Ascent Industries Faces Canadian Cannabis License Removal

Health Canada has informed Ascent Industries and its licensed producer subsidiary that it intends to revoke its producer’s and dealer’s licenses.

Ascent Industries (CSE:ASNT) announced on Wednesday (November 21) the removal of executives, including its CEO, following the news that Health Canada intends to revoke the company’s federal cannabis licenses.

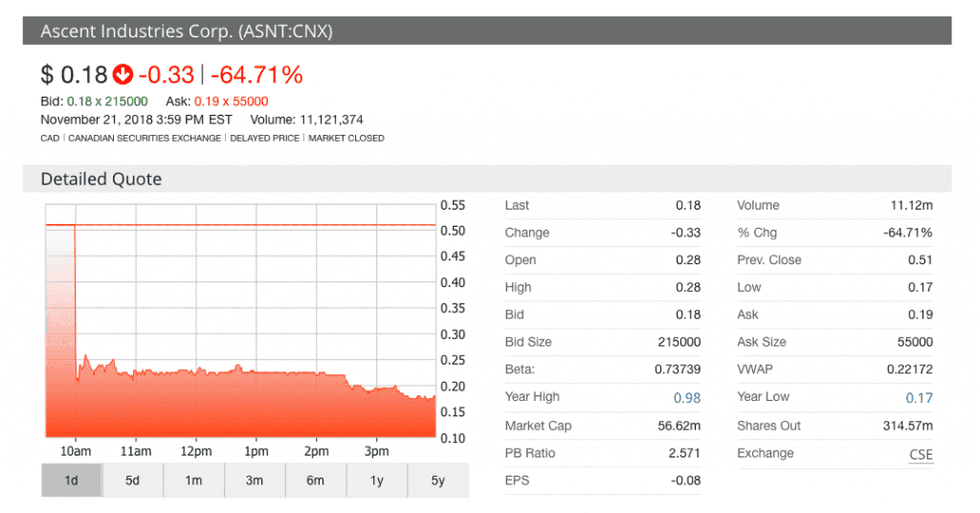

Shares of the Canadian cannabis company bottomed out on Wednesday following the issued announcement. The stock closed at a price of C$0.18, a 64.71-percent loss from its opening of C$0.28.

Ascent’s licensed producer (LP) subsidiary Agrima Botanicals faced a suspension of its producer’s and dealer’s licenses following an inspection from Health Canada in August.

The company notified shareholders on September 27 after finding out from Health Canada the new status of its licenses.

After the suspension was placed, Ascent was tasked with submitting additional information to challenge the review from the government agency.

Ascent told investors in the September announcement that the failings were seen by Health Canada as related to “record keeping and other compliance requirements.”

On Wednesday, the company said that Health Canada deemed the review unsatisfactory and intends to revoke Agrima Botanicals producer’s and dealer’s licenses.

The LP obtained an Access to Cannabis for Medical Purposes Regulations (ACMPR) license in November of 2017.

Following the review of additional information from Ascent, Health Canada has decided it intends to revoke the licenses of the LP.

In an email statement to the Investing News Network (INN), Health Canada said it informed Agrima Botanicals of its decision last Friday (November 16).

“Health Canada is taking this action because, amongst other reasons, the company has failed to demonstrate that the suspension was unfounded and that the failure that gave rise to the suspension was rectified,” the government agency said.

In its statement to investors on Wednesday, Ascent said it has accepted the resignation of Philip Campbell as CEO and chair of the company; Reid Parr as co-founder, director and COO; and James Poelzer as chief business development officer.

The Vancouver-based company said it intends to “exercise its right to be heard under the Cannabis Act and Cannabis Regulations in order to maintain its licences.”

When reached for comment, Ascent declined to answer questions for this story.

“Health Canada’s review is focused on the period during which the Company was privately held. Health Canada asserts that unauthorized activities with cannabis took place under the Company’s ACMPR license during this period,” Ascent indicated to shareholders on Wednesday.

Deepak Anand, vice president of business development and government relations with regulatory firm Cannabis Compliance, told INN this is a never-before-seen enforcement from the federal agency.

“We haven’t seen this unprecedented move by Health Canada before,” Anand said in an email to INN.

Ascent went public on the Canadian Securities Exchange (CSE) on August 9 after completing an amalgamation with Paget Minerals.

The company closed its first trading day with a price of C$0.47. Ascent currently holds a valuation of just over C$50 million, according to the TMX Group.

Newly appointed Interim CEO Blair Jordan, who acts as CFO for the company, said he and a newly assembled independent committee of the board will give this issue their full attention.

In an interview on YouTube show Midas Letter on October 9, Campbell addressed the original suspension.

“What happened is we had a surprise inspection from Health Canada at Agrima Botanicals, our wholly owned licensed producer, in August, and during that inspection it was clear there were some deficiencies that needed to be addressed,” the now-departed CEO said then.

In addition to its Canadian operations growing marijuana, Ascent holds assets in Nevada, Oregon and a recent entry into the California market.

Ascent has also assembled a European move with a subsidiary that has applied for a wholesaler dealer’s license and a controlled drug license in Denmark.

Despite a dip in the earlier segment of the trading session, shares of Ascent closed again at a price of C$0.18 on Thursday (November 22).

Ascent shares have been on a downturn since the original announcement from Health Canada was disclosed in September, diminishing in value by 33.77 percent since September 27.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Ascent Industries is a client of the Investing News Network. This article is not paid-for content.