May 16, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) refers to the announcement released on 16 May 2024 titled “HIGH PRIORITY BEDROCK GOLD TARGET IDENTIFIED AT GIDJI JV” (Announcement).

An updated announcement is attached, which includes a JORC Table 1 and 2 with details of the Offset Pole-Dipole IP survey conducted by the Company in May 2022.

To clarify, the gravity image presented in Figure 5 of the above Announcement was produced by gridding open file gravity data over the project area downloaded from WA government websites.

This announcement was authorised for release by the board of directors.

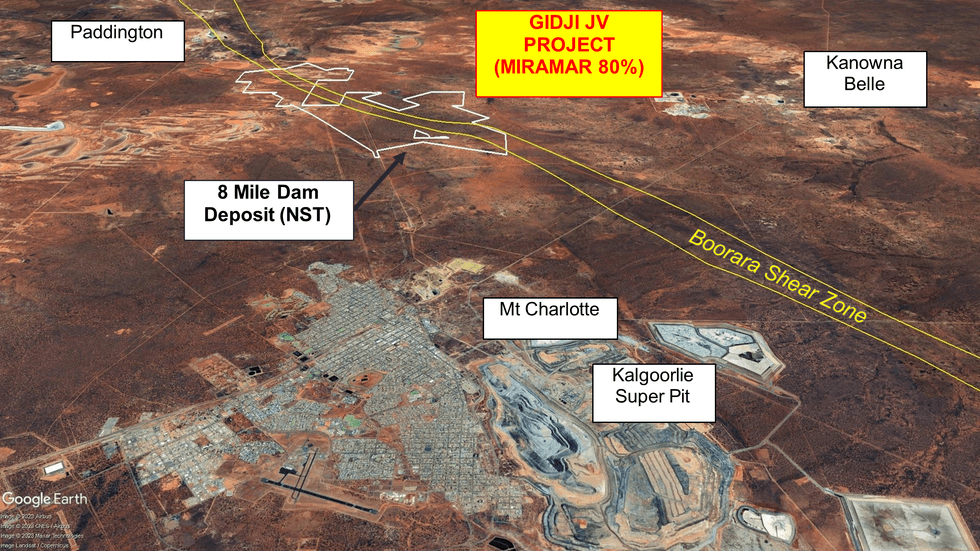

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that reprocessing of geophysical data has upgraded the 8-Mile target within the Gidji JV Project (“Gidji” or “the Project”), 15 kilometres north of Kalgoorlie, WA.

- Reprocessing of geophysical data increases potential for northern extension to NST’s 313koz “8 Mile Dam” Deposit at Miramar’s 8-Mile target

Miramar’s 8-Mile target is located at the southern boundary of the Gidji JV Project and abuts Northern Star Resources Limited’s 313koz “8 Mile Dam” gold deposit (Figure 1).

The reprocessed data shows a well-defined gravity and Induced Polarisation (IP) anomaly north of the 313koz “8 Mile Dam” Resource, which appears to have been offset by a SW-NE trending fault and underlies numerous significant aircore end of hole (EOH) results.

Miramar’s Executive Chairman, Mr Allan Kelly, said the combination of the multiple coincident datasets increased the potential for an extension to the 8 Mile Dam deposit within the Company’s Gidji JV Project.

“We have multiple high-grade end of hole aircore gold results overlying an IP and gravity anomaly which looks very similar to the 8 Mile Dam gold deposit immediately south of our tenement boundary,” he said.

“The geophysical data suggests that the deposit may extend into our ground but has been offset approximately 400 metres to the northeast by a fault,” he added.

“The 8-Mile offset target is within reach of RC drilling and, unlike the targets further north, there is no paleochannel covering the basement geology,” he said.

According to publicly available information, the 8 Mile Dam Project contains 7Mt @ 1.4g/t Au for 313,977 contained ounces1 with primary mineralisation hosted in a steep southwest-dipping mafic unit within volcanoclastic sediments of the Black Flag Beds. Figure 2 shows a cross section through the deposit approximately 40m south of the Gidji JV tenement boundary.

In March-April 2021, Miramar completed the second phase of aircore drilling across the Gidji JV Project, including several holes at the 8-Mile target. Significant results along strike from 8 Mile Dam included 1m @ 1.17g/t (GJAC092), 3m @ 1.22g/t Au (GJAC097) and 1m @ 1.78g/t Au (GJAC099). Other holes also intersected anomalous gold including at the end of hole (ASX Release 12 April 2021 and 29 June 2021).

In May 2021, Miramar completed three diamond drill holes targeting a strike extension to the 8 Mile Dam deposit. All three diamond holes intersected the same geological package as 8 Mile Dam but intersected only minor gold mineralisation within the mafic unit (ASX Release 11 May 2021).

At the same time, Miramar completed an orientation IP survey comprising one line of Dipole-Dipole IP just north of the tenement boundary. The survey highlighted a chargeability anomaly close to the projected position of the 8 Mile Dam deposit but underneath and south of Miramar’s diamond holes (Figure 3).

Given the interpreted depth of the IP anomaly, the limited potential strike length north of the tenement boundary and the disappointing diamond drilling results, the target was downgraded with the Company focussing on the Marylebone target where numerous high-grade aircore gold results were being received.

The Company subsequently received assay results from EOH samples from the second phase of aircore drilling. Several holes at 8-Mile returned significant fire assay gold results (see Table 1). The best EOH results were offset to the northeast of both the diamond drilling and the IP anomaly and did not correlate well with the original aqua-regia assay results.

In early 2022, following the takeover of KCGM, Northern Star Resources Limited commenced diamond drilling at the 8 Mile Dam deposit, immediately south of the tenement boundary. Miramar staff observed that the new drilling was oriented towards the southwest, in the opposite direction to most of the drilling conducted by KCGM, implying that Northern Star were targeting a different geological model.

To date, Northern Star have not announced any results from that drilling.

In May 2022, Miramar completed a follow-up IP survey comprising a central transmitter line and two receiver lines spaced approximately 350m apart and extending for 1600m.

This Pole-Dipole IP survey highlighted a NW-trending chargeability anomaly offset approximately 400m to the northeast of the diamond holes and the orientation IP anomaly and located underneath the significant EOH aircore results (Figure 4). The new IP anomaly has a strike length of at least 250m, is approximately 400m below surface and remains open to the northwest.

The Company also reprocessed open file gravity data which highlights NW-trending gravity anomalies underlying both the 8 Mile Dam deposit and Miramar’s 8-Mile target where the gravity anomaly is also offset approximately 400 metres to the northeast by a SW-NE-trending fault (Figure 5).

Miramar is reviewing options for testing the offset 8-Mile target including aircore drilling and/or RC drilling. The Company has Programme of Work (POW) approval for drilling at this target.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00