- WORLD EDITIONAustraliaNorth AmericaWorld

February 09, 2024

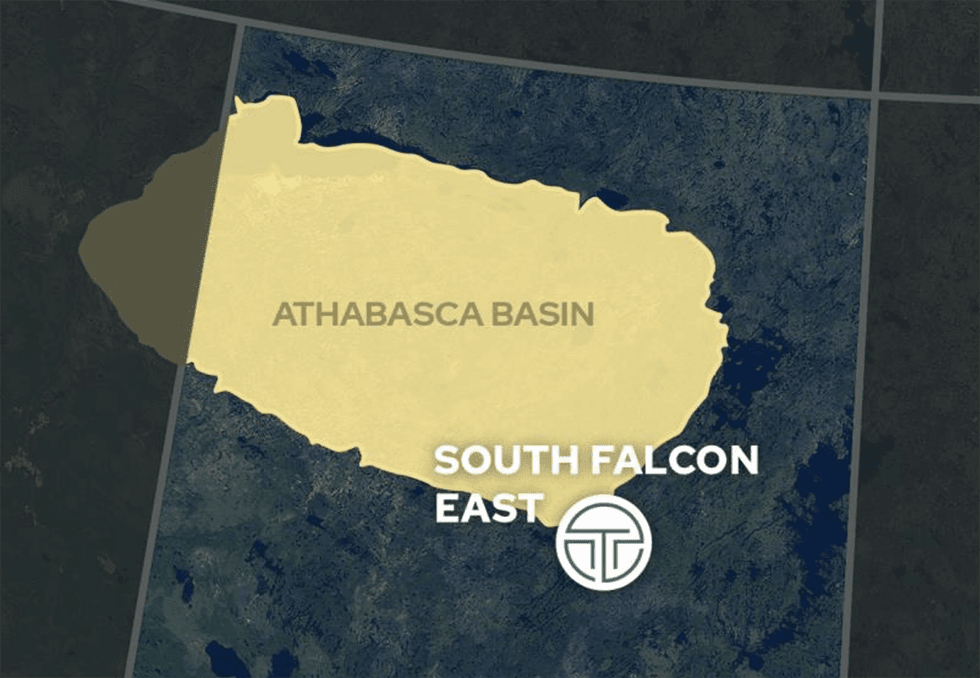

Tisdale Clean Energy (CSE:TCEC) focuses on uranium exploration and development by exploring the South Falcon East uranium project that spans over 12,000 hectares in the Athabasca Basin in Saskatchewan, Canada, and is home to the Fraser Lakes B uranium and thorium deposits.

In October 2022, Tisdale entered into an agreement with Skyharbour Resources (TSXV:SYH,OTCQX:SYHBF, FWB:SC1P) to acquire up to 75 percent interest in the South Falcon East project.

he South Falcon East is the company’s flagship uranium project where outcrop grab samples from 2008 to 2011 returned between 0.04 percent and 0.45 percent triuranium octoxide, and drill core samples returned mineralized sections with values from 0.01 percent to 0.55 percent triuranium octoxide. The Fraser Lakes Zone B deposit comprises multiple-stacked uranium, thorium and REE mineralization with an NI 43-101 mineral resource estimate of 6.9 Mlb triuranium octoxide at 0.03, and 5.3 Mlb thorium oxide at 0.023 percent within 10.3 million tons (Mt) of material using a cut-off grade of 0.01 percent triuranium octoxide.

Company Highlights

- Tisdale Clean Energy is a Canadian company focused on uranium exploration and development.

- The company’s flagship South Falcon East uranium project in the Athabasca Basin in Saskatchewan, Canada, contains the Fraser Lakes B uranium/thorium deposit.

- The South Falcon East project has a historic inferred mineral resource estimate of 6.9 million pounds (Mlbs) triuranium octoxide at a grade of 0.03 percent, and 5.3 Mlbs thorium oxide at 0.023 percent thorium oxide.

- The geological and geochemical characteristics of the project are similar to several other high-grade deposits in the basin, such as Eagle Point, Millennium, P-Patch and Roughrider.

- The Athabasca Basin is home to most of Canada’s high-grade uranium deposits and contributes over 20 percent of the world’s supply. Saskatchewan is a geopolitically stable, proven mining jurisdiction with significant infrastructure already in place.

- Uranium prices have crossed $100/lb, last seen in 2007, reflecting a tight market driven by an increased focus on nuclear energy as the world transitions to net zero.

This Tisdale Clean Energy profile is part of a paid investor education campaign.*

Click here to connect with Tisdale Clean Energy (CSE:TCEC) to receive an Investor Presentation

TCEC:CC

Sign up to get your FREE

Terra Clean Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 January

Terra Clean Energy

Advancing an expansive uranium landholding in the prolific Athabasca Basin and past-producing uranium districts in the United States

Advancing an expansive uranium landholding in the prolific Athabasca Basin and past-producing uranium districts in the United States Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Terra Clean Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00