February 13, 2025

Corazon Mining (ASX:CZN) unlocks value in high-quality base and precious metals projects in Canada and Australia. Focusing on the MacBride Project reflects Corazon’s growing demand for copper, zinc and gold, while concurrently maintaining the Lynn Lake project as a significant, strategic nickel asset for the future.

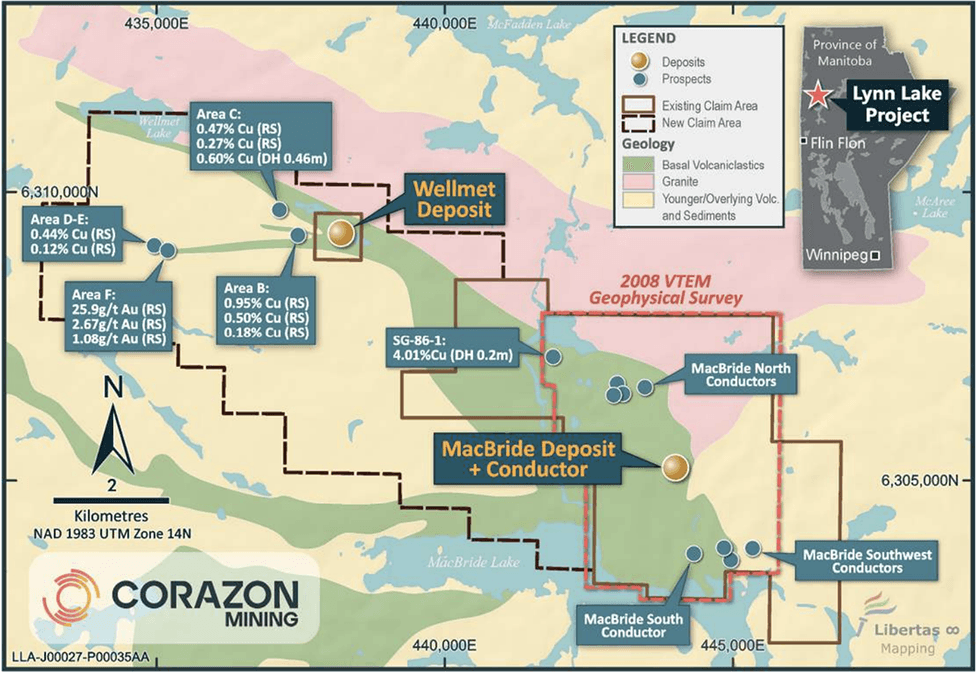

The MacBride project is Corazon Mining's recent acquisition exemplifying high-grade, near-surface mineralisation. MacBride holds drill-defined, high-grade copper-zinc-gold deposits, with multiple geophysical anomalies that indicate significant exploration upside.

Located just 60 kilometres from Lynn Lake, MacBride benefits from the infrastructure and logistical advantages of the established mining district. Corazon’s ongoing work will focus on drill testing these targets, to establish a camp of base and precious metal massive sulphide deposits at MacBride.

Company Highlights

- Corazon’s exploration focus is on its recently acquired MacBride Project, which has proven prospectivity for high-grade copper-zinc-gold-silver.

- MacBride is located in the Lynn Lake District of Manitoba, Canada, where Corazon also owns 100 percent of the entire historic Lynn Lake nickel-copper-cobalt sulphide camp.

- Lynn Lake provides a unique opportunity for the creation of a large-scale, polymetallic-processing hub, with established beneficial infrastructure, including low-cost renewable hydroelectric power.

- Corazon’s assets are positioned in a historically productive district, where large-scale deposits have been previously mined. MacBride’s proximity to other major deposits supports its potential for a new, large-scale discovery.

- With a small market cap and large, high-quality assets, Corazon offers a compelling investment opportunity. Though its nickel sulphide resources rival those of larger competitors, Corazon remains significantly underappreciated in the market.

- Lynn Lake’s location in a mining-friendly jurisdiction, with access to hydroelectric power, road and rail infrastructure, enhances project economics and accelerates development timelines.

This Corazon Mining profile is part of a paid investor education campaign.*

Click here to connect with Corazon Mining (ASX:CZN) to receive an Investor Presentation

CZN:AU

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 August 2025

Corazon Mining

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets.

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets. Keep Reading...

25 February

Heritage Survey underway PoW Approved for Maiden Drilling

Corazon Mining (CZN:AU) has announced Heritage Survey underway PoW Approved for Maiden DrillingDownload the PDF here. Keep Reading...

04 February

4km Gold Anomaly Defined at Two Pools

Corazon Mining (CZN:AU) has announced 4km Gold Anomaly Defined at Two PoolsDownload the PDF here. Keep Reading...

28 January

Quarterly Appendix 5B Cash Flow Report

Corazon Mining (CZN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Quarterly Activities Report

Corazon Mining (CZN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

24 November 2025

Execution of Land Access Agreement

Corazon Mining (CZN:AU) has announced Execution of Land Access AgreementDownload the PDF here. Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00