Cannabis Weekly Round-Up: Ben & Jerry’s Plans CBD Ice Cream Launch

The Investing News Network rounds up some of the biggest company and market news in the cannabis market for the past trading week.

During the past trading week (May 27 to 31), leading frozen treat manufacturer Ben & Jerry’s announced its entry into the cannabidiol-infused (CBD) product market.

A stock upgrade from a hemp producer in the Canadian public markets made headlines, while a new report on a police investigation into a Canadian producer also caught attention.

Here’s a closer look at some of the biggest news during last week’s trading period.

US CBD market set to gain frosty treat

On Thursday (May 30), ice cream maker Ben & Jerry’s announced a plan to launch a CBD-infused ice cream product once the derivative is federally legal.

Despite this wait until legal clarity due to the US Food and Drug Administration (FDA) restricting the use of CBD in food and beverages, the company announced it will source its CBD from an undisclosed partner in Vermont.

“We aspire to love our fans more than they love us and we want to give them what they’re looking for in a fun, Ben & Jerry’s way,” Matthew McCarthy, CEO of the company, said in a press release.

Hemp producer upgrades to TSX listing

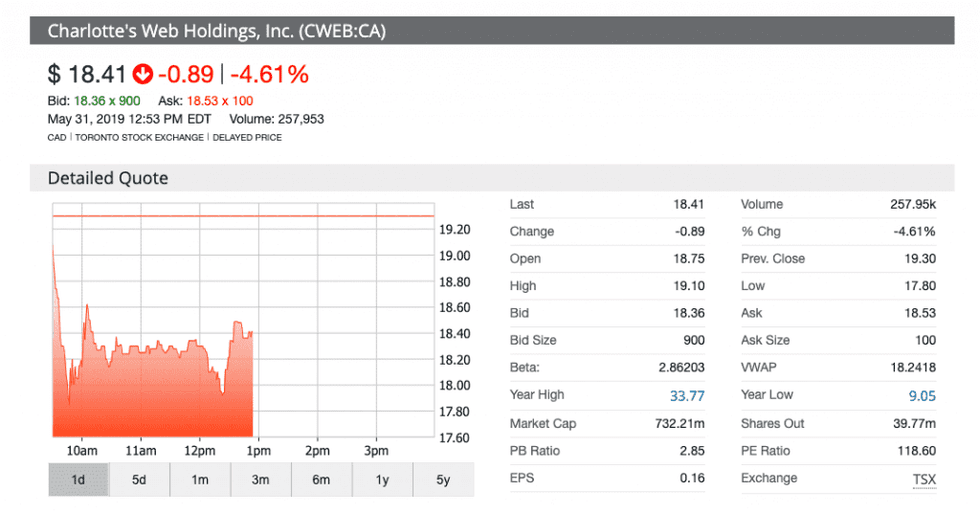

This past week, Charlotte’s Web Holdings (TSX:CWEB,OTCQX:CWBHF), a Colorado-based hemp producer, announced it would shift public listings as it dropped the Canadian Securities Exchange (CSE) in favor of a senior Canadian listing.

Shares of the producer began trading on the Toronto Stock Exchange (TSX) on Friday (May 31).

“While Charlotte’s Web previously met operational, governance and capital requirements for a TSX listing at the time of its IPO, uncertainties regarding the federal legality of hemp in the United States at the time were not clear enough to satisfy TSX listing policies,” the company said in a press release.

Charlotte’s Web expects this listing to expose the company to a “wider capital markets audience, increase trading liquidity and expand access to international institutional investors and capital.”

Scathing report suggests wrongdoing from Canadian producers

On Friday, the Financial Post published a report based on details obtained from a request for information about an RCMP marijuana seizing in 2014. According to the report, the Canadian authorities prepared an announcement that was scrapped on the seizure of over 700 kilograms of BC marijuana bud product at the Kelowna International Airport.

The seize was done against two legal producers, Canopy Growth (NYSE:CGC,TSX:WEED) and Mettrum Health, which is now owned by Canopy.

According to documents from the RCMP, the seized items from both producers in 2014 were not just the indicated plants but rather marijuana buds “packaged for resale.”

The report suggests “strategic considerations” from the authorities in the release of information about the seizure, including the fact that at the time Canopy, then known as Tweed, had just reached the TSX Venture Exchange as the first cannabis pot stock.

“Several local growers had pooled their products for transfer … but the shipment fell outside the parameters of the legislation and was subsequently seized by police,” a scrapped press release prepared by the authorities said, according to the Financial Post report.

On paper, Tweed and Mettrum said they planned to transport 2,071 plants and 730 plants, respectively. But when RCMP examined the shipments, they instead found harvested marijuana buds that were packaged for resale, the records say.

Jordan Sinclair, Canopy Growth’s vice president of communications, told the Financial Post the company “believed then and now” its action fell within the regulations.

Market updates

A new Canadian bank analyst report contains a warning to the marijuana sector: Oversupply in Canada could be closer than originally expected.

Bank of Nova Scotia (Scotiabank) (NYSE:BNS,TSX:BNS) analyst Oliver Rowe issued a research note this week raising his concern about projections of when cannabis supply will meet and surpass demand from consumers in Canada.

“Producers we have spoken to are generally aware that the industry will eventually be oversupplied, but there is a degree of complacency since few think the market will become oversupplied any time soon or that they will be the ones unable to sell their product,” Rowe wrote in his note, according to a report from Marijuana Business Daily.

“While several sources have indicated undersupply will last three to five years, the data suggest otherwise,” the Scotiabank analyst said.

Additionally, Tamy Chen, cannabis analyst for the Bank of Montreal (BMO) (NYSE:BMO,TSX:BMO), issued a note this week indicating the shortage conditions in Canada are improving “sooner than we had anticipated.”

According to a report from Yahoo Finance, the BMO analyst said that Canadian producers Aurora Cannabis (NYSE:ACB,TSX:ACB), CannTrust Holdings (NYSE:CTST,TSX:TRST), Canopy Growth and Organigram Holdings (NASDAQ:OGI,TSX:OGI) are set to benefit from new store openings in Alberta and improved business hours for retailers in Quebec.

A new marijuana multi-state operator (MSO) listing attracted the attention of investors this past week thanks to its high valuation right out of the gate. AYR Strategies (NEO:AYR.A), formerly special purpose acquisition company Cannabis Strategies Acquisition, completed a qualifying offer to begin trading as the new firm.

“AYR will aggressively seek additional growth both organically and through accretive external opportunities,” Jonathan Sandelman, CEO of the firm, said in a press release.

The MSO now holds five marijuana operations in Nevada and Massachusetts thanks to its qualifying transaction.

The NEO Exchange confirmed AYR is the first cannabis firm with a recreational market focus to list on its exchange and hold an enterprise value of over C$1 billion.

On Tuesday (May 28), Acreage Holdings (CSE:ACRG.U,OTCQX:ACRGF) announced it has received the support from an aggregate of shareholders representing just over 90 percent of the eligible votes for its proposed acquisition deal with Canopy Growth.

“Additionally, I’m proud to say that shareholders representing approximately 38 (percent) of votes eligible to be counted for purposes of the disinterested shareholder approval have already indicated their support of the deal,” Kevin Murphy, CEO of the MSO, said in a press release.

Canadian producer HEXO (NYSEAMERICAN:HEXO,TSX:HEXO) informed shareholders of the creation of a new US-based subsidiary, HEXO USA, and the appointment of a new chief financial officer.

“I have been touring the US to meet with current and potential investors and to tell the HEXO story. We’ve been sharing our vision and plans to operate in legal markets in the US to provide legal cannabis experiences powered by HEXO,” said Sebastien St-Louis, CEO of HEXO.

“Onboarding a US-based CFO of Michael’s caliber and establishing HEXO USA are real steps towards bringing the HEXO experience to the US.”

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Acreage Holdings are clients of the Investing News Network. This article is not paid-for content.