Overview

As the world continues its transition away from many carbon-based forms of energy, so too does the urgency arise for sustainable sources for the critical components of green technology – primarily copper and nickel. The global energy transition is the largest coordinated effort in our generation and mandates from governments, corporations, financial institutions, and portfolio companies worldwide have demonstrated their desire to invest in a greener world.

However, with increased demand for both metals, the world faces significant supply deficits — making major copper and nickel projects among the world’s most strategic mineral deposits. Nova Royalty (TSXV:NOVR, OTCQB:NOVRF) is the only royalty company focused solely on copper and nickel. Nova offers investors direct exposure to these critical metals and is an efficient way for investors to participate in the future of greener energy.

Nova has a portfolio of tier-one, long-lived royalties on the next generation of the world’s major copper projects, with select exposure to strategic nickel deposits. Nova’s royalty portfolio is built on highly-strategic deposits in prolific jurisdictions, owned by some of the world’s leading mining companies who have established track records of success in building and operating mines.

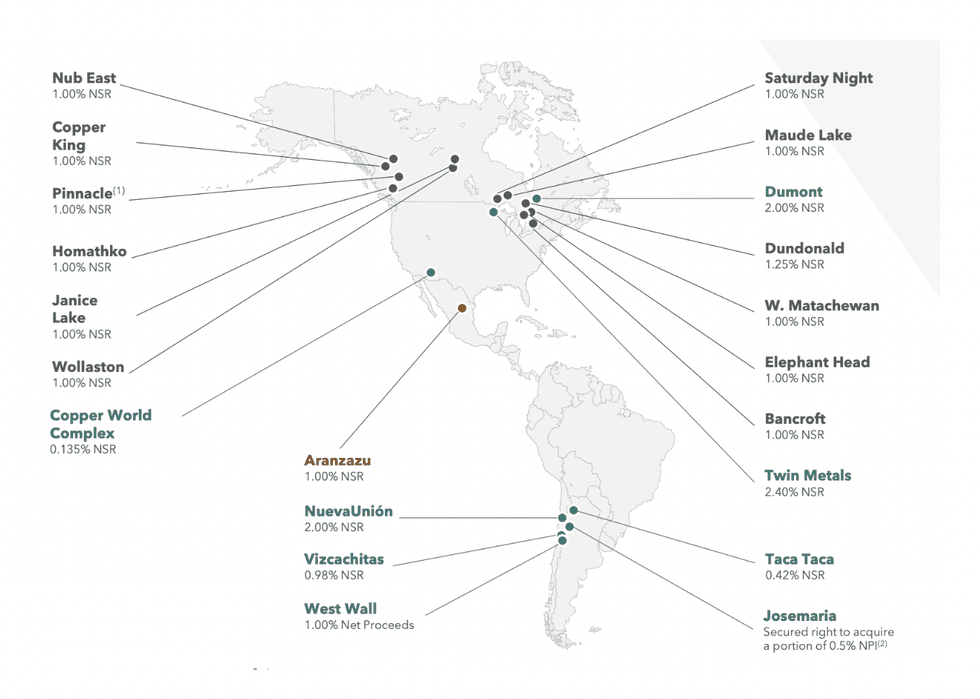

Nova currently has 22 royalties: one producing royalty, eight development-stage royalties and 13 exploration-stage royalties.

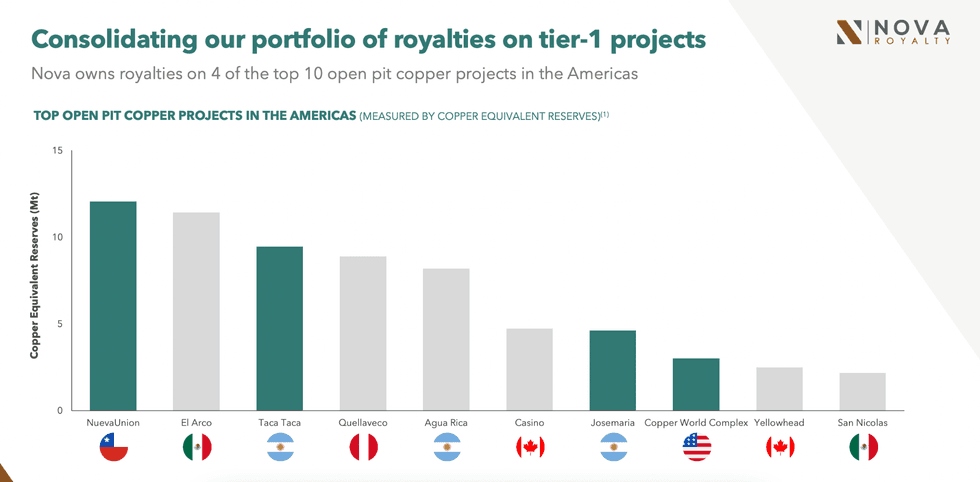

As a royalty company, Nova has substantially reduced overall risk with a global portfolio of high-quality assets. The company owns royalties on 4 of the top 10 open pit copper projects in the Americas.

Nova has acquired royalties on large-scale, high-quality projects owned by major mining companies leading development and exploration. These owners, and their accompanying assets, include First Quantum’s Taca Taca, Hudbay’s Copper World Complex, Lundin Mining’s Josemaria, Teck and Newmont’s NuevaUnion, Aura Minerals’ Aranzazu, Waterton Global's Dumont, and Antofagasta’s Twin Metals. With several other exploration assets, Nova Royalty has built a solid foundation and has turned its focus and attention toward adding near-term cash flow generating royalties to its roster.

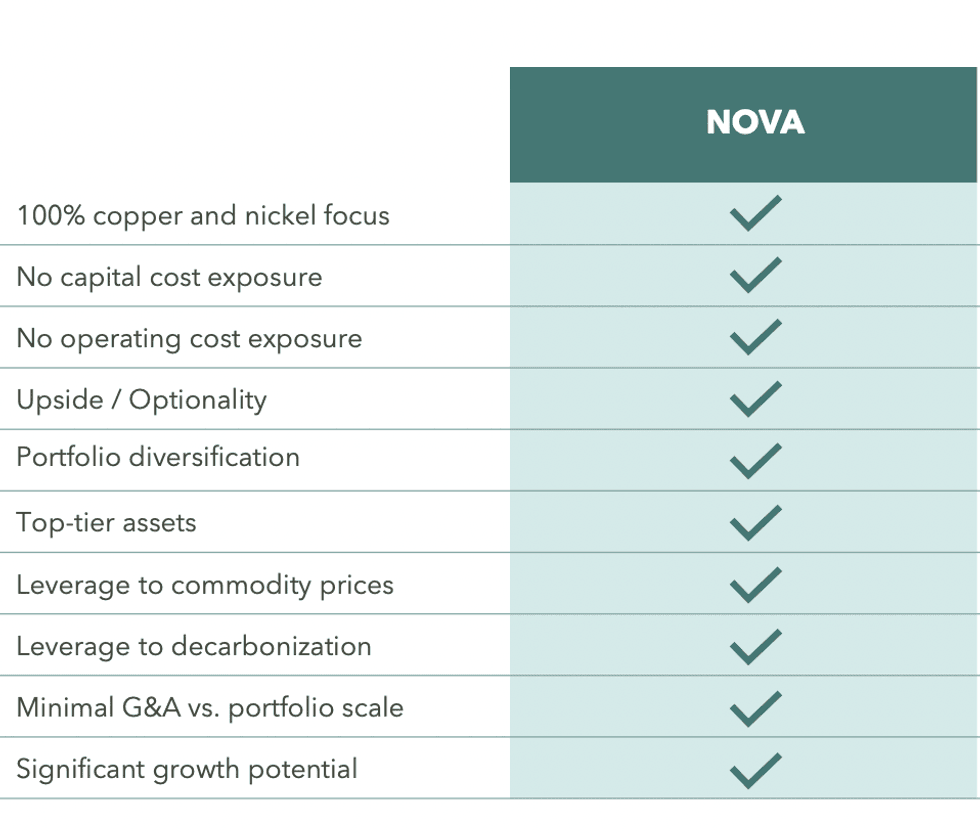

Additionally, the royalty model offers direct exposure and optionality to commodity price appreciation and production increases, while protecting investors from direct operating and exploration costs typically associated with a traditional mining business.

Company Highlights

- Nova Royalty is a royalty company focused on leveraging the transition to green energy with a direct investment in valuable copper and nickel assets, the building blocks for the energy transition.

- The company has an international portfolio of production, development and exploration projects spanning strategic jurisdictions in Chile, Argentina, Mexico, Canada and the US. The region that hosts the Dumont mining project in Quebec has the world's largest emerging reserves of nickel.

- As a royalty company, Nova is exposed purely to revenues and is protected from any direct operating, carrying, exploration or development costs. It offers optionality on copper/nickel price appreciation, production expansion and reserve increases without any additional capital or operating costs.

- Strategic operators in Nova's portfolio include First Quantum, Teck, Hudbay, Lundin, Newmont, Antofagasta and Rio Tinto. The company also has several other exploration royalties.

Get access to more exclusive Copper Investing Stock profiles here