Platinex: District-Scale Potential in the Prolific Abitibi Gold Camp in Ontario

Platinex Inc. (CSE:PTX) has launched its campaign on the Investing News Network.

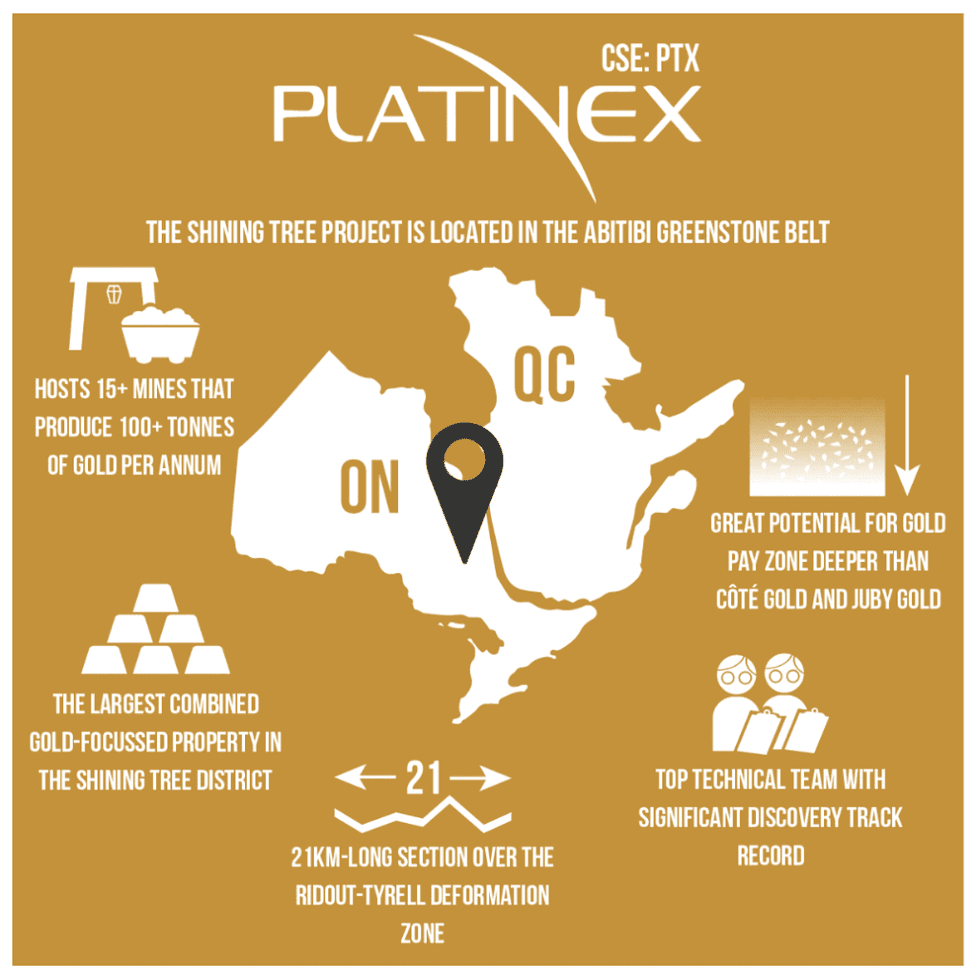

Platinex Inc. (CSE:PTX) focuses on its 100 percent owned Shining Tree gold project near the prolific Abitibi Greenstone Belt in Ontario, Canada. The Shining Tree gold project is a consolidation of 21,720 hectares adjacent to the Côté Gold-Gosselin development project owned by IAMGOLD and 2.3-million-ounce Juby gold deposit hosted by Aris Gold Corp. (TSX:ARIS).

Platinex also operates a robust royalty portfolio, which provides gold, PGE, nickel, copper and chromium exposure. Key royalties include a 2.5 percent NSR royalty on production from the former Big Trout Lake property in northwestern Ontario. This asset is one of the largest known PGE and chromium deposits in Canada.

Sign up for an investor kit from Platinex Inc. (CSE:PTX)

Platinex’s Company Highlights

- Platinex Inc. is a mineral exploration company focused on acquiring, exploring and developing highly prospective mineral projects across mining-friendly jurisdictions.

- The company has created the largest combined gold-focused property package in the Shining Tree District with its 100 percent owned Shining Tree gold project. The property spans 21,720 hectares southwest of the prolific Abitibi Greenstone Belt in Ontario, Canada.

- The Shining Tree gold project sits strategically between the Côté Gold-Gosselin development project owned by IAMGOLD and 2.3-million-ounce Juby gold deposit hosted by Aris Gold Corp. The project boasts district-scale potential.

- The company plans to conduct extensive diamond drilling and prospecting campaigns in 2021. Priority targets include the Caswell, Ronda, Herrick and Churchill mines.

- Platinex also has an impressive royalty portfolio on gold, PGE and base metal properties in Canada Chile. This collection includes a 2.5 percent NSR royalty on production from the former Big Trout Lake property, one of Canada’s largest known PGE and chromium deposits.

- Platinex boasts an impressive capital structure and tight shareholder portfolio. An advantageous CAD$10 million market cap and strategic shareholder ownership pose significant growth for the company.