MedMen posted a net loss of US$40.6 million in its latest quarter following the departure of its longtime CEO.

After a recent bout of uncertainty and the departure of its longstanding CEO, US cannabis operator MedMen Enterprises (CSE:MMEN,OTCQX:MMNFF) issued its latest quarterly financial report, experiencing heavy losses.

The company posted an adjusted earnings before interest, tax, depreciation and amortization loss of US$35.1 million for its second fiscal quarter of 2020, alongside a net loss attributable to shareholders of US$40.6 million.

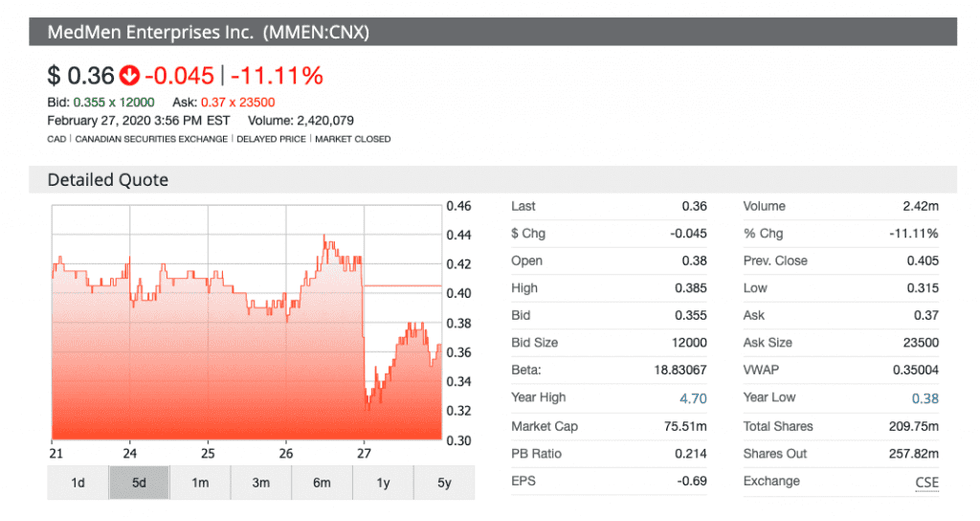

Amid the losses, the company’s share price took a hit in Thursday’s (February 27) trading session. The company dropped 11.11 percent as the markets closed, slipping to C$0.36.

“We feel positive about the progress made while remaining aware there is still substantial work to be done,” Ben Rose, executive chairman of the board, said in a statement.

At the end of January, MedMen confirmed the departure of Adam Bierman, its co-founder and CEO. The former leading executive said at the time that he was still a believer in the path ahead for the company.

Following the Q2 quarterly results release, Ryan Lissack, the firm’s newly appointed interim CEO, said MedMen’s next phase “will be defined by financial discipline and strategic growth.”

Across the company’s core assets in California, Nevada, New York, Illinois and Florida, it reported a revenue uptick of 11 percent from the previous quarter for a number of US$44.1 million.

Lissack added that the company’s current timeline includes an assessment of all its operations in order to “narrow the focus on what (it does) best” — which, according to the interim leader, is retail.

MedMen has embarked on a journey to let go of some of its non-core assets, as the firm has accepted that some of its spending was extravagant.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.