Aphria Continues Drop After Response to Short Seller Report

Shares of Canadian licensed producer Aphria fell even more on Tuesday after the company responded to a short seller report.

The downturn for Aphria (NYSE:APHA,TSX:APHA) continued on Tuesday (December 4) as the company combated allegations raised in a short seller report.

The Canadian cannabis licensed producer issued a new response and offered a closer look into the assets being called into question by the short sellers.

Despite the update, shares of Aphria on the Toronto Stock Exchange (TSX) and New York Stock Exchange (NYSE) have kept dropping.

On Monday (December 3), a report from Quintessential Capital Management and Hindenburg Research caused a decline of nearly 30 percent for Aphria’s share price.

The company closed at C$7.60 and US$5.72 on the TSX and NYSE, respectively, during Monday’s trading session. On Tuesday it opened at C$6.40 and US$4.93.

As of 12:30 p.m. EST on Tuesday, Aphria had taken in more losses with a drop of 17.37 percent on the TSX and over 20 percent on the NYSE.

“The company’s response largely reiterated its earlier press releases touting the supposed worth of its acquisitions and did nothing to dispute our core findings,” Hindenburg Research wrote on Tuesday.

The short seller report raised questions about the state of the Latin American assets Aphria acquired from Sol Global Investments (CSE:SOL), formerly known as Scythian Biosciences.

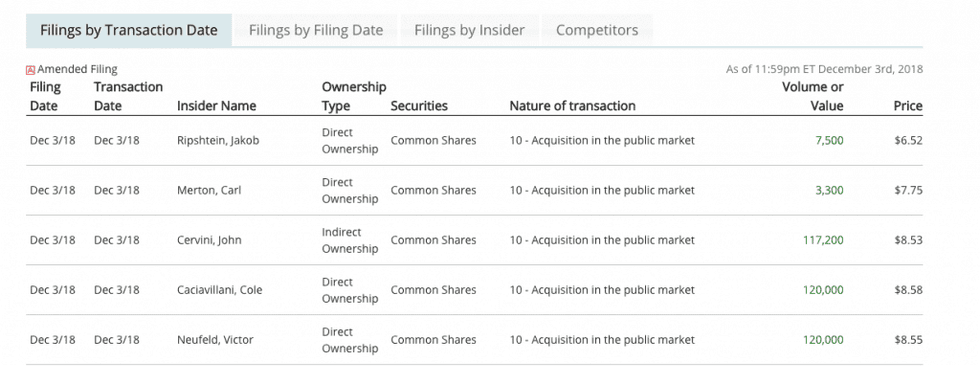

Even as the stock plummeted, four executives at the company are not giving up on its performance, and in fact have added to their portfolios.

Canadian Insider shows five buying order transactions on Monday from Aphria CEO Vic Neufeld, Co-founder and Vice President of Growing Operations Cole Caciavillani, fellow Co-founder and Vice President of Infrastructure and Technology John Cervini, CFO Carl Merton and President Jakob Ripshtein.

Neufeld confirmed the purchases in Aphria’s response to the short seller report.

“Yesterday, I, along with other members of our Executive Management team, stepped up to demonstrate our confidence in the Company’s business plan … by personally investing more than [C]$3.1 million in Aphria’s common shares,” Neufeld said in the statement.

Analysts looking at Aphria have had to reposition themselves in terms of their predictions for the company, with a few swapping their ratings.

On Tuesday, BNN Bloomberg reported that analysts for GMP Securities and the Bank of Nova Scotia had changed their rating to “under review.” Additionally, the Bank of Montreal slashed its price target from C$22 to C$9.

“We believe that management’s credibility may have been impacted by the allegations raised in this report. It is unclear at this point how the company will re-establish trust with investors,” Martin Landry, an analyst for GMP, wrote in a note to investors.

In a note on the state of the market, Ninepoint Partners said the cannabis sector is vulnerable to short reports “because of its early stage” and the fact the industry value is “based on future promises.”

Charles Taerk and Doug Waterson of Faircourt Asset Management, who manage the Ninepoint Alternative Health Fund, wrote that the Aphria incident will create “considerable uncertainty” for the stock and the overall sector for the “next few days.”

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.