The BCSC announced an investigation into CSE-listed companies for an “abusive” scheme to the market, with four being cannabis ventures.

Four CSE-listed cannabis companies could face sanctions from a provincial securities regulatory body as part of an “abusive” market scheme.

On Monday (November 26), the British Columbia Securities Commission (BCSC) issued a notice blocking a group of consultants denominated as the BridgeMark Group from buying or selling shares of 11 companies trading on the Canadian Securities Exchange (CSE).

Peter Brady, executive director of the BCSC, is alleging participation in a scheme described as “abusive to the capital markets” in which the consultants purchased shares of the companies under a special setting that they didn’t deserve.

“The executive director alleges that the securities sales to BridgeMark were illegal because they improperly used the consultant exemption to avoid filing a prospectus, a formal document that provides details of an investment,” the BCSC said.

Brady argues, “the BridgeMark Group’s members are not consultants, that they provided little or no consulting services to the issuing companies, and engaged in the scheme for their own profit.”

The BCSC has now blocked all current CSE issuers from selling shares using the consultant exemption without a prospectus to the BridgeMark Group.

“Staff are concerned that members of the BridgeMark Group generated profits for themselves and that the Issuers raised capital through the scheme,” the BCSC says in its full notice of hearing.

Here is a list of the 11 companies included in the BCSC announcement:

- Cryptobloc Technologies (CSE:CRYP)

- New Point Exploration (CSE:NP)

- Green 2 Blue Energy (CSE:GTBE)

- BLOK Technologies (CSE:BLK)

- Kootenay Zinc (CSE:ZNK)

- Affinor Growers (CSE:AFI)

- Beleave (CSE:BE)

- Liht Cannabis (CSE:LIHT)

- PreveCeutical Medical (CSE:PREV)

- Speakeasy Cannabis Club (CSE:EASY)

- Abattis Bioceuticals (CSE:ATT)

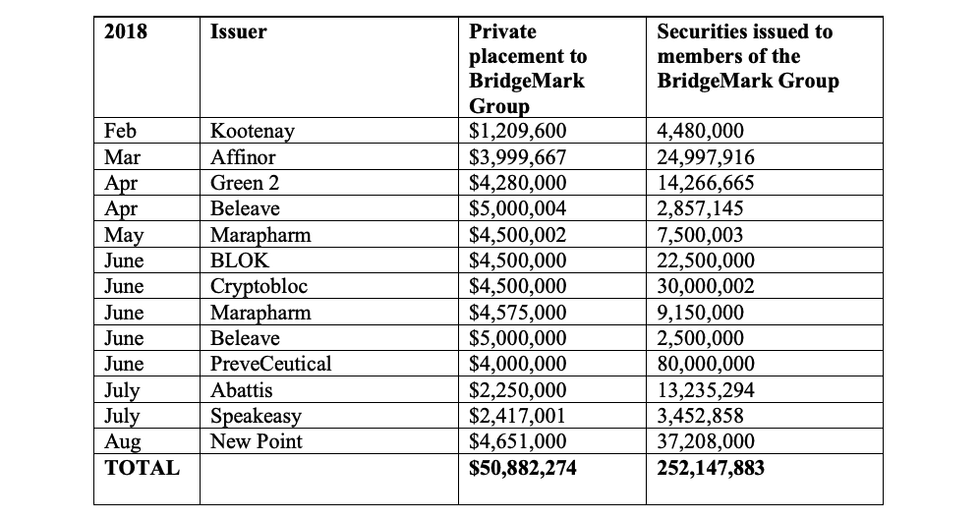

The BCSC shows that transactions between the group of issuers and the BridgeMark Group took place between February and August:

A hearing on an extension of the temporary bans by the BCSC is scheduled for December 7.

“If there are findings that those allegations are true, then there would be sanctions from our administrative tribunal,” Brian Kladko, spokesperson for the BCSC, told the Investing News Network.

The allegations remain unproven, and the BCSC will continue its investigation into these companies.

From the 11 companies, the BCSC argues Cryptobloc Technologies, New Point Exploration, Green 2 Blue Energy and BLOK Technologies paid approximately C$15.3 million back to the BridgeMark Group following the raise from the BridgeMark Group.

“The four companies subsequently issued news releases saying they had raised a certain amount of money by selling their shares, even though they had paid most of the purchase amount back to BridgeMark,” the BCSC says.

Effectively, the BCSC alleges, under the guise of private placements, the BridgeMark Group obtained actual free-trading securities of these companies with the consultant exemption and compensation from the companies.

The BridgeMark Group then went on to sell the shares gained from these companies for net profits of C$6.2 million.

BCSC contends the actual status of members associated with the BridgeMark Group as actual consultants, which granted them the “Consultant Exemption.”

According to the BCSC, the total number of shares purchased by the BridgeMark Group through the private placements was 252,147,883.

The provincial securities regulatory agency is “concerned” members of the BridgeMark Group used the same tactic with the rest of the companies listed.

SpeakEasy issued an update to investors saying it has “undergone several changes over the past number of months, including significant changes to its management team.”

Anthony K. Jackson, one of the respondents cited in the BCSC announcement, was a director and CFO for SpeakEasy up until September.

Similarly, on Wednesday (November 28), Liht Cannabis issued a statement to shareholders confirming its engagement in consulting services from members of the BridgeMark Group.

“Prior to the announcement, the Company had undertaken its own internal investigation and fact-finding, to reconcile the contracts and services rendered to the Company,” Liht Cannabis said.

The company, formerly known as Marapharm Ventures, said its internal investigation has not finished.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: BLOK Technologies, New Point Exploration and PreveCeutical Medical are clients of the Investing News Network. This article is not paid-for content.