CannTrust Class-action Suit Moving Forward, Law Firms Say

A group of lawyers representing investors went public on Monday with an update on their suit from the Ontario Superior Court of Justice.

Maligned Canadian cannabis producer CannTrust Holdings (NYSE:CTST,TSX:TRST) is facing a class-action lawsuit update.

On Monday (February 3), Henein Hutchison, speaking for a group of Ontario-based law firms, issued a statement claiming that the Ontario Superior Court of Justice has confirmed that the group can carry on with a proposed securities class action targeting the marijuana company.

The legal action is tied to CannTrust’s improper cannabis growing operations, which were discovered by regulators in July 2019. The misstep led to an eventual license suspension for the company and the damage to its reputation caused to the larger Canadian cannabis market to take a hit.

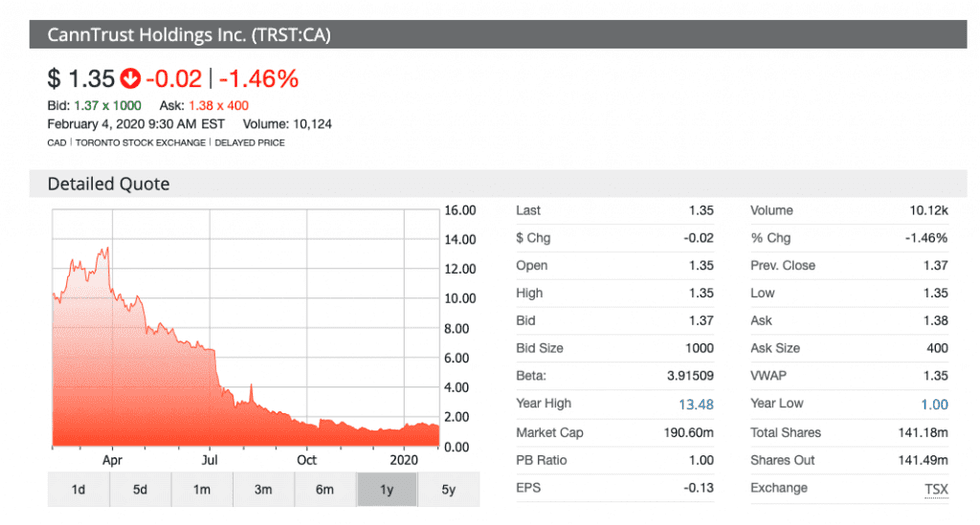

Shares of CannTrust fell in both New York and Toronto during Monday’s session. The company finished the first trading day of the week priced at US$1.04 and C$1.37.

In the pre-market trading portion of Tuesday (February 4), the company was already down an additional almost 4 percent on the New York Stock Exchange. However, just after the official start of the session, it bounced back with a 2.92 percent increase in Toronto and a 1.44 percent marginal jump in New York.

Since the original illegitimate growing discovery, which brought the dismissal of the firm’s former CEO and of its co-founder, shares of CannTrust have dropped in value dramatically by over 70 percent in both New York and Toronto.

“Cases like this show the power of class actions to bring access to justice to individuals who place their savings at risk in the stock markets,” Dimitri Lascaris, a lawyer working within the group representing the investors raising the suit, said in a statement.

Marie Henein, another lawyer working on the lawsuit, said the case will be brought in front of the courts “at the earliest opportunity.”

In an emailed statement, a CannTrust spokesperson declined to comment for this story.

In its most recent mandated bi-weekly update to investors, CannTrust made no mention of the progress for the class-action suit. The company signaled it still has a cash balance of nearly C$175 million.

The legal action comes from CannTrust investors who bought shares of the company between June 1, 2018, and September 17, 2019, according to the parameters of the suit, in addition to investors who participated in a prospectus offering from the company in May 2019.

In addition to CannTrust, the suit also includes the underwriters of the CannTrust offering: Merrill Lynch Canada, Citigroup Global Markets Canada, Credit Suisse Securities (Canada), RBC Dominion Securities, Jefferies Securities and Canaccord Genuity.

The raise was designed to secure CannTrust with US$170 million in gross proceeds thanks to the sale of just over 5.4 million shares.

Tax audit and advisory firm KPMG is also included as a defendant in this case, given its role as CannTrust’s auditor.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.