Hemp for Health Inc. Receives Positive Analysis for Its Test Crop Carmagnola

Hemp For Health Inc. announces lab results from test crop of Carmagnola Hemp that was planted for the 2019 growing season.

HEMP FOR HEALTH INC. (CSE:HFH) (the “Company”), a cultivator and distributor of premium CBD products in Italy and Europe, is pleased to announce its lab results from its test crop of Carmagnola Hemp that was planted for the 2019 growing season.

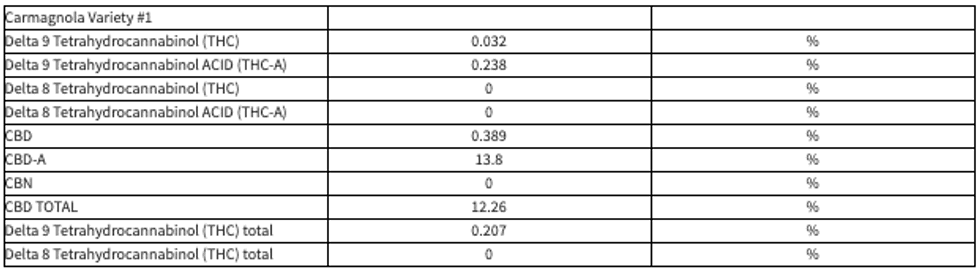

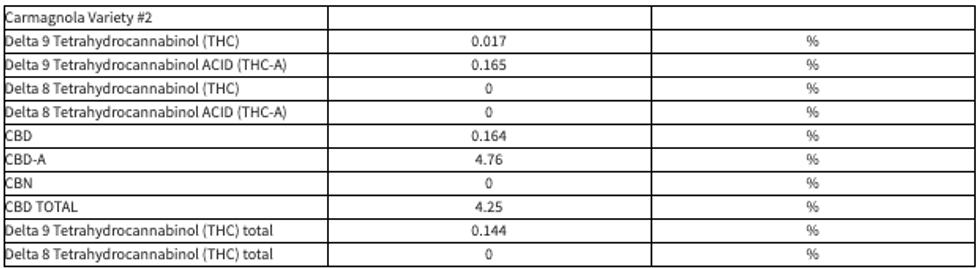

The certificate of analysis was provided by an independent laboratory, Crabion Toxicology, in Italy. The results for the two varieties of Carmagnola came back favorably with 14% CBD and 0.03 THC and 4.7% CBD and 0.01% THC. The results are listed in the following tables:

“We are pleased with the results and cultivation of this year’s test crop of Carmagnola Hemp,” reported C.E.O. and founder, Robert Eadie. “The strain which is native to Italy and recognized by the EU as a low technical cultivator with low THC is positive for our future products and the end users.”

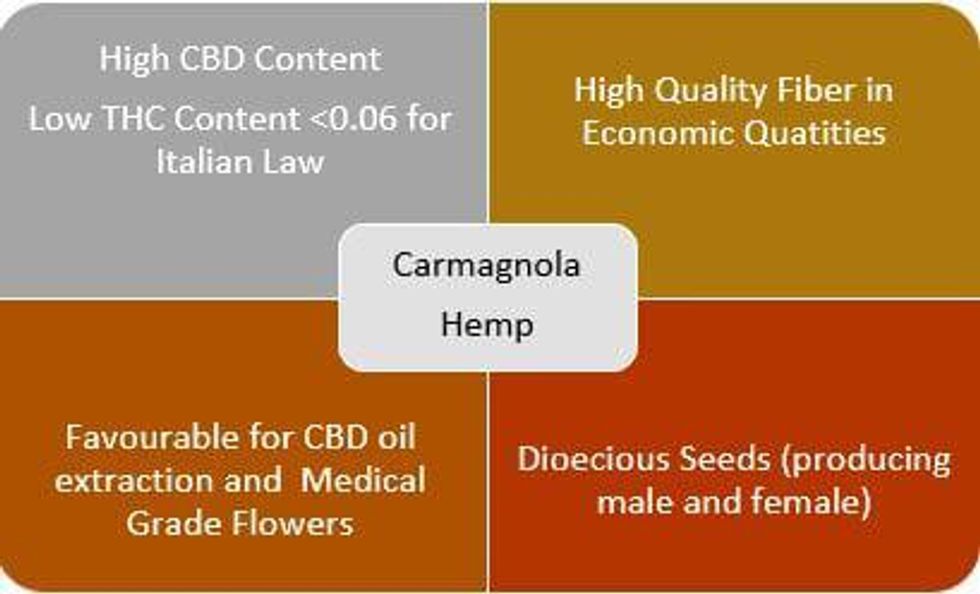

Some other benefits and unique traits of the Carmagnola variety are displayed below in the diagram:

About Hemp for Health Inc.:

Hemp for Health is a cultivator and distributor of premium CBD products with an exclusive, long-term contract for land with farmers in the Tuscan region of Italy for the purpose of yielding the highest quality hemp-based CBD. Our focus is to offer the absolute best in natural and organic CBD products to our customers, and that starts with pristine soil, seeds, and sun. (See further details available in the Company’s filings on SEDAR.)

ON BEHALF OF HEMP FOR HEALTH INC.

(sgd.) Robert Eadie

President & CEO

The Canadian Securities Exchange has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Evan Eadie

Telephone: 416-402-2341

Toll Free: 1-866-602-4935

Email: evan@hempforhealth.eu