Colombia-based cannabis operator PharmaCielo responds to a new short seller report targeting the company, which caused its share price to decrease by over 30 percent in one day.

The cannabis industry is facing another targeted short-seller attack leading to a massive value drop.

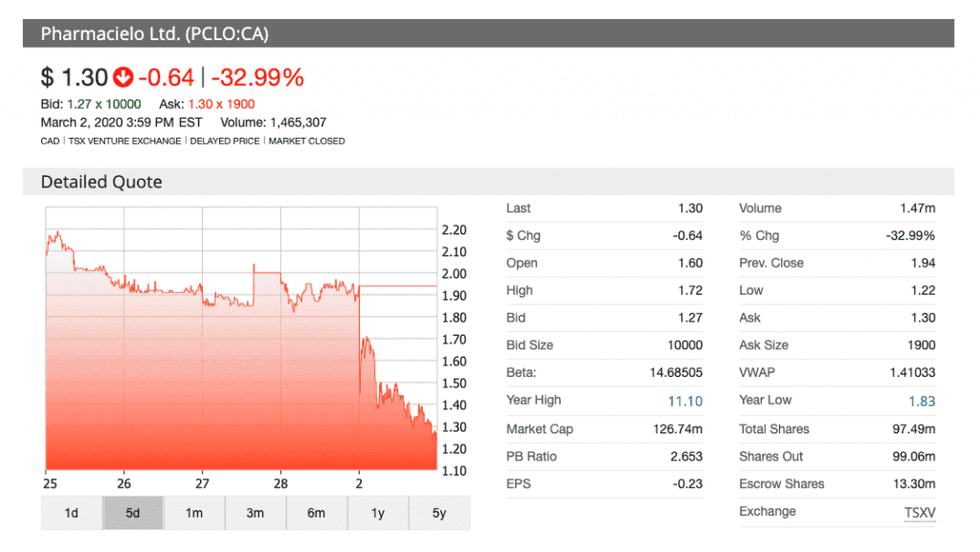

On Monday (March 2) Colombia-based operator PharmaCielo (TSXV:PCLO,OTCQX:PCLOF) opened at a price of C$1.60 in Toronto, indicating a double-digit percentage drop in its share price directly tied to new claims raised in a report.

A group known as Hindenburg Research shared with the market a new note in which the researchers pose several claims against company co-founder and former CEO Anthony Wile. The group has picked up a short position but it did not indicate a price-target for the shares of PharmaCielo.

“PharmaCielo has property, greenhouses, licenses, and some residual cash. But with essentially no revenue, continued cash burn, and management’s track record of self-enrichment and the co-founder/former CEO’s history of securities fraud charges, we believe PharmaCielo ends up as a total loss for investors,” the short sellers indicated in the note.

Hindenburg Research raised its concern over an investigation by the US Securities and Exchange Commission (SEC) into Wile. The targeted attack also called into question the firm’s operations in Colombia.

The company faced a severe drop-off in the open market following the release of the report. At the closing of Monday’s trading session, PharmaCielo ended with a price per share of C$1.30, representing a 32.99 percent decline.

In a statement issued on Tuesday (March 3) PharmaCielo said it believed the report was created as a “malicious attempt to manipulate” it’s share price.

“This report was written with the express intention of manipulating market opinion, to reward a select group of short sellers at the expense of all honest market participants,” David Attard, CEO of Pharma Cielo, said.

The company distanced itself from Wile in its statement indicating to shareholders he has not been an active participant of the management team since December 2018.

While the firm issued a comment to the publication of the report, it indicated it will also offer a response to it at a later date. PharmaCielo told shareholders it was reviewing its legal options when it came to the impact of this report.

This isn’t the first time Hindenburg Research has targeted a specific player within the cannabis industry. In December 2018, the group was involved in a now-infamous report directly targeting Canadian licensed producer (LP) Aphria (NYSE:APHA,TSX:APHA).

The research report stemmed from questions into the assets purchased by the LP as part of an expansion into Latin America. Following the turmoil from the short attack, former Aphria CEO Vic Neufeld eventually stepped down from the leadership role for the company and fellow co-founder Cole Cacciavillani also left the firm.

These are part of a continued effort by short sellers evaluating players in the cannabis capital markets.

Last year in December, Trulieve Cannabis (CSE:TRUL,OTCQX:TCNNF) faced an attack by way of a report from a group called Grizzly Research. The multi-state operator with assets and a stronghold in Florida faced a steep decline in its share price from a peak of C$17.60 reached on December 6.

Since the report by Grizzly Research went public, the US-based operator has dropped in value by 21.6 percent.

“It appears today’s report is a disingenuous attempt to manipulate Trulieve’s stock price,” the firm said at the time.

Short sellers of the cannabis industry have consistently bet against the space given the volatile rhythm of the stock market in the emerging area.

Research firm S3 Partners has tracked the development of short seller gains or losses related to cannabis. Most recently, the firm indicated shorts made substantial gains thanks to a downgrading report from financial institution Cowen.

The move provided some much-needed relief for those with short positions. “Short selling in the top 20 shorts in the sector has been absent in the sector in February after shorts were down US$102 million in mark-to-market losses in January,” Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, said in a note issued last Monday (February 24).

Dusaniwsky explained that this year shorting some of the top cannabis stocks was a costly proposition with an over 35 percent fee attached to the action.

“If short selling losses continued to mount after January’s poor short performance, we might have seen some short covering in the sector,” the short selling expert said. However, thanks to the change seen in the space, he expected the market to “see an upsurge in sector short selling.”

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.