Blackstone Positions Ta Khoa Nickel-Cu-PGE Project for Li-ion Battery Market with Positive Scoping Study

Blackstone Minerals (ASX:BSX) is pleased to announce the completion of the Scoping Study for the development and restart of the Ta Khoa Nickel-Cu-PGE Project in Vietnam.

Scoping Study

Blackstone Minerals (ASX:BSX) is pleased to announce the completion of the Scoping Study for the development and restart of the Ta Khoa Nickel-Cu-PGE Project in Vietnam. The Ta Khoa Project comprises an open pit mine at the Ban Phuc Disseminated Sulfide (DSS), upstream processing and downstream processing to produce a Precursor product for Asia’s growing Lithium-ion Battery Industry.

The Company sees the Scoping Study as an important milestone and an initial platform to build a mine-tomarket nickel business over the coming years with multiple upside opportunities to improve on the Scoping Study as presented. Blackstone looks forward to developing the Ta Khoa Project and has immediately commenced the next phase of Pre-Feasibility Studies.

Highlights

• Maiden Ban Phuc DSS indicated resource of 44.3Mt @ 0.52% Ni for 229kt Ni and Inferred Mineral Resource of 14.3Mt @ 0.35% Ni for 50kt Ni;

• Annual production of ~12.7ktpa Ni over ~8.5-year project life;

• Gross Revenue of ~US$3.3 billion (US$2.95 billion to US$3.6 billion);

• Net pre-tax cashflow of ~US$1.2 billion (US$1.03 billion to US$1.37 billion);

• Pre-production capital cost of ~US$314m including contingency;

• Pre-tax cashflow of ~US$179mpa (US$155mpa to US$210mpa);

• Pre-tax NPV8% of ~US$665m (US$550m to US$780m) and ~45% IRR (38% to 50% IRR);

• Capital Payback Period of ~2.5 years;

• Economically robust nickel sulfide project to produce downstream nickel: cobalt: manganese (NCM) Precursor products for the Lithium-ion battery industry;

• Downstream processing utilises existing well-tested technology;

• Blackstone’s downstream NCM Precursor product significantly improves the payability of nickel, from ~70-80% to ~125-135% of LME metal prices;

• Upside opportunities include staged Capex, by-product credits (including copper, gold, platinum, palladium and rhodium), King Cobra Discovery Zone (KCZ), Ban Chang, Ta Cuong and 25 untested massive sulfide vein (MSV) targets.

Blackstone’s Managing Director Scott Williamson commented:

“The Scoping Study defines a project path that maximises economics, minimises environmental and social impacts, and offers a lasting legacy to the people in our local community.”

“Whilst we are pleased with the outcomes of this study, we will continue to expand our resource and increase our production potential in this exciting, and yet under-explored region of Vietnam and have commenced work on PFS level studies for the project.”

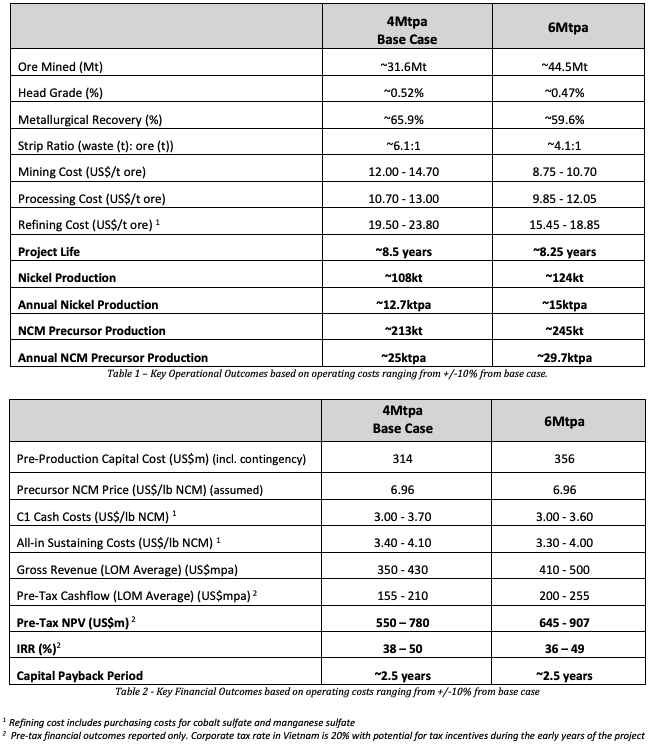

Conceptual Operational and Financial Outcomes

The following table should be read in conjunction with the details in following sections of this release as well as the material assumptions included in Appendix 1. All figures provided below and in this release are estimates or approximates based on Blackstone’s operational knowledge, familiarity of the scoping study team with deposits of similar size and complexity, in analogous settings and discussions with suppliers and key consultants, and may be subject to future modification during Pre-Feasibility and Definitive Feasibility stages.