Orchid Ventures Enters into an Acquisition of a Dispensary in Southern California

Orchid Ventures, Inc. announces that it has entered into a stock purchase agreement effective October 7, 2019.

Premium cannabis brand Orchid Ventures, Inc. (CSE:ORCD, OTC:ORVRF) (“Orchid Ventures” or the “Company”) announces that it has entered into a stock purchase agreement effective October 7, 2019, to purchase 100% (one-hundred percent) of the membership interest of San Bernardino, CA based Pure Dispensaries for a total of 5,000,000 shares of the Company’s common stock (“Payment Shares”) and $1,250,000 USD. The cash portion of the acquisition is being carried as a non-convertible note by the owner for 12 months at an interest rate of 10% per annum. The Payment Shares will be subject to resale restrictions as required by applicable securities laws and the policies of the Candian Securities Exchange (CSE). There are no finders fees, nor change of control. The acquisition is subject to certain closing conditions, including, without limitation, completion of due diligence by each party and the transfer of the city and state licenses. There can be no assurance that the acquisition will be completed as proposed or at all. The acquisition is currently expected to close in November, 2019

*renderings of construction plans show above. Retail name has not been finalized.

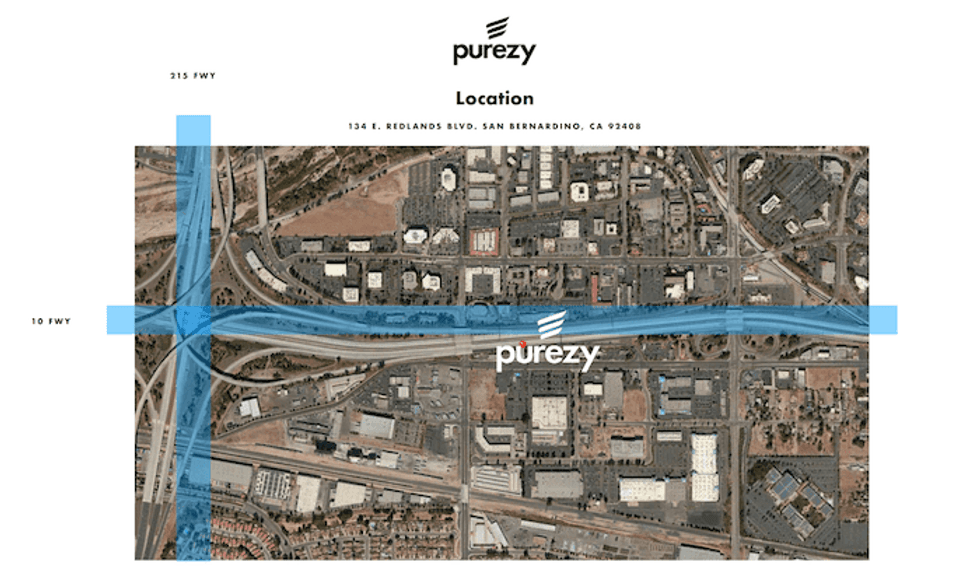

The dispensary is located at 164 West Redlands Blvd. San Bernardino, CA 92408 with a provisional retail license from the BCC (C10-0000311-LIC exp. 6/26/2020). The building is a stand-alone 7,500 sq. ft. building with freeway signage, a rooftop pole sign, and visibility located at a major freeway interchange of the I-215 and I-10 freeways.

Construction has already begun and the Company expects the retail and delivery operations to be open for business in December of 2019.

“Our new Southern California dispensary is a great addition to the growing Orchid portfolio. This transaction once again highlights our abilities to seek out only the most accretive deals and pay a fraction of what others are paying. Recent transactions of retail stores in Southern California have been in the $15MM – $23MM from what we’ve seen, which we believe is highly overvalued. For a purchase including cash and stock at a combined value of $1,650,000 USD, this comes in as the best deal for retail we’ve seen in California, and we expect this transaction to be an indicator of the relative value of retail in California. This is an ideal location and we expect to drive significant revenue from this acquisition.” says Corey Mangold, CEO & Founder of Orchid Ventures. “San Bernardino will be operated and managed directly by our amazing team at Orchid Ventures.”

“The Pure Dispensaries, LLC location has easy access and superb visibility, making it one of the most viable Cannabis locations in the Inland Empire. The decision to merge this property into Orchid Ventures’ vertical business structure as the first retail and delivery location in California, complements its assets acquired through the GreenBloom transaction,” says Merv Simchowitz, President of Pure Dispensaries, LLC. “The fact that Orchid owns leading compliant brands and controls their own supply chain in Oregon, and is building the integration for California, satisfied this priority and made this an ideal situation.” Sellers are represented by Wayne R. Johnson & Associates, PLC of Beverly Hills, CA.

None of the securities to be issued pursuant to the acquisition have been or will be registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and any securities issued pursuant to the acquisition are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Rule 506(b) of Regulation D and/or Section 4(a)(2) of the U.S. Securities Act and applicable exemptions under state securities laws. In addition, the securities issued under an exemption from the registration requirements of the U.S. Securities Act will be “restricted securities” as defined under Rule 144(a)(3) of the U.S. Securities Act and will contain the appropriate restrictive legend as required under the U.S. Securities Act.

ABOUT ORCHID ESSENTIALS

Orchid Essentials is an Irvine, CA-based multi-state operator that launched in Oregon and California in August 2017 and has since developed a mass-market brand and loyal consumer following with its premium cannabis products. Orchid’s product lines are currently sold in 350+ dispensaries across California and Oregon and are handcrafted and designed for optimal user-experience and overall enjoyment. The company’s proven processes and passion for what it does carry through into its products. The end result is an unparalleled experience for new and practiced cannabis users alike. Orchid plans to expand its operations into new national markets, as well as global markets such as Latin America and Europe. With a continued focus on brand and intellectual property development, Orchid will continue to execute strategic acquisitions to further solidify it’s vertically integrated infrastructure with the goal of becoming a dominant premium cannabis company in the United States. Orchid’s management brings significant branding, product development and distribution experience with a proven track record of scaling revenues, building value-generating partnerships and creating enterprise value. Learn more at https://orchidessentials.com/

ON BEHALF OF THE BOARD OF DIRECTORS – ORCHID VENTURES, INC.

Corey Mangold

CEO and Director

investors@orchidessentials.com

Investor Relations

Antonio Cruz

(949) 769-3859

a.cruz@orchidventures.com

The CSE does not accept responsibility for the adequacy or accuracy of this release.

Safe Harbor Statement

Except for historical information contained herein, statements in this release may be forward-looking and made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “estimate”, “expect”, “intend” and similar expressions, as they relate to Orchid Ventures, Inc. and Orchid Essentials any of its affiliates or subsidiaries (collectively, the “Company”) or its management, identify forward-looking statements. These statements are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and probably will, differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in the Company’s Canadian securities regulatory filings with sedar.com, Factors which could cause actual results to differ materially from these forward-looking statements include such factors as (i) the development and protection of our brands and other intellectual property, (ii) the need to raise capital to meet business requirements, (iii) significant fluctuations in marketing expenses, (iv) the ability to achieve and expand significant levels of revenues, or recognize net income, from the sale of our products and services, (v) the Company’s ability to conduct the business if there are changes in laws, regulations, or government policies related to cannabis, (vi) management’s ability to attract and maintain qualified personnel necessary for the development and commercialization of its planned products, and (vii) other information that may be detailed from time to time in the Company’s Canadian securities regulatory filings with sedar.com. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Click here to connect with Orchid Ventures Inc. (CSE:ORCD) for an Investor Presentation.