When the US dollar strengthens against other major currencies, the prices of commodities typically drop. Find out why.

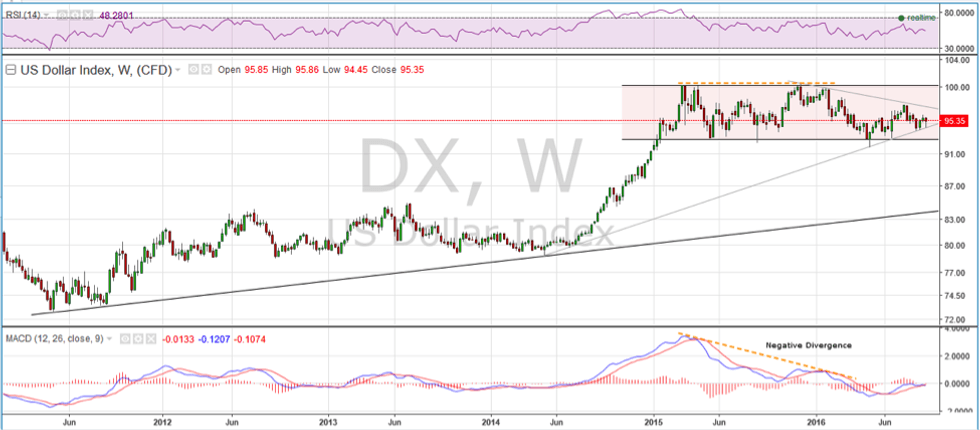

On a weekly basis, the US Dollar Index (DX) has been in an 18+ month sideways consolidation channel digesting an explosive move from 80 to 100. It is typical for such a consolidation to be the midpoint of a higher move with 115+ as a measured move target.

There is, however a negative divergence between the moving average convergence divergence (MACD) and price which would seem to suggest that a lower valuation for the DX is more likely.

A negative divergence on a weekly scale is usually a very reliable indicator of future price levels. Given the contradictory signals being given, it is very difficult to say with conviction whether to expect a higher or lower US dollar in the coming months. For the time being, the sideways consolidation channel is the status quo, and until we see a breakout one way or the other, the DX remains range bound between 92.50 and 100.

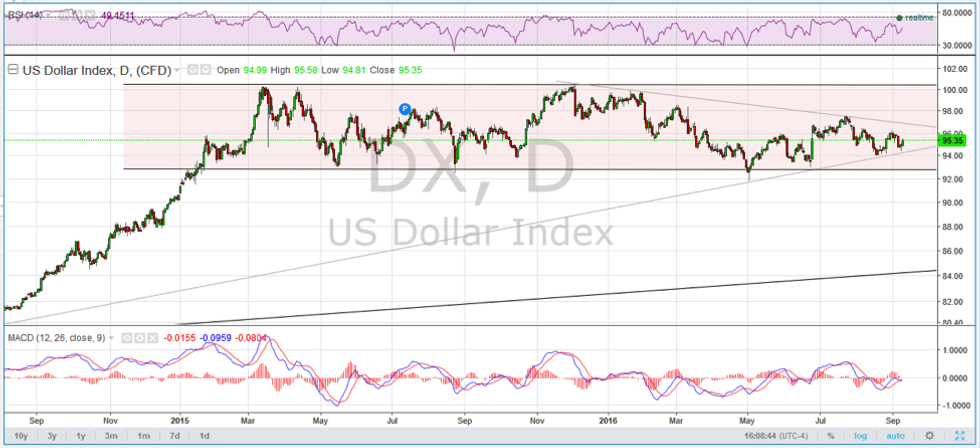

On a daily basis, price is coiling into a tighter and tighter range–suggesting a stronger move may be imminent. A break above the grey trendline would imply the 100 level could be tested, although the prior congestion between 97.50 and 98 is a resistance zone. A break below the lower grey trendline and all eyes will be focused on the 92.50 level which has offered support dating back almost 2 years. Failure to hold that level would deal a significant blow to the US$ bull, and selling pressure could intensify.

While it is yet to be determined what the future holds in terms of a stronger or weaker dollar, what happens going forward has definite implications for commodities. There is normally an inverse relationship between the US$ and commodity prices. It isn’t a perfect correlation, but when the dollar strengthens against other major currencies, the prices of commodities typically drop. When the value of the dollar weakens against other major currencies, the prices of commodities generally move higher.

There are many reasons why the value of the dollar has an impact on commodity prices. The main one being that commodities are priced in dollars. If the value of the dollar drops, it takes more dollars to buy commodities. With energy’s relative importance to global GDP, it should come as no surprise that the 5 most negatively correlated commodities to the US dollar are all oil-based and a fall in the dollar tends to correspond to a rise in these commodities. Less intuitively, commodities such as livestock and sugar tend to have much weaker relationships with the dollar.

The US Dollar Index is a measure of the value of the United States dollar relative to a basket of foreign currencies. It is a weighted geometric means of the dollar’s value relative to the: Euro (EUR), 57.6 percent weight, Japanese yen (JPY) 13.6 percent weight, Pound sterling (GBP), 11.9 percent weight, Canadian dollar (CAD), 9.1 percent weight, Swedish krona (SEK), 4.2 percent weight, Swiss franc (CHF) 3.6 percent weight.

Terry Yaremchuk is an Investment Advisor and Futures Trading representative with the Chippingham Financial Group. Terry offers wealth management and commodities trading services. Specific questions regarding a document can be directed to Terry Yaremchuk. Terry can be reached at tyaremchuk@chippingham.com.

This article is not a recommendation or financial advice and is meant for information purposes only. There is inherit risk with all investing and individuals should speak with their financial advisor to determine if any investment is within their own investment objectives and risk tolerance.

All of the information provided is believed to be accurate and reliable; however, the author and Chippingham assumes no responsibility for any error or responsibility for the use of the information provided. The inclusion of links from this site does not imply endorsement