VIDEO - Fund Managers: US Becoming Center of Cannabis Investment

Two cannabis fund managers discuss the growth of the US market and the role it plays in the marijuana investment story.

As a critical presidential election in the US draws nearer, the Investing News Network asked two fund managers to share their perspectives on the cannabis investment landscape.

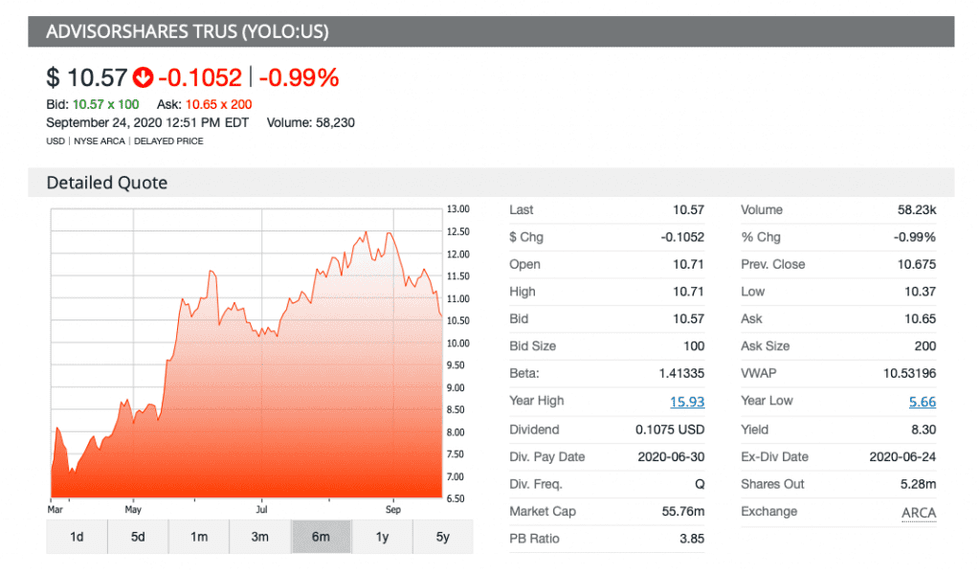

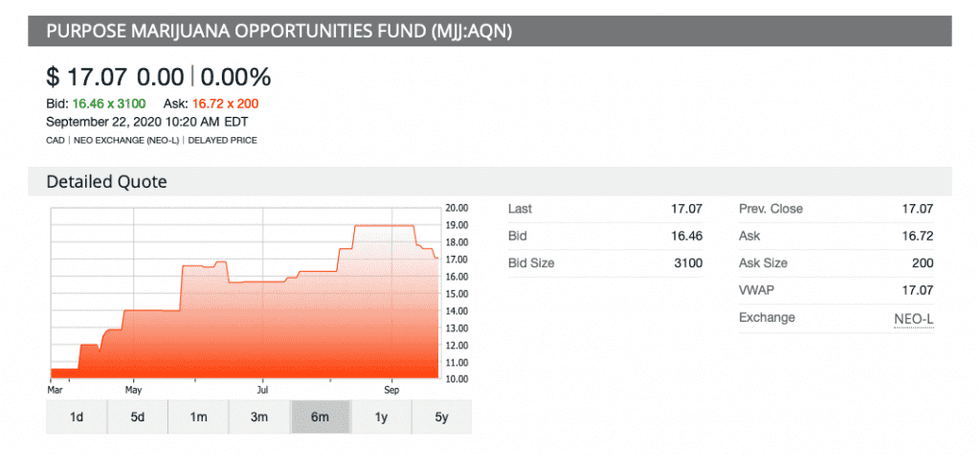

The guests were Nawan Butt, portfolio manager at Purpose Investments and co-manager of the Purpose Marijuana Opportunities Fund (NEO:MJJ), and Dan Ahrens, managing director and chief operating officer with AdvisorShares and manager of the AdvisorShares Pure Cannabis ETF (ARCA:YOLO).

To stay ahead and keep their funds performing well, both of the fund managers carefully scan developments in the cannabis market on a day-to-day basis.

Ahrens kicked the discussion off by noting that he is still supremely interested in seeing healthy balance sheets and in tracking the path to profitability for cannabis companies. He is excited about the rising division between players that are performing well and those that aren’t.

“Cannabis stocks have traded way too much on hype in the past,” Ahrens said. “In 2020, we’re seeing some real separation between some of the biggest Canadian licensed producers.”

AdvisorShares recently launched a new cannabis exchange-traded fund (ETF) focused entirely on multi-state operators in the US market. It is called the AdvisorShares Pure US Cannabis ETF (ARCA:MSOS) and is also managed by Ahrens.

Ahrens previously shared his frustration with the cannabis investment space, particularly in terms of the lack of awareness on which companies will actually benefit from advancements in the US — a market he is heavily bullish on when it comes to cannabis.

Six month performance of the AdvisorShares Pure Cannabis ETF.

Ahrens and Butt both share the view that the US market represents the smart money opportunity for investors at the moment, offering a clear distinction in the overall cannabis stock universe.

Beyond the presidential election, the American cannabis market is set to potentially see some catalysts as five states in the country ask voters about introducing cannabis programs. Decisions are pending in Arizona, Mississippi, Montana, New Jersey and South Dakota, and could add momentum for operators.

Butt pointed to New Jersey as a state market that he is watching in particular. Additionally, he praised Arizona as a state with an organized framework with its medical cannabis program and said he is excited by the potential of this market going recreational this year.

Six month performance of the Purpose Marijuana Opportunities Fund.

In a recent note to investors, Butt, alongside Greg Taylor, his fellow fund manager and the chief investment officer at Purpose Investments, wrote that the upswing for cannabis operations in US state markets will continue with or without federal reform for the industry.

“We continue to see outsized growth in most states as operators have worked out how to optimize within the current constraints,” the pair from Purpose Investments wrote as part of their commentary. “Any reform at the federal level will cause a step function in valuations of these operators, but explosive growth can still continue under current regulations.”

Watch the full video above to hear the entire discussion between Butt and Ahrens.

Don’t forget to follow us @INN_Cannabis for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.