Cobalt Market Update: Q2 2024 in Review

Oversupply weighed on the cobalt sector in Q2, hurting prices and changing miners' plans. Find out what else happened and what factors could drive the sector for the rest of the year.

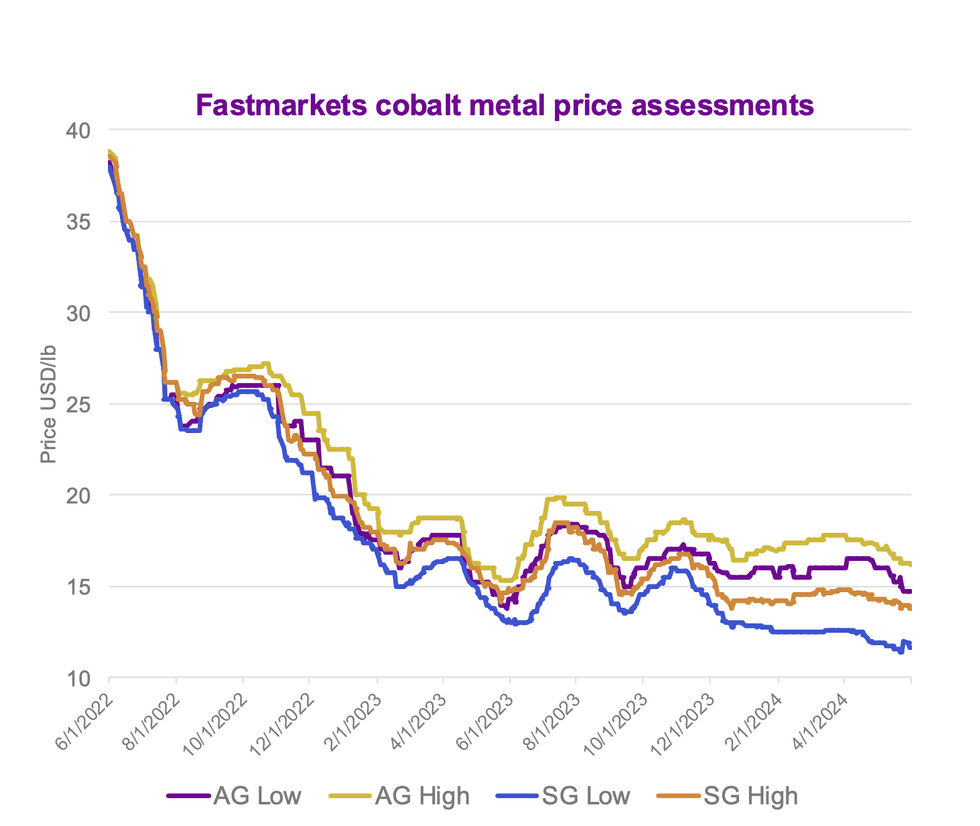

Prices for cobalt metal continued to contract in Q2 on the back of oversupply. Meanwhile, values for alloy-grade cobalt saw some growth due to increased demand in the aerospace and defense sectors.

Starting the 90 day session at US$28,551.80 per tonne, prices for cobalt metal shed 4.93 percent through Q2, ending the period at US$27,143.90. “We've seen prices for standard grade kind of draw down to eight year lows, despite the energy transition demand in the space that's been moving forward,” said Alex Cook, senior price reporter at Fastmarkets.

At Fastmarkets' Lithium Supply and Battery Raw Materials event, Cook noted that increased production in the Democratic Republic of Congo (DRC), Indonesia and China outpaced demand growth and impeded price momentum.

Reiterating that point in a July report, Cook and Angeline Shi, also of Fastmarkets, note that China’s CMOC Group (OTC Pink:CMCLF,SHA:603993) produced 54,024 tonnes of cobalt metal in the first half of the year, achieving 83 percent of its annual guidance of 60,000 to 70,000 tonnes. This surge, which added to an already oversupplied market, was reportedly driven by the expansion of CMOC’s TFM mine, along with increased monthly output at the KFM mines in the DRC.

As Cook explained, Fastmarkets expects cobalt metal prices to trend lower through the third quarter of 2024.

Cobalt metal price graph, June 2022 to April 2024.

Chart via Fastmarkets.

While cobalt metal prices remained muted in Q2, Cook noted that there is a growing price discrepancy between the value of cobalt metal, or standard-grade material, and alloy-grade material.

The spread between alloy-grade and standard-grade cobalt has widened to its largest point since 2009. Strong demand from the US aerospace sector has created a premium for approved aerospace brands amid supply tightness, he noted.

“We are seeing alloy grade at a premium,” Cook told the audience at the Fastmarkets event. “The main demand source at the moment is aerospace demand, and military defense applications as well.”

Additionally, a 25 percent US tariff on Chinese cobalt metal is somewhat restricting long-term imports. While some have opted to pay the tariff, Cook sees that trend as unsustainable.

He also highlighted a discrepancy between low standard-grade and high standard-grade prices. Supply disruptions for some western brands have created a small premium, with deals clustering around the higher end of the range. The rapid expansion of production capacity for Chinese brands has increased their availability, further widening the range.

Oversupply creating cobalt price pressure

Last year, global cobalt mine supply jumped 16.75 percent year-over-year, rising from 197,000 tonnes in 2022 to 230,000 in 2023. Both the DRC and Indonesia saw significant production increases, with the DRC's output climbing from 144,000 tonnes in 2022 to 170,000 in 2023 — that amounts to 74 percent of global supply. Indonesian production grew from 9,600 tonnes to 17,000 tonnes during the same timeframe, making up 8 percent of supply.

With higher mine output from the DRC and Indonesia, and increased refinery production in China, Fastmarkets is forecasting a 10,000 tonne surplus for 2024, which will add to price headwinds. This despite China’s State Reserve Bureau (SRB) making a strategic cobalt acquisition of 15,000 tonnes for delivery by the end of the year.

“Initially the (stockpiling) provided a boost to standard-grade prices; (however), the low end has since fallen to levels seen before the SRB purchase,” explained Cook. Moving forward, the SRB's 15,000 tonne acquisition could be offset by heightened production in China through the second half of the year.

Elsewhere, high copper prices are likely to keep cobalt by-product production in the DRC at elevated levels.

Indonesian cobalt supply is the result of high-pressure acid leaching (HPAL), a process used to extract nickel and cobalt from laterite ore bodies. Fastmarkets expects this space to grow significantly in the next decade.

“An increase in Indonesian HPAL capacity will more than double its share of cobalt mine supply by 2028," said Cook. “Indonesia will account for 19 percent of mine supply by 2028.”

With this increased production in the DRC and Indonesia, Fastmarkets anticipates that the market will take in an additional 52,000 tonnes of cobalt supply by 2028.

On the demand side, the battery segment will continue to drive growth. In 2023, batteries accounted for 73 percent of global cobalt demand, and according to Fastmarkets, demand from the sector is projected to rise at a CAGR of 12.5 percent between 2023 and 2028. This increase will boost the battery sector's share of demand to 81 percent.

In contrast, demand growth from superalloys and other sectors is expected to be much lower. These segments have estimated CAGRs of 4.4 percent and 2 percent, respectively.

Low prices weighing on western cobalt supply

Outside the DRC and Indonesia, cobalt mines have been impacted by weak prices.

“Those low prices that we've seen have really started to threaten the development of western cobalt capacity,” said Cook.

“Already over the last 12 to 18 months, we've seen a US cobalt mine having to be shuttered because of the low price environment — the breakeven cost is far higher than the market price," he added.

In April, cobalt- and nickel-focused Jervois Global (TSXV:JRV,ASX:JRV,OTCQB:JRVMF) suspended final construction and full concentrator commissioning at its Idaho Cobalt Operations (ICO).

“ICO’s mineral resource and reserve is the largest and highest grade confirmed cobalt orebody in the US and when commissioned will represent the country’s only primary cobalt mine supply,” the company said.

“Jervois has determined that not mining ICO cobalt at cyclically low prices, will preserve the optionality and inherent strategic value of ICO for shareholders and key stakeholders including local communities and the State of Idaho. The company also views not mining ICO at current prices is consistent with US Government critical mineral policy objectives.”

ICO isn't the only cobalt endeavor that has sidelined by a changing environment.

In late June, BASF (OTCQX:BFFAF,FWB:BASF) decided against a US$2.6 billion investment in a nickel and cobalt refinery. Although the move was largely attributed to increasing global availability of nickel, cobalt will be affected too.

BASF initially announced the plan with Eramet (EPA:ERA) in 2020, and the refinery project was expected to output 42,000 tonnes of nickel and 5,000 tonnes of cobalt annually for BASF.

What factors will move the cobalt market in 2024?

The cobalt market saw more stability in late June as some excess supply was absorbed.

“Prices continued their steady decline in June due to persistent oversupply from mines in the Democratic Republic of Congo and Indonesia,” FocusEconomics' July Consensus Forecast reads. “Against this backdrop of low prices, several hedge funds have recently entered the cobalt market as buyers, providing some support to pricing.”

Overall, Fastmarkets expects to see demand for cobalt increase in 2024, but believes this increased demand will not be enough to offset rising supply, leading to another year of surplus.

“(For) alloy grade it’s a little bit different,” said Cook. “We're seeing the opposite in that demand is actually increasing far above the availability of supply.” However, he did note that alloy demand is a small segment of the cobalt market.

“Our research team expects cobalt supply to continue to increase year-on-year, dominated by China. We are expecting China’s refined cobalt supply capacity to increase as well,” said Cook.

While Fastmarkets sees continued price pressure and bearishness in the cobalt industry for the remainder of the year, FocusEconomics has painted a more optimistic picture.

“Prices will surge from current levels by year-end on the back of resilient demand for electric vehicles (EVs), as well as speculative buying from hedge funds and planned stockpiling in China,” its report states. “In the longer term, prices will increase further as the metal is used in electronic applications and lithium-ion batteries, which are widely used in EVs.”

FocusEconomics panelists are projecting that cobalt prices will reach US$34,526 in Q4.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

- Top 3 Canadian Cobalt Stocks in 2024 ›

- Cobalt Stocks: 5 Biggest Producers ›

- Cobalt Reserves: Top 3 Countries ›

- Top 10 Cobalt Producers by Country ›

- 5 Largest Cobalt Mines in the World ›