Conscience Capital Announces Name Change to DGTL Holdings Inc., Amendment to Share Exchange Agreement, and Commencement of Trading on TSXV

Conscience Capital Inc. (“Conscience”, “DGTL Holdings” or the “Company”) (TSXV:DGTL.P) is pleased to announce that it has effected a change of its corporate name to “DGTL Holdings Inc.”

Conscience Capital Inc. (“Conscience”, “DGTL Holdings” or the “Company”) (TSXV:DGTL.P) is pleased to announce that it has effected a change of its corporate name to “DGTL Holdings Inc.“. The name change was approved by shareholders of Conscience on March 5, 2020, and is being completed in connection with the Conscience’s closing of the acquisition of Hashoff LLC (“Hashoff”), the Company’s Qualifying Transaction.

DGTL Holdings has received approval from the TSX Venture Exchange to graduate from a capital pool company to Tier II Technology Issuer. The Company’s common shares will resume trading on the TSX Venture Exchange (the “TSX-V”) under the ticker symbol “DGTL” on August 4, 2020.

Name Change

The name DGTL Holdings Inc. functions as an acronym for “Digital Growth Technologies and Licensing” Holdings Inc. Moving forward, DGTL Holdings Inc. intends to acquire, fund, accelerate and optimize a diversified portfolio of innovative and disruptive Advertising Technologies (Adtech) companies, powered by Artificial Intelligence (AI). The Company will specialize in incubating fully commercialized B2B (business to business) enterprise level AI-Adtech SaaS (software as a service) companies via a range of unique capitalization structures, including; equity investment, M&A and technology licensing.

The CUSIP and ISIN numbers assigned to the Company’s common shares under its new name will be 23343T104 and CA23343T1049, respectively. No action will be required by existing shareholders with respect to the name change. Certificates representing common shares of Conscience Capital Inc. will not be affected by the name change and will not need to be exchanged. The Company encourages any shareholder with concerns in this regard to be directed to such person’s broker or agent.

Amendment of Share Exchange Agreement

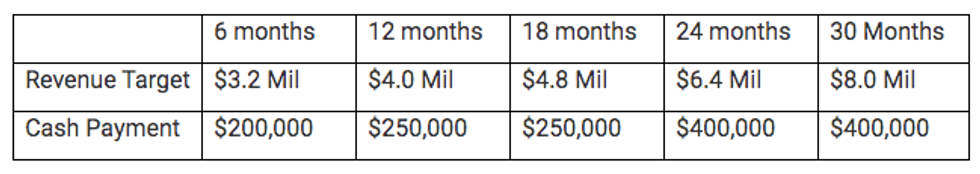

The Company further announced that it has entered into an amendment agreement (the “Amendment”) with Hashoff modifying the terms of the Share Exchange Agreement dated December 23, 2019 (the “Share Exchange Agreement”). The Share Exchange Agreement provided that the Company was to make post-closing payments up to USD $1,500,000 (the “Deferred Cash Payments”) pursuant to a 30 month deferred payment schedule, payable every 6 months following the closing of the acquisition.

Pursuant to the Amendment, Hashoff has agreed to postpone the effective date of the Deferred Cash Payments to January 1, 2021, such that the first payment will be payable on June 30, 2021, 6 months from the new effective date. The Deferred Cash Payments are dependent on Hashoff meeting the revenue targets set in the Share Exchange Agreement and failure to meet the revenue targets results in deferral and/or reduction of the payments.

In consideration for the postponement of the Deferred Cash Payments, the Company has agreed to reduce the attributable revenue targets by 20% for each 6 month period for the duration of the 30 month period, as set out below:

Exchange of Subscription Receipts

As previously announced, the Company completed a non-brokered private placement of subscription receipts (each, a “Subscription Receipt”) for gross proceeds of approximately $1.32 million (the “Offering”). The gross proceeds of the Offering were held in escrow by Fish Law Professional Corporation (the “Subscription Receipt Agent”) as subscription receipt agent, pursuant to the terms of a subscription receipt agreement dated March 23, 2020 (the “Subscription Receipt Agreement”) between the Company and the Subscription Receipt Agent, pending satisfaction of the Escrow Release Conditions (as defined in the Subscription Receipt Agreement), which included that all conditions precedent to the closing of the Qualifying Transaction be satisfied or waived. The Company satisfied the Escrow Release Conditions upon closing of the Qualifying Transaction such that each Subscription Receipt was exchanged, without further payment of consideration or any further action by the holders of Subscription Receipts, into one common share in the capital of the Company.

The Company paid finder’s fees of $5,267 in cash representing 7% of the gross proceeds raised by certain arm’s length finders in connection with the Offering.

ABOUT DGTL HOLDINGS INC.

DGTL Holdings Inc. intends to operate as a venture capital investment company designed to; acquire, fund, accelerate and optimize a diversified portfolio of innovative and disruptive Advertising Technologies (Adtech) companies, powered by Artificial Intelligence (AI). The Company will specialize in incubating fully commercialized B2B (business to business) enterprise level AI-Adtech SaaS (software as a service) companies via a range of unique capitalization structures, including; equity investment, M&A and technology licensing.

The DGTL technology accelerator model leverages strong sector relationships, and employs a unique and system of analytical evaluation and creative M&A structures to maximize the long term growth opportunities for DGTL shareholders. For more information, DGTL Holdings Inc. has also launched a corporate communications platform including newly rebranded multimedia investor materials found at www.DGTLinc.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

DGTL Holdings Inc.

Email: IR@DGTLINC.COM

Phone: +1 (877) TSX-DGTL (879 – 3485)

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable securities laws relating to the proposal to complete the Transaction and associated transactions, including statements regarding the terms and conditions of the Transaction and associated transactions. Any such forward-looking statements may be identified by words such as “expects”, “anticipates”, “believes”, “projects”, “plans” and similar expressions. Readers are cautioned not to place undue reliance on forward-looking statements. Actual results and developments may differ materially from those contemplated by these statements depending on, among other things, the risks that the parties will not proceed with the Transaction and associated transactions, that the ultimate terms of the Transaction and associated transactions will differ from those that currently are contemplated, and that the Transaction and associated transactions will not be successfully completed for any reason (including the failure to obtain the required approvals or clearances from regulatory authorities). The statements in this news release are made as of the date of this release. Conscience undertakes no obligation to update any such forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on any such forward-looking statements. Conscience undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Conscience and Hashoff, or their respective financial or operating results or (as applicable), their securities.