Beleave CEO Walks Away, Deals With Incoming Lawsuit From Investor

Beleave’s now former CEO Jeannette VanderMarel took to Twitter to announce her departure just two months after being appointed in October.

A Canadian cannabis firm is dealing with a one-two punch after losing its newcoming CEO and facing a lawsuit from a fellow marijuana company.

On Wednesday (December 18), Beleave’s (CSE:BE,OTCQX:BLEVF) now former CEO Jeannette VanderMarel took to Twitter (NYSE:TWTR) to announce her departure from the company just two months after being appointed to the leadership role in October.

The company confirmed her transition away from Beleave and the succession of Kevin Keegan, the company’s former interim CFO.

In her message, VanderMarel said she had “happily resigned as CEO of Beleave Kannabis” and was “moving on to things (she) believes in.” Beleave Kannabis is the registered licensed producer operation under the public corporation.

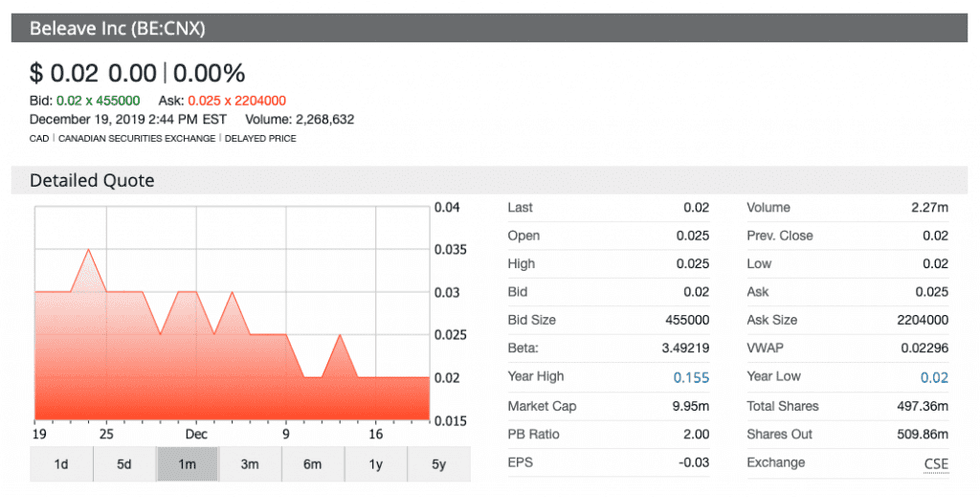

Beleave’s shares have sunk over 33 percent in the last month, and since the beginning of the trading week, prices have dropped 20 percent to C$0.02.

Interestingly, VanderMarel will retain her seat on Beleave’s board of directors.

VanderMarel has been fairly mobile within the Canadian cannabis industry, having worked as the co-CEO of 48North Cannabis (TSXV:NRTH), co-founder and president of Good & Green and co-founder of The Green Organic Dutchman (TSX:TGOD,OTCQX:TGODF) prior to her appointment at Beleave.

The firm has been recently facing financial issues. In a November 29 regulatory filing, Beleave reported that it had C$133,329 in cash by the end of September, down significantly from the C$3.6 million it reported in September 2018.

During its annual shareholder meeting this month, the company got approval to consolidate its shares by a ratio up to 10:1.

Beleave suffered another hit when the planned sale of its 250,000 square foot greenhouse space in London, Ontario, fell through, according to the filing.

The company had originally entered into a letter of intent with a private purchaser to sell the property in August for C$7 million, but the agreement was cancelled in September.

In the filing, Beleave said it was reviewing its options regarding the London facility, including seeking cultivation license approval from Health Canada and selling or leasing the property.

The November filing also revealed that Auxly Cannabis (TSXV:XLY,OTCQX:CBWTF) had filed a statement of claim against Beleave and its subsidiary, Beleave Kannabis, claiming that a purchase agreement from October 2017 had been breached.

As a part of the original agreement, Auxly, previously known as Cannabis Wheaton Income, gave Beleave C$5 million in non-dilutive debt financing.

“The company disputes Auxly’s allegations, both on their purported merits and on procedural grounds, and intends to vigorously defend itself in any proceedings,” Beleave said in its filing.

Beleave did not immediately respond to the Investing News Network’s request for comment.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.