The results of our reader survey show a dramatic increase in the level of interest and investment in the rare earth markets. The rise of rare earths in 2010 is a direct result of Chinese export policies have that helped the dramatic rise of rare earth prices.

By Michael Montgomery—Exclusive to Rare Earth Investing News

The results from our reader survey are back, and some interesting trends have developed. This is not a scientific survey; but it is a survey to see what stories, markets, and trends our readers are following. The past year has been promising for most commodities, as many markets have rebounded after the economic collapse that crushed most commodities in 2008-09. Gold and silver have seen near record highs, molybdenum has rebounded, and rare earths have skyrocketed as a result of China’s trade policies. How have these events affected what our readers’ value and where they have invested? Let’s take a look.Rare earth elements (REE’s) have had quite a run this year. Many factors have played into this meteoric rise. The main catalyst in the growth of the REE’s rise was China’s export policies. Chinese officials in an attempt to discourage illegal trading of rare earths, as well as an effort to reduce the environmental impact of REE mining slashed export quotas over 70 percent. The news cycle picked up this story, as a result governments and international electronics companies were scrambling for answers. As the world started catching on the importance of rare earths, and the power that the Chinese monopoly holds over the market with over 95 percent of world supply, a major political event poured gasoline on the fire.

A Chinese fisherman was arrested after ramming a Japanese Coast guard boat, in waters around islands in a territorial dispute between the two nations. In what seemed, by many analysts, as a political maneuver, Chinese customs officials stopped all shipments of rare earths to Japan. The unofficial embargo brought even more attention to the rare earth market, investors started pumping money into junior mining firms, and the price of many of the 17 elements that comprise rare earth elements shot through the roof. There are no signs on the horizon that these export quotas will be dropped, as a result, prices of these elements should remain high until non-Chinese sources come online. The creation of the Van Eck Rare Earth ETF, allows investors to get into the rare earth market and capitalize on the various aspects that are unique to investing in rare earths. This avenue may be appealing to those afraid to risk investing in individual mining firms, and will increase the total investments in this sector.

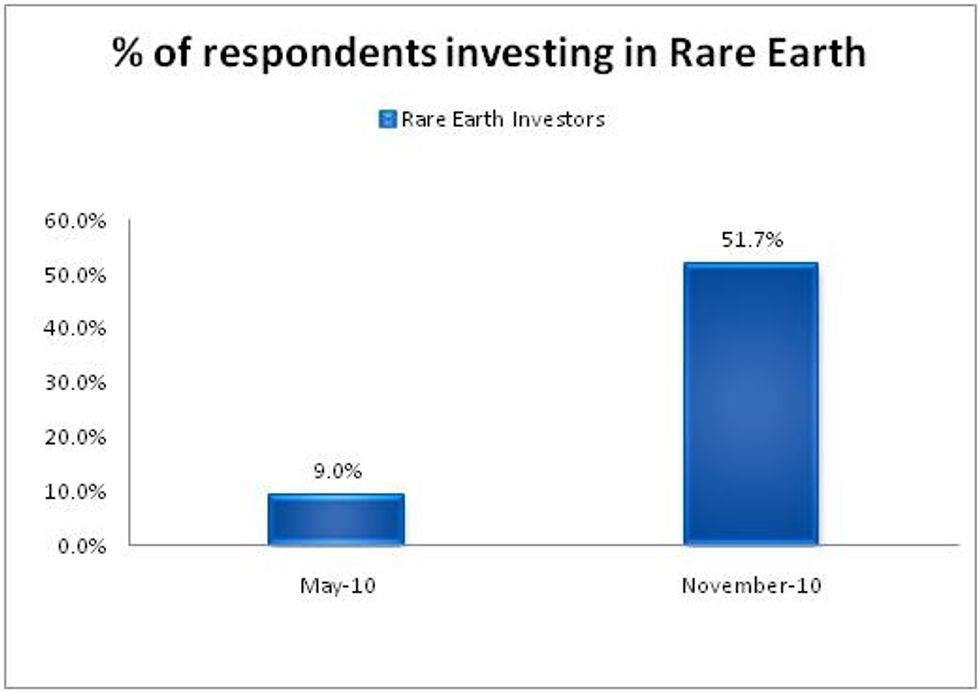

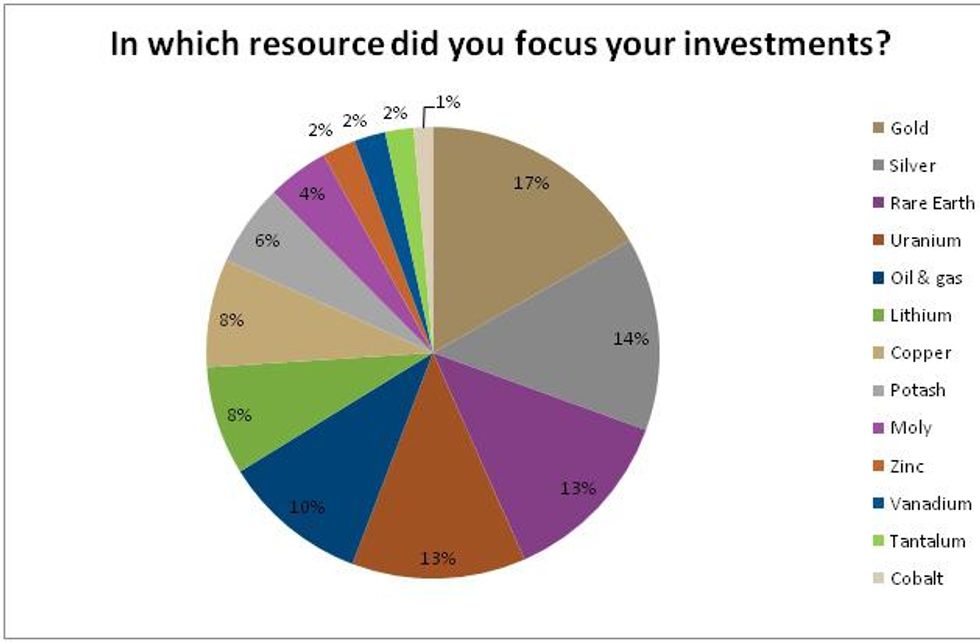

In May of 2010 only 9 percent of survey respondents claimed to be invested in the rare earth market. In our latest survey this number has jumped to 51.7 percent, as massive increase that is indicative of the increased attention to this market. As a percent of the total investment universe, 13 percent of our readers now are invested in rare earths tied with uranium, bested only by gold and silver.

There has been an increase in respondents with investments in all of the top five categories, gold and silver’s performance can be tied to those looking to hedge inflation and mistrust of global monetary policy. But the most dramatic increases, in the energy and rare earth fields are most likely tied with investors looking to capitalize on the growing industrial demand for these commodities.

The outlook for rare earth elements in 2011 is strong. The continuance of China’s export policies will keep the supply and demand fundamentals strong. This factor, coupled with the lack of new mining operations will hold supply of the metals in a constant and predictable level. Outside of Lynas Corp. (ASX:LYC) and Molycorp (NYSE:MCP) no new mines will come online outside of China in 2011. Molycorp is not planning to mine their deposit until 2012, as of now, they are selling material from old tailing on the Mt. Pass, California site. There are many promising deposits that are vital to the rare earth market, but as a reality of mining these difficult elements, they will not be producing in the short term. Watch for another strong year for rare earth elements.