an average net realized price of C$7.08/gram after receiving sales license in August 2018

- Broke ground on 50,000 square foot, first-of-its-kind R&D Facility in partnership with Hawthorne Canada, a subsidiary of The Scotts Miracle-Gro Company

The Flowr Corporation (TSXV:FLWR; OTC:FLWPF) (“Flowr” or the “Company”), a Canadian Licensed Producer and global leader in premium cannabis R&D, innovation, and cultivation, today announced its results for the fourth quarter and full year ended December 31, 2018. The Company’s financial statements and management’s discussion and analysis for the periods are available on SEDAR at www.sedar.com. All results are reported in Canadian Dollars.

Management Commentary

“2018 was an incredibly eventful year at Flowr and we are only just getting started. As a global leader in the premium cannabis industry, our design and cultivation expertise along with our superior IP know-how enables us to grow high quality cannabis on a large scale at what we believe will be industry-leading yields. The revenue numbers reflect our ability to grow and process high quality product with only a fraction of our facility and packaging area complete. Once our Kelowna 1 facility is completed in Q3 2019, our operational efficiency will only improve.”

Flowr Co-CEO Vinay Tolia continued, “The fourth quarter of 2018 marked a major milestone for Flowr, as we launched our medicinal and recreational sales channels after receiving our licenses in August 2018, and sold nearly 406 kilograms of premium cannabis, despite having only 20% of our grow rooms in Kelowna 1 operational during the quarter itself. As of today, we have 10 grow rooms in Kelowna 1 licensed for use and expect to have all 20 grow rooms fully constructed in the third quarter of 2019. Completion of Kelowna 1 should enable us to begin capitalizing on strategic growth opportunities for medicinal and recreational use with approximately 10,000 kilograms of capacity for premium cannabis flower on an annualized basis.”

Results of Operations Three Months Ended December 31, 2018, and December 31, 2017

Net loss in Q4 2018 totaled $6,059,002 which was $4,171,257 higher than the net loss in Q4 2017. The increase is mainly driven by the ramp up of the activities related to cultivation operations, harvests and sales. Key costs in Q4 2018 were cost of sales, selling, general and administrative expenses and share-based compensation partially offset by unrealized gains on changes in fair value of biological assets.

Selling, general and administrative expenditures, consisting primarily of salaries and professional fees, were $4,286,622 in Q4 2018 compared to $1,411,933 in Q4 2017. Share-based compensation was $3,356,823 in Q4 2018 compared to $601,536 in Q4 2017. Share-based compensation expense in Q4 2018 resulted from the issuance of stock options in the latter half of 2018 primarily to officers and directors of the Company.

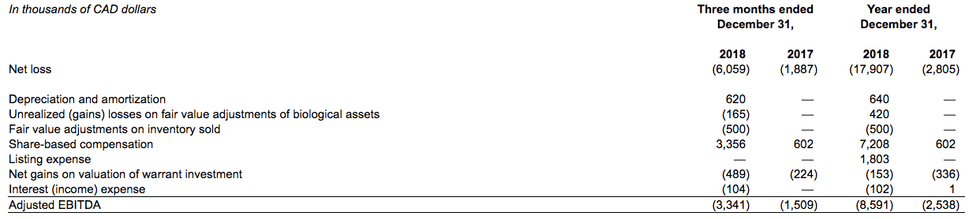

Adjusted EBITDA (Non-IFRS Measure)

Adjusted EBITDA is net loss, plus (minus) income taxes (recovery), plus (minus) interest income (expense), net, plus depreciation and amortization, plus share-based compensation, plus (minus) non-cash fair value adjustments on biological assets and inventory sold, plus listing expense costs and plus (minus) loss (gain) on investments. Management believes this measure provides useful information as it is a commonly used measure in the capital markets and as it is a close proxy for repeatable cash used by operations.

Adjusted EBITDA losses were higher for the three and twelve months ended December 31, 2018 compared to 2017 by $1,832,000 and $6,053,000, respectively, due to the ramp up of cultivation, operating activities and sales in 2018.

Recent Business Developments

- On December 20, 2018 Flowr announced that it had entered into an agreement to acquire a 19.8% interest in Holigen Holdings Limited (Holigen). Holigen is a European-based cannabis company in the process of developing large-scale cannabis cultivation facilities and Good Manufacturing Process (GMP) compliant production facilities that are expected to provide finished medical cannabis products, pharmaceutical ingredients, and plants and seeds to medical cannabis markets globally. Benefitting from Portugal’s climate, cost-effective land and labour, and the high crop yields it expects to generate by employing Flowr’s cultivation IP that has been provided by Flowr, Holigen could be among the lowest cost producers in the world. The closing of the acquisition is subject to certain customary closing conditions.

- In February 2019, another stage of construction was completed resulting in 6 additional grow rooms, similar in size to existing grow rooms, with 4 available for use and propagated with plants. Flowr expects to complete construction of Kelowna 1 by the end of Q3 2019. As of today, Flowr has a total of 10 grow rooms licensed, of which 8 are propagated with plants. Upon completion of the final stages of construction, an additional 10 grow rooms will become available.

- On February 5, 2019 Flowr announced that it submitted an application to list its common shares on The NASDAQ Capital Market (“NASDAQ”) and filed a Form 40-F Registration Statement with the U.S. Securities and Exchange Commission (“SEC”). The listing of Flowr’s shares on the NASDAQ will be subject to a number of regulatory requirements, including registration of the common shares with the SEC and a determination by the NASDAQ that Flowr has satisfied all applicable listing requirements. Subject to approval for listing, the common shares will continue to trade on the TSXV under FLWR. A trading date will be made public once all regulatory formalities are satisfied.

- On March 8, 2019 Flowr announced its FlowrRx® products are now available for purchase through Shoppers Drug Mart’s online medical cannabis site, shoppersdrugmart.ca/cannabis and that Shoppers Drug Mart will be the direct-to-patient online provider of FlowrRx® products in Canada. Medical Cannabis by Shoppers Drug Mart is currently available only to patients in Ontario. Previously FlowrRx® products were available online to patients registered via Flowr’s website.

Recent Leadership Developments

- Expansion of the R&D team with the hiring of North America’s first cannabis cultivation Doctor of Philosophy (Ph.D.) Deron Caplan as director of plant science.

- Celebrated Canadian Chef Ryan Reed to develop signature edible cannabis products. Chef Reed will collaborate closely with Flowr’s R&D Team to research and develop high-quality edibles that are expected to address the needs of a premium client.

- Promotion of Jason Broome to the role of Chief Research and Innovation Officer (CRIO). Mr. Broome previously served as Senior Vice President of Operations. As CRIO, Mr. Broome will seek to develop new high-quality products and lead Flowr’s research into cultivars, form factors and delivery systems for the global markets. He will also oversee Flowr’s state-of-the-art R&D facility, part of an exclusive partnership with Hawthorne Canada, a subsidiary of The Scotts Miracle-Gro Company.

Growth Opportunities

- Flowr is expected to begin selling a wide selection of cannabis cultivars in both clone and seed form in Q2 2019. The Company expects that its highly efficient cultivation process will allow it to produce more than 3.2 million high quality clones on an annualized basis once its initial cultivation facility is completed. These clones will be incremental to Flowr’s cultivation process and therefore will be in excess of what it needs for its retail and medical production.

- On February 12, 2019, Flowr completed the purchase of land adjacent to its Kelowna 1 facility. The Company intends to use these properties for greenhouse and outdoor production of cannabis and extraction of such other form factors (“Flowr Forest”). Pending Health Canada approval, Flowr plans to begin construction of 42 greenhouses, each of approximately 4,500 sq. ft. in size. As well, there are plans for roughly 150,000 sq. ft. of outdoor grow on the same land. The products cultivated from Flowr Forest are intended to be used for extraction in developing edibles and concentrates.

- Flowr intends to develop a second facility (“Kelowna 2”) on adjacent land parcels that have already been purchased. Kelowna 2 is expected to be four times the size of Kelowna 1 and have 80 grow rooms. The Company would require additional sources of financing to move forward with the project.

Conference Call and Webcast

Flowr will host a conference call and webcast today at 5:00 p.m. Eastern Time. A question-and-answer session will follow.

Toll Free: 1-877-705-6003

Toll/International: 1-201-493-6725

Webcast: www.flowr.ca/investors

A telephonic replay of the call will be available later that same day through Thursday, April 18, 2019. To listen to the archived call, dial Toll Free 1-844-512-2921 or Toll/International 1-412-317-6671 and enter replay pin number 13689126, or access the webcast replay via Flowr’s website.

About The Flowr Corporation

Flowr, through its subsidiaries, holds a cannabis production and sales license granted by Health Canada. With a head office in Toronto and a production facility in Kelowna, BC, Flowr builds and operates large-scale, GMP-designed cultivation facilities. Flowr’s investment in research and development along with its sense of craftsmanship and a spirit of innovation is expected to enable it to provide premium-quality cannabis that appeals to the adult-use recreational market and addresses specific patient needs in the medicinal market.

For more information, visit www.flowr.ca. Follow Flowr on Twitter: @FlowrCanada; Facebook: Flowr Canada; Instagram: @flowrcanada; and LinkedIn: The Flowr Corporation.

On behalf of The Flowr Corporation:

Vinay Tolia

Co-CEO and Director

Non-IFRS Financial Measures

This press release makes reference to certain measures that are not recognized measures under International Financial Reporting Standards (“IFRS”). These non-IFRS measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. When used, these measures are defined in such terms as to allow the reconciliation to the closest IFRS measure. These measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute to the Company’s financial information reported under IFRS. Management uses non‐IFRS measures such as Adjusted EBITDA to provide investors with supplemental information of the Company’s operating performance and thus highlight trends in the Company’s core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management believes that securities analysts, investors and other interested parties frequently use non‐IFRS measures in the evaluation of issuers. Management also uses non‐IFRS measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets, to assess its ability to meet future debt service requirements, in making capital expenditures, and to consider the business’s working capital requirements. Readers are cautioned that the non‐IFRS measures contained herein may not be appropriate for any other purpose.

Forward-Looking Information

This press release includes forward-looking information within the meaning of Canadian securities laws regarding Flowr and its business, which may include, but are not limited to: statements with respect to Holigen, including the closing of the acquisition, facilities Holigen is proposing to complete, the products it proposes to produce and sell, and the markets it proposes to operate and distribute its products in, Holigen potentially being among the lowest cost producers in the world, Flowr intending to use the Flowr Forest for greenhouse and outdoor production of cannabis and extraction of such other form factors, the Company initiating its licensing process with Health Canada and obtaining its license for Flowr Forest, the Company planning to begin construction and growing the Flowr Forest in 2019 and beyond, the products cultivated from the Flowr Forest being used for extraction in developing edibles and concentrates, the number of greenhouses, size of greenhouses, and size of the outdoor grow at the Flowr Forest, the Company intending to develop Kelowna 2, the planned size of Kelowna 2 and the number of grow rooms expected in Kelowna 2, Flowr only getting started with its planned operations and strategic direction, Flowr’s design and cultivation expertise and superior IP know-how enabling it to grow high quality cannabis on a large scale at industry leading yields, Flowr’s operational efficiency improving with the completion of the Kelowna 1 facility, Flowr having 20 grow rooms fully constructed in the third quarter of 2019, the completion of the Kelowna 1 facility enabling Flowr to begin to capitalize on strategic growth opportunities, the number of kilograms of capacity on an annualized basis, Flowr beginning to sell a wide selection of cannabis cultivars in both seed and clone form in the timeframe disclosed herein, the Company’s cultivation process allowing it to produce high quality clones, the number of clones that Flowr expects to produce on an annualized basis upon completion of the Kelowna 1 facility, the clones being incremental to the Company’s cultivation process and in excess of what it needs for its retail and medical production, the completion and timing of completion of the Kelowna 1 facility, the additional grow rooms that will become available upon completion of the Kelowna 1 facility, the listing of the Company’s common shares on the NASDAQ, the timing thereof and trading of the common shares being approved for listing, Chef Reed developing signature edible cannabis products and high quality edibles that are expected to address the needs of a premium client, the timing of the availability of edible products, Mr. Broome developing high quality products and leading Flowr’s research into cultivars, form factors and delivery systems for the global markets, Flowr being well positioned to complete its facilities build-out and ramp-up production in 2019 and capitalize on its strategic growth opportunities globally, Flowr’s investment in research and development along with its sense of craftsmanship and a spirit of innovation enabling it to provide premium-quality cannabis that appeal to the adult-use recreational market and address specific patient needs in the medicinal market and other factors. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “is expected”, “expects”, “scheduled”, “intends”, “contemplates”, “anticipates”, “believes”, “proposes” or variations (including negative and grammatical variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Such statements are based on the current expectations of Flowr’s management and are based on assumptions and subject to risks and uncertainties. Although Flowr’s management believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this press release may not occur by certain specified dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties affecting Flowr, including, but not limited to, Flowr being delayed in closing the acquisition of Holigen or such acquisition not being completed, Holigen being unable to complete construction of its proposed facilities or being unable to get the required licenses to operate such facilities, Holigen not being able to produce and/or sell the products described herein or in the markets it proposes to sell such products, Holigen not being among the lowest cost producers in the world, resulting in decreased margins, higher costs and additional financing requirements, the inability of Flowr to use the Flowr Forest for greenhouse and outdoor production of cannabis and extraction of such other form factors, as result of the inability to receive required approvals and licenses, which could have a material adverse impact on Flowr’s results of operations, financial condition and business, the number of greenhouses, size of greenhouses and/or size of outdoor production being materially less than the numbers described herein, which could materially adversely impact the products to be cultivated and produced out of the Flowr Forest and the Company’s forecasts, the Company failing to initiate its licensing process with Health Canada and/or being unable to obtain its Health Canada license for the Flowr Forest, the Company being delayed in initiating its licensing process or Health Canada not approving the license for the Flowr Forest, which could have a material adverse impact on its financial condition, results of operations and business, the Company being delayed in constructing the Flowr Forest or not being able to construct or plant the Flowr Forest at all for any reason, including as a result of not receiving required approvals or due to weather conditions, which could have a material adverse impact on Flowr’s financial condition, results of operations, business, and/or ability to compete in the other form factor markets, the products cultivated from the Flowr Forest not being used or the inability to use such products for extraction in developing edibles and concentrates, any delay in the timing that edibles and concentrates are expected to be legally sold in Canada, which could materially adversely impact Flowr’s future cash-flows and forecasts, Flowr not being in a position to launch cannabis oils and vape technologies in 2019 or not launching them at all, which could have a material adverse impact on Flowr financial results, operations and financial condition, including losing competitive advantages over other licensed producers, the Company not being able to construct the Kelowna 2 facility, which would reduce Flowr’s capacity and have an impact on future financial results, Kelowna 2 being smaller and/or containing fewer grow rooms than as described herein, which could materially reduce the Company’s future planned capacity and forecasts, Flowr not being well positioned to execute on its planned operational and strategic direction, the inability of Flowr’s design and cultivation expertise and superior IP know-how enabling it to grow high quality cannabis on a large scale at industry leading yields, Flowr’s operational efficiency not improving as a result of the completion of the Kelowna 1 facility, Flowr failing to complete the 20 grow rooms or such rooms not being fully operational on the timing described herein, which could have a material adverse impact on Flowr’s business, financial condition and results of operations, the completion of the Kelowna 1 facility not allowing Flowr to begin to capitalize on strategic growth opportunities, Flowr not achieving or producing the number of kilograms of capacity on an annualized basis as set forth herein, which could have a material adverse effect on Flowr’s business, financial condition and results of operations, Flowr not being able to or being delayed in selling a wide selection of cannabis cultivars in both seed and clone form in 2019, which could have a material adverse impact on Flowr’s business, financial condition and results of operations, the Company’s cultivation process not enabling it to produce high quality clones, Flowr not being able to produce the number of clones set forth herein or at all on annualized basis upon completion of the Kelowna 1 facility, which could have a material adverse impact on Flowr’s business, financial condition and results of operations, the clones that Flowr produces not being incremental to the Company’s cultivation process and in excess of what it needs for its retail and medical production, which could have a material adverse impact on Flowr’s business, financial condition and results of operations, the Kelowna 1 facility not being completed or completed in time, the additional grow rooms that will become available upon completion of the Kelowna 1 facility not becoming available on time or at all, which could have a material adverse impact on Flowr’s business, financial condition and results of operations, the listing of the Company’s common shares on the NASDAQ not being approved or further delayed, which could impact the liquidity of the Company’s common shares or cause a significant decline in the price of the common shares, Chef Reed not being able to develop signature edible cannabis products and high quality edibles that are expected to address the needs of a premium client, any delay in the timing of the availability of edible products, which could materially adversely impact additional revenue streams for Flowr, Mr. Broome not being able to lead and develop high quality products and Flowr’s research into cultivars, form factors and delivery systems for the global markets, which could have a material impact on Flowr’s growth and share of an addressable market, the steps taken by Flowr not preparing it financially and/or operationally for the recreational use market and/or to execute on its business strategy, Flowr not completing the build out and/or ramp-up of production in 2019, which could materially adversely impact Flowr’s financial condition, results of operations and business, Flowr not being able to execute on growth strategies, including international opportunities, which could adversely impact Flowr’s growth and future prospects, Flowr not being able to sustain its competitive advantage in cultivation and being unable to remain at the forefront of industry innovation, whether as a result of failed construction of the facilities or otherwise, Flowr not being able to meet demand or fulfill purchase orders, which could materially impact revenues and its relationships with purchasers, Flowr requiring additional financing from time to time in order to continue its operations or expand domestically or globally and such financing not being available when needed or on terms and conditions acceptable to the Company, new laws or regulations adversely affecting the Company’s business and results of operations, results of operation activities and development of projects, project cost overruns or unanticipated costs and expenses, the inability of Flowr’s products to be high quality, the inability of Flowr’s products to appeal to the adult-use recreational market and address specific patient needs in the medicinal market, the inability of Flowr to produce and distribute premium, high quality products, the inability to supply products or any delay in such supply, Flowr’s securities, the inability to generate cash flows, revenues and/or stable margins, the inability to grow organically, risks associated with the geographic markets in which Flowr operates and/or distributes its products, risks associated with fluctuations in exchange rates (including, without limitation, fluctuations in currencies), risks associated with the use of Flowr’s products to treat certain conditions, the cannabis industry and the regulation thereof, the failure to comply with applicable laws, risks relating to partnership arrangements (including the Hawthorne partnership), possible failure to realize the anticipated benefits of partnership arrangements (including the Hawthorne partnership), product launches (including, without limitation, unsuccessful product launches), the inability to launch products, the failure to obtain regulatory approvals, economic factors, market conditions, risks associated with the acquisition and/or launch of products, the equity and debt markets generally, risks associated with growth and competition (including, without limitation, with respect to Flowr’s products), general economic and stock market conditions, risks and uncertainties detailed from time to time in Flowr’s filings with the Canadian Securities Administrators and many other factors beyond the control of Flowr. Although Flowr has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking information can be guaranteed. Except as required by applicable securities laws, forward-looking information speaks only as of the date on which it is made and Flowr undertakes no obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events, or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

CONTACT INFORMATION:

U.S. MEDIA:

Tim Streeb, ICR

1-646-677-1800

tim.streeb@icrinc.com

CANADIAN MEDIA:

Rebecca Brown, Crowns Agency

1-647-456-5599

rebecca@crowns.agency

INVESTOR RELATONS:

Raphael Gross, ICR

1-203-682-8253

raphael.gross@icrinc.com

Bram Judd

The Flowr Corporation

1-647-483-7065 ext. 1520

bram@flowr.ca

Click here to connect with The Flowr Corporation (TSXV:FLWR) for an Investor Presentation.

Source: www.globenewswire.com