Nutritional High Announces Financial Results for Q1 2020 Ended Oct 31, 2019

Q1 Cannabis Sales of $6.7 million, Quarter over Quarter growth of 19 percent

Nutritional High International Inc. (“Nutritional High” or the “Company”) (CSE:EAT, OTCQB:SPLIF) is pleased to announce its financial and business results for the first quarter ended October 31, 2019.

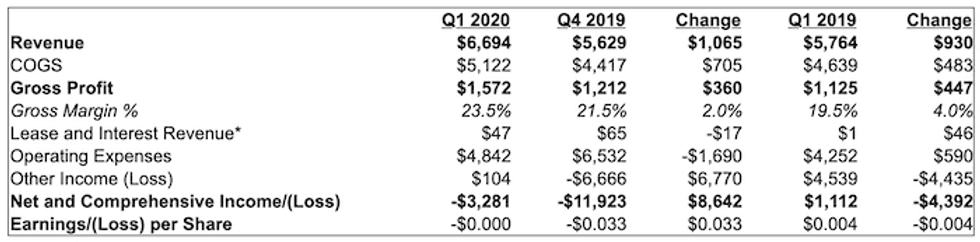

All Figures in Thousands CAD, unless otherwise stated

Green Therapeutics (Nevada) and Palo Verde (Colorado) financials are not consolidated in these results

* Historically, revenue was derived from lease and interest income; beginning fiscal Q3 2018, the Company started to earn revenue from Cannabis sales

Q1 2020 Financial Highlights:

• Revenue

• $6.7 million from the sale of cannabis related products, primarily via its distributor in California, Calyx Brands Inc. (“Calyx”), which has now become one of the leading distributors in the state catering to over 600 retailers.

• Represents a Q.o.Q increase of 19% , Y.o.Y increase of 16% and highest quarterly revenue for the Company.

• In the coming months, management fully expects to consolidate revenue and financials from Green Therapeutics, LLC (“Green Therapeutics”) and directly enter the Colorado market.

• Gross Profit of 23.5%, indicating cost of goods sold of $5.1 million including costs of product purchase, direct labor related to products sales and an allocation of overhead directly attributable to product sales. Margin improvement of 2.0% vs prior quarter and 4.0% vs prior year.

• Operating expenses of $4.8 million, a decrease of $1.7 million from the prior quarter, primarily due to one-time Q4 2019 true up of payroll taxes and reserve on inventory, along with general reduction in legal and consulting fees.

• Other Income gain of $0.1 million, an improvement of $6.8 million versus prior quarter primarily due to Q4 2019 Marley License and Trademark Impairment of $5.2 million. Excluding this, financing costs, foreign exchange gain/loss, and other items attributed to the residual change of $1.6M.

• In the coming months, management is focusing on efforts to bring on and ramp up higher margin business lines through a renewed focus on its manufacturing infrastructure in California, Oregon, Colorado and Nevada, and is taking steps toward Calyx achieving break-even followed by a sustained growth in profitability arising from its new distribution service model.

Business Highlights: Q1 2020 and Subsequent

• Calyx has continued to demonstrate its capability to consistently grow revenues and expand its distribution footprint across the State of California. For the three months ended October 31, 2019, the Company recognized Calyx’s record revenue of $6,679,276.

• In December 2019, there was a termination of the distribution relationship between Calyx and a subsidiary of Plus Products Holdings Inc which constituted a significant amount of revenue for the Company. However, over the last couple of months, Calyx has taken multiple steps towards the implementation of a new distribution service model. With a more diversified customer base and absence of any go-forward concentration risk, Calyx is able to offer a range of services from a lower cost, fulfillment-only to full-service sales and support depending on the customer needs and stage of brand lifecycle. This is complemented by recent cost re-structuring actions at the Company’s subsidiary which includes an elimination of any non-critical operational costs, a reduction in administrative headcount and a division wide pay reduction, while leaving in place its statewide sales organization to facilitate the new service model and continuous brand on-boarding.

• In Q1 2020 and subsequent, Calyx onboarded five new brand partners and the Company expects further substantial onboarding over the next 6 months. Through its revamped model featuring flexible à la carte service offerings, Calyx is proving to be the premier distribution option for brands at every stage of their growth cycle. Even with a reduced revenue base, Calyx is expecting an improvement in profitability as an outcome of both the new service model and the cost optimization carried out. While it will take some time and additional financing sources for Calyx’s new model to replace the revenue lost by the shift away from servicing Plus Products, management is confident that the new model will prove over time to be more scalable, profitable and a source of sustained competitive advantage for Calyx.

• The Company amended its asset purchase agreement with Calyx which was previously closed in escrow pending regulatory approval, to recast it as a share purchase agreement to better streamline operations and simplify regulatory compliance. The Company now holds an aggregate of 80% interest in Calyx for no additional consideration, with the option to purchase the remaining 20% for nominal consideration.

• The Nutritional High team has been working closely with Palo Verde LLC in the development, manufacturing and marketing of FLÏ™ products in Colorado and continuing to improve current facility’s operations and processes. In December 2019, Palo Verde LLC won the LeafLink List 2019 award for the best-selling vaporizer in the nation.

• In Colorado, recent regulatory changes in the State have paved the way for publicly traded companies to own the means of cannabis production and the Company is looking forward to additional ease of access to the market as a result of these changes.

• In October 2019, the Company positioned itself to be a first mover in an underexplored segment of the market by entering a binding framework agreement with Golden Triangle Health Company Ltd. (“Golden Triangle”) to manufacture and distribute Asian branded products in North America. Golden Triangle is a Thailand-based health and wellness company with a strong family of brands (the “Brands”) looking to break into the North American market. Nutritional High will be responsible for providing North American market assessments for the Brands’ products, and for those products selected will be responsible for infusion, packaging, marketing, distribution and sales in jurisdictions where those products are legal.

• On December 19, 2019, the Company appointed Robert Wilson as CFO, replacing Michael DiNapoli. Mr. Wilson is an accomplished senior executive having previously held positions in investment banking and private equity at BMO Nesbitt Burns, Mackie Research Capital and Yorkton Securities. Mr. Wilson also served as senior executive and director for a number of Canadian and US publicly listed companies where he was responsible for corporate finance, investor relations, financial and regulatory reporting, and mergers and acquisitions.

• On August 23, 2019, the Company issued a non‑brokered private placement comprised of 1,807 secured convertible debenture units (the “Debenture Units”) a price of $1,000 per Debenture Unit for an aggregate principal amount of $1,807,000. Each Convertible Debenture Unit is comprised of a $1,000 principal amount 9% subordinate secured convertible debenture and 5,000 common share purchase warrants. Each common share purchase warrant is exercisable into a common share of the Company at a price of $0.24 for 36 months from the date of issuance. The Convertible Debentures are convertible into common shares at a price of $0.20 per share at any time prior to maturity date.

• On December 30, 2019, the Company held a meeting of the unsecured debenture holders of March 2018 convertible debentures and received approval for the proposed amendments to the terms of the debentures as follows:

• A reduction in the Conversion Price from $0.60 to $0.15 until maturity of the Debentures; and

• The Company is authorized to pay the interest due on the Debentures in cash at the existing rate of 10% per annum, or through the issuance of its Common Shares at a rate of 14% per annum, at the sole discretion of the Company. Such issuance of Common Shares will be set at a price which is equal to the weighted average closing price for the Common Shares during the twenty (20) trading day period ending on the last complete trading day, five (5) days prior to the date upon which interest is due on the Debentures. (the “Interest Conversion Price”).

In accordance with the approved amendments, the Company has elected to pay the interest due on December 31, 2019 in Common Shares. Based on an Interest Conversion Price of $0.045 per share, the Company shall issue 12,339,707 Common Shares to the debenture holders.

• On December 9, 2019, the Company, through Calyx, entered into a settlement agreement with Carberry, LLC, Plus Products Holdings Inc., and Plus Products Inc. (collectively referred herein as “Plus”) to settle certain disputes relating to the service agreement entered between Calyx and Plus on February 1, 2018. Pursuant to the settlement agreement, Plus will assume responsibility for Plus‑branded inventory held by Calyx and certain trade receivables and cash balance associated with sales of Plus products. As part of this settlement agreement, the Company ceased to undertake new sales of Plus‑branded products and Plus will forbear for a period of 180 days for repayment of amount owing to Plus.

• In November 2019, the Company reached a settlement agreement with TKO Products LLC (“TKO”) whereby the Company accepted a settlement for a total receipt of US$325,000. The settlement agreement releases all matters including TKO’s counterclaim (see The Company’s press release dated July 25, 2019).

• The Company has also commenced a strategic review of the business to become more cost-efficient, with a focus on manufacturing and brand development. To assist in the review process, the Company has engaged Eight Capital as a financial advisor.

About Nutritional High International Inc.

Nutritional High is focused on developing, manufacturing and distributing products under recognized brands in the cannabis products industry, with a specific focus on edibles and oil extracts for medical and adult recreational use. The Company works exclusively with licensed facilities in jurisdictions where such activity is permitted and regulated by state law.

The Company follows a vertically integrated model with a fully developed strategy for acquisitions in extraction, production, sales, and distribution sectors of the cannabis industry. Nutritional High has brought its flagship FLÏ™ edibles and extracts product line from production to market through its wholly owned subsidiaries in California and Oregon, as well as Colorado where its FLÏ™ products are manufactured by a third-party licensed producer. In California, the Company distributes its products and products manufactured by other leading producers through its wholly owned distributor Calyx Brands Inc. and is entering the Nevada, Washington State and Canadian markets in the near future.

For updates on the Company’s activities and highlights of the Company’s press releases and other media coverage, please follow Nutritional High on Facebook, Twitter and Instagram or visit www.nutritionalhigh.com.

For further information, please contact:

David Posner

Chair of the Board

Nutritional High International Inc.

647-985-6727

Email: dposner@nutritionalhigh.com

Ethan Karayannopoulos

Director, Investor Relations

Nutritional High International Inc.

416-777-6175

Email: ethan@nutritionalhigh.com

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR OTC MARKETS GROUP INC., NOR THEIR REGULATIONS SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release may contain forward-looking statements and information based on current expectations. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Risks that may have an impact on the ability for these events to be achieved include completion of due diligence, negotiation of definitive agreements and receipt of applicable approvals. Although such statements are based on management’s reasonable assumptions, there can be no assurance that such assumptions will prove to be correct. We assume no responsibility to update or revise them to reflect new events or circumstances.

The Company’s securities have not been registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), or applicable state securities laws, and may not be offered or sold to, or for the account or benefit of, persons in the United States or “U.S. Persons”, as such term is defined in Regulation S under the U.S. Securities Act, absent registration or an applicable exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in the United States or any jurisdiction in which such offer, solicitation or sale would be unlawful.

Additionally, there are known and unknown risk factors which could cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law. Some of the risks and other factors that could cause actual results to differ materially from those expressed in forward-looking information expressed in this press release include, but are not limited to: obtaining and maintaining regulatory approvals including acquiring and renewing U.S. state, local or other licenses, the uncertainty of existing protection from U.S. federal or other prosecution, regulatory or political change such as changes in applicable laws and regulations, including U.S. state-law legalization, market and general economic conditions of the cannabis sector or otherwise.

Click here to connect with Nutritional High (CSE:EAT, OTCQB:SPLIF) for an Investor Presentation.