Managing Wealth Across Borders: Q&A with CompareForexBrokers’ Justin Grossbard

Justin Grossbard of CompareForexBrokers shares strategies for cross-border transfers and smart investing.

Navigating international money transfers can be costly and complex, with hidden fees and poor exchange rates often eroding returns. To shed light on how individuals and businesses can better manage these transactions, the Investing News Network sat down for a Q&A with Justin Grossbard, co-founder of CompareForexBrokers, who shared strategies for cross-border transfers and smart investing.

What are the biggest forex costs individuals and businesses face with international transfers?

The conversion rate is now the number one cost facing international transfers. In the past, institutions were more transparent with their charging fees for sending money overseas, but this practice was unpopular. Today, those fees are built into the conversion rate for each transaction, which is often unfavorable for the client.

Investors have several options for transferring money internationally, including using banks, credit cards, or specialized transfer platforms. What should they focus on when comparing providers?

The exchange rate offered should be the primary focus when deciding the best option. This rate isn’t just when sending money, but also when receiving funds from overseas. Often when you receive funds into a bank, the bank may not only give you a poor rate (if it’s not sent in your local currency) but also charge a fee for accepting the payment.

Additionally, you should also factor in any additional fees when sending money. When using a credit card, for example, people don’t often realise they may get charged a ‘cash advance fee’ (commonly 2 percent to 5 percent of the amount withdrawn) and a foreign transaction/overseas fee (often 2 percent to 3 percent of the transaction amount).

These fees are why credit cards should be used rarely for international transactions, despite offering other benefits like personal protection.

For individuals or companies moving larger sums, where are the greatest opportunities to save on foreign exchange costs?

Finding a provider that allows you to have separate wallets for different currencies, is the greatest opportunity to save on foreign exchange rates. For example, if you have a USD wallet and you purchase and receive USD, you can avoid conversion fees altogether.

Use of separate wallets is also beneficial when investing. For example, if you're trading on the NASDAQ, having a USD wallet is ideal when purchasing and selling shares.

Beyond fees, what other factors should investors consider when making transfer decisions?

The most important factor is convenience.

You need to find a way to easily send and receive currencies that integrate with your normal systems (e.g., your local bank account). This doesn’t mean I’m advocating going down the most convenient option (since they might have high fees), but finding one that aligns with your current processes and infrastructure while keeping fees down.

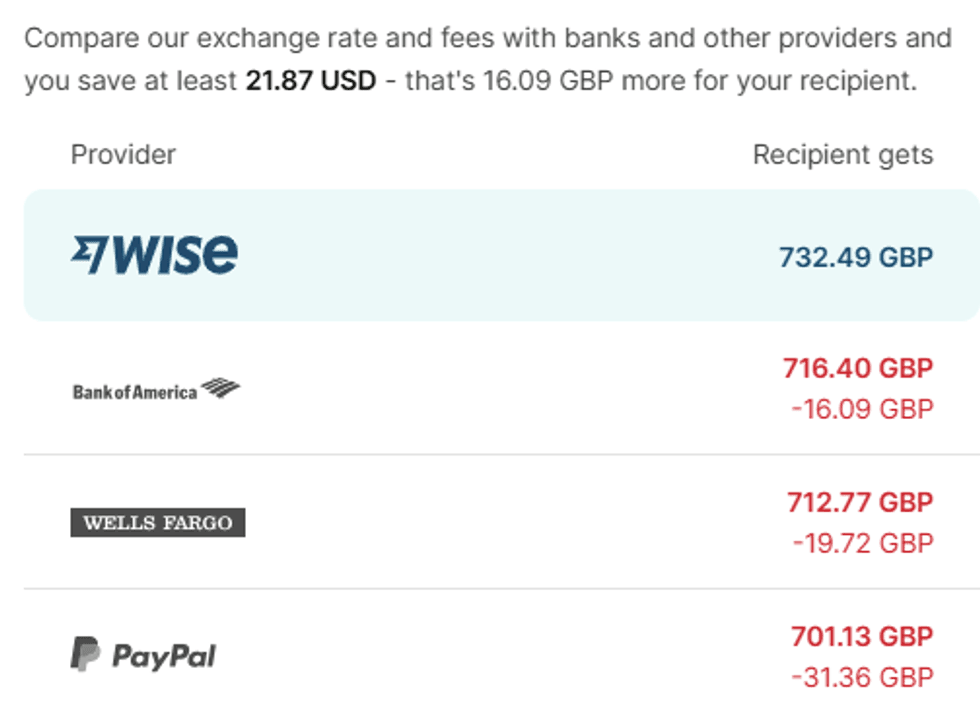

Below is an example comparing sending USD to GBP. It shows how using a local bank or a service like PayPal results in $1,000 US dollars becoming a significantly smaller amount in British Pounds. I personally use Wise based on the convenience it offers, low fees and the ability to have multiple wallets, making it easier to receive payments.

How do foreign exchange costs and transfer efficiency fit into the overall strategy for investors managing wealth internationally?

Most investors are now buying shares in companies across multiple exchanges. A mistake they make when using a broker is they compare the brokerage rates but ignore the currency conversion fees.

For example, in Australia, NAB Trade is a solid choice for trading on the Australian Stock Exchange. The issue is that when you choose a share like Google that is listed on the NASDAQ, the broker provides a poor exchange rate as that’s another lucrative revenue stream for them. For this reason, I personally choose Interactive Brokers, which provides a fairer exchange rate and the ability to hold funds in different currencies.

Are there particular currency pairs that investors should be watching more closely?

There are two currency pairs that I feel are critical on a global scale. The first is the US dollar to Japanese yen rate. This is due to the large amount of US treasuries Japan holds and the interest rate differential between the two economies. Changes in this rate are often a sign of currency flows and can even impact the price of shares as people borrow money in Japan (at low rates) and place it on US equities.

The second rate to focus on is the Euro/US dollar, which is the most traded worldwide. What both economies have in common is extremely high government debt levels and general trade deficits. If this rate moves rapidly either way, it will destabilise the financial system as we know it, hence why it's worth watching.

Looking ahead, how do you see comparison tools changing the way investors and businesses handle cross-border transactions?

I believe that many banks and institutions are making too much money from international money flows to reduce their rates. This is why I strongly advocate for the growth of international money intermediaries and have even purchased shares in Wise. Not only can I see these companies attracting more businesses and individuals, but the amount for which each entity uses their services will increase as well. Then it comes down to brokers becoming more transparent on what they charge for overseas equity purchases (e.g., shares) offering fairer rates.

Our website, CompareForexBrokers, for currency trading, has compared the average spreads (difference between the ask and sell price of each currency pair) and the commission rates. This helps provide a complete fee comparison picture by broker to determine the best value provider.

About the CEO

Justin Grossbard is the co-founder of CompareForexBrokers and BrokersRegulados, both of which are comparison sites. He holds both a Commerce and a Master's degree and wrote the book "5 Alternative Investments to Earn a Return Outside of Stocks and Bonds." These resources provide the tools for individuals to make sound financial decisions — from choosing the right broker to the right investment.