Platinum Price Forecast: Top Trends That Will Affect Platinum in 2024

The platinum deficit deepened in 2023 — how will this supply shortfall impact the market in the year ahead?

After posting a sizeable surplus of 776,000 ounces in 2022, platinum market dynamics began to reverse course last year on the back of strong demand and decreased supply for the precious metal.

At the start of 2023, the World Platinum Investment Council (WPIC) expected platinum to slip into a deficit of around 556,000 ounces for the year based on increasing demand from the auto sector and strong imports from China.

Platinum is widely used in catalytic converters, which contain one or more of the platinum-group metals (PGMs). They act as catalysts to break down harmful emissions, and separate nitrogen from oxygen in nitrogen oxide molecules.

The metal is also increasingly being used in the production of green hydrogen, which is hydrogen produced from renewable sources as opposed to fossil fuels. PGMs are used to create proton exchange membranes as a catalyst to separate hydrogen and oxygen from water molecules. Hydrogen technologies already have more than US$570 billion in announced investments through 2030, and have the potential to add significantly to platinum demand growth.

And of course, platinum is party to considerable demand from investors looking for a safe haven.

Read on to learn more about the factors that moved the platinum market in 2023 and what to expect in 2024.

How did platinum perform in 2023?

In its most recent quarterly report, released in November 2023, the WPIC revised its platinum deficit expectation for 2023 to a shortfall of 1,071,000 ounces, nearly twice the initial number of 556,000 ounces.

On the supply side, 4,046,000 ounces of platinum were produced globally from Q1 to Q3 of last year, down 2.63 percent year-on-year. The majority of platinum production comes from South Africa, where mines continued to face electricity problems at the start of the year, leading to significant production deficits year-on-year in Q1 and Q2.

Data from the WPIC indicates that over the first three quarters of 2023, South African platinum output came to a total of 2,789,173 ounces, a decrease of 6.53 percent — or 194,844 ounces — compared to the equivalent period in 2022.

Production in the country improved slightly over the course of 2023, and Q3 output was up by 19,000 ounces compared to Q3 2022, marking the first quarter to see a year-on-year production increase since Q4 2021. The WPIC notes that the increase was the result of better management of load curtailment and less downstream processing capacity downtime.

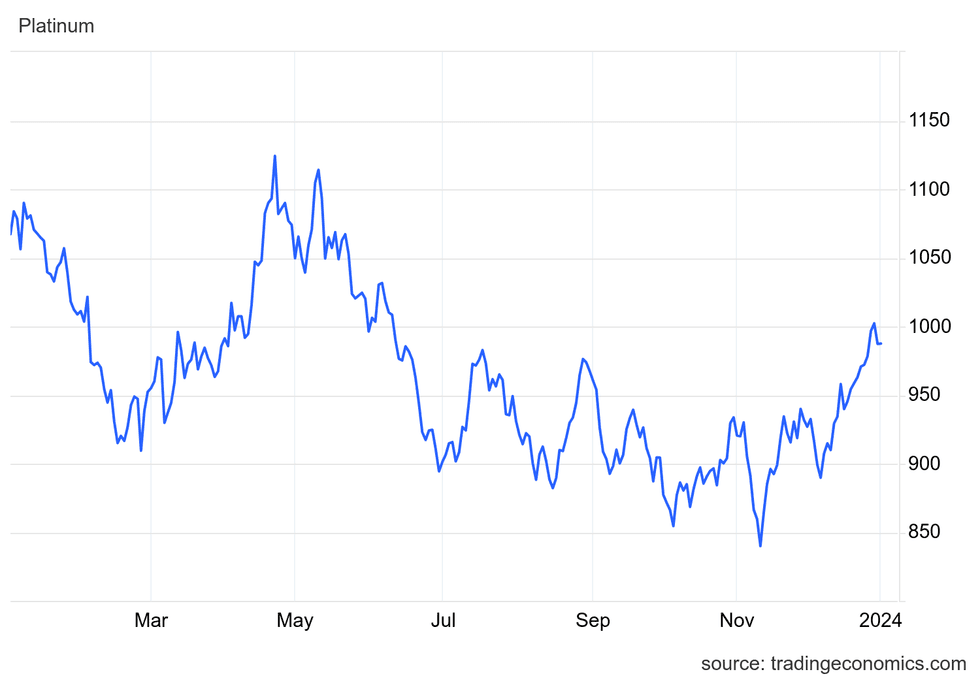

Platinum price from January 1, 2023, to December 31, 2023.

Chart via TradingEconomics.

Russia, Zimbabwe and North America also produce significant amounts of the metal, and all three saw production increases compared to 2022, partially offsetting South Africa’s losses.

Russia’s platinum production rose 6.96 percent to 537,739 ounces due to deferred downstream maintenance, while Zimbabwe’s output was up 3.82 percent to 370,467 ounces. Meanwhile, North America’s output increased 3.76 percent to 204,740 ounces. The three regions combined for an additional 56,038 ounces.

Supply was also impacted by a 12.98 percent decrease in recycled platinum, which came to 1,094,000 ounces in the first nine months of 2023, down from 1,257,000 ounces in 2022.

This overall decrease in platinum supply has been set against a backdrop of increasing demand, which came in at 6,077,500 ounces in the first nine months of 2023 compared to 4,767,000 ounces in 2022. Uptake was largely driven by increased production in the automotive sector, which has begun to return to pre-pandemic levels.

In an email to Investing News Network (INN), Edward Sterck, director of research at the WPIC, said recycled platinum supply from vehicles is down at the same time. “Recycling supply has been held back by a shortage of end-of-life vehicles as consumers are running existing vehicles for longer,” he explained.

Platinum demand was also bolstered in 2023 by investors beginning to return to the market, with 322,000 ounces being traded through the first half of the year as opposed to a net selloff of 327,000 ounces in the first half of 2022. The biggest change came from investment inflows from exchange-traded funds, which saw 196,000 ounces purchased in the first half of 2023 versus outflows of 278,000 ounces in the first half of 2022.

However, even though platinum is expected to end 2023 in a deficit, the price finished the year at US$987.25, significantly down from its yearly peak of US$1,124.28 on April 21, as aboveground stockpiles came into play.

“The biggest issue facing the platinum market in the past year has been the development of a record supply/demand deficit, which has been met by a drawdown from aboveground stocks that has acted to suppress a response in the platinum price,” Sterck commented to INN.

What will happen to the platinum price in 2024?

Wilma Swarts, director of PGMs at Metals Focus, told INN she sees a continued supply deficit going into 2024.

“Mine supply is at risk of increasing decline,” she said. “Given the inflationary costs of wages, power and the weakening rand, more than 50 percent of mines in South Africa are loss-making at the spot basket price. We can expect to see production curtailment and mine closures if prices remain at current levels over the next two to five years.”

Rohit Savant, vice president of research with CPM Group, also mentioned to INN that supply curtailment is a concern, although he doesn’t see it happening until after 2024.

“While mining companies are expected to be challenged by the weakness in prices, cutting production this year is likely to be difficult, especially in South Africa" he commented. "Especially since it is an election year, and so much of South African employment and GDP is dependent on the mining sector."

Sterck emphasized the importance of aboveground stocks in 2024 and beyond, again saying that they are dampening the platinum price despite strong demand. “We forecast platinum to remain in sustained market deficits through 2027. The biggest driver is likely to be the point at which the depletion of aboveground stocks reaches a critical level where higher prices are needed to attract additional material into the market,” he concluded.

Investor takeaway

As the auto industry adjusts to tighter emissions regulations, catalytic converters are requiring higher loadings of PGMs, meaning that demand for platinum is likely to remain high for the next several years.

The metal is also facing increasing demand specifically for its use in the production of green hydrogen, which is an emerging sector that is expected to be an important part of the energy transition, particularly beyond 2035.

However, with aboveground stocks still in play, investors may have to wait to see the platinum price move.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- 4 Platinum Uses for Investors to Know ›

- How to Invest in Platinum ›

- Will Platinum be Impacted by Electric Cars? ›