Rodinia has 100% mineral rights to 50,440 acres in Nevada’s lithium-rich Clayton Valley in Esmeralda County and is currently in the process of assessing the size, quality and processing alternatives of its Lithium Brine Project. Early estimates put the valley’s lithium deposits as high as 700 million kg, ranking it second only in size to the deposits found in Chile.

Overview

Rodinia has 100% mineral rights to 50,440 acres in Nevada’s lithium-rich Clayton Valley in Esmeralda County and is currently in the process of assessing the size, quality and processing alternatives of its Lithium Brine Project. Early estimates put the valley’s lithium deposits as high as 700 million kg, ranking it second only in size to the deposits found in Chile.

Highlights

- Property adjacent to the only US lithium production facility

- Focused on low-cost lithium brine production

- Known historical resource in mining-friendly Nevada

Chief Properties

Clayton Valley Project

Esmeralda County, Nevada

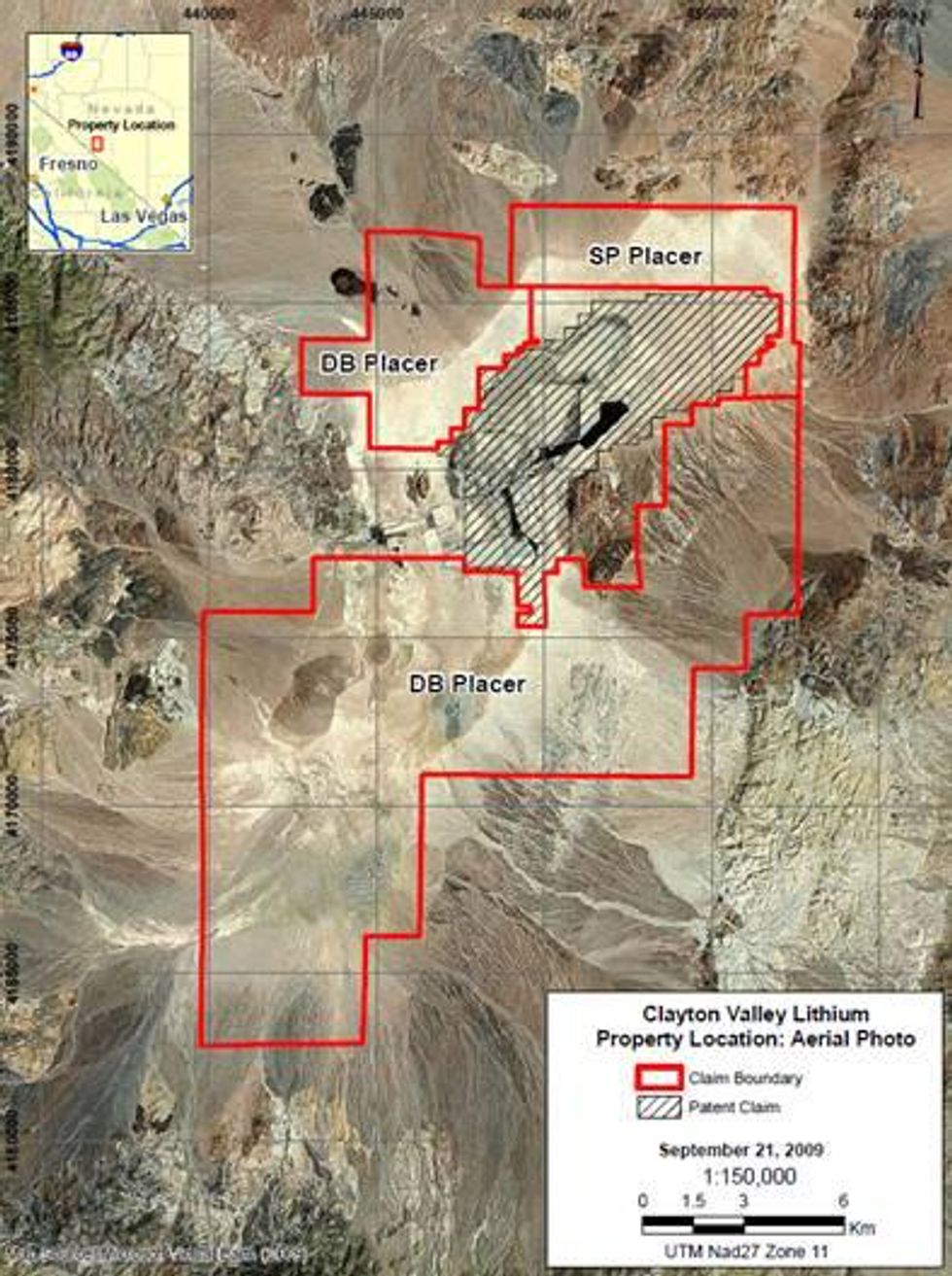

Clayton Valley is located in the centre of Esmeralda County, Nevada, approximately 70 kilometres west of Goldfield, the county seat, and approximately 88 kilometers southwest of Tonopath the largest nearby town.

Clayton Valley is home to the only lithium producer in the United States. This plant extracts lithium from brines pumped from aquifers below the valley and has been in production since 1967. The plant is designed to produce 1.2 million kg of lithium per year and to date has produced an estimated 50 million kg of lithium. Rodinia’s property is adjacent to this production facility.

In 1975, I.A. Kunasz of the American Institute of Mining, estimated the mineral endowment of Clayton Valley to be 750 million kg of lithium. A more recent study by Price, Lechler, Lear and Giles in 2000, suggests that significantly more lithium was released into the Clayton Valley catchment by the weathering of high lithium bearing rocks. They suggest that as groundwater enters the basin, it appears to be dissolving lithium minerals accumulated in valley sediment and is partially recharging the lithium content of the brine, while mining operations have been ongoing.

Rodinia now has a total of 45,440 acres under its control, accounting for approximately 90% of the valley. The Company has planned an aggressive exploration program to target additional layers of lithium bearing brines which may exist throughout the property.

Management

- David Stein, MSc., CFA – President, Chief Executive Officer, and Director – Mr. Stein brings over 9 years of asset evaluation, research and corporate finance experience to Rodinia. Prior to joining Rodinia, Mr. Stein was a mining equities analyst, director and member of the executive committee at Cormark Securities Inc., a leading Canadian boutique investment bank. Mr. Stein is also President, Chief Operating Officer and Director of Aberdeen International.

- William Randall, MSc., P.Geo – Vice President, Exploration – Mr. Randall is a Professional Geologist with extensive experience in management of mineral exploration and production. Mr. Randall has run and supervised numerous discoveries and has taken deposits from the resource stage through to feasibility and production.

- Aaron Wolfe – Vice President, Corporate Development – Mr. Wolfe brings corporate finance and advisory experience to Rodinia. Prior to joining Rodinia, Mr. Wolfe spent 4 years at Macquarie Capital Markets Canada Ltd., the Canadian division of a global Investment Bank, most recently as Senior Associate, Investment Banking. Prior to this Mr. Wolfe was an Associate Consultant with an International management and human resources consulting firm. Mr. Wolfe is also Vice President, Strategy at Forbes & Manhattan Inc.

- Ryan Ptolemy – Chief Financial Officer – Mr. Ptolemy was most recently the CFO of an independent investment dealer in Toronto. In that role, Mr. Ptolemy was responsible for financial and regulatory reporting, auditing and budgeting. Mr. Ptolemy is a Certified General Accountant and is a CFA charter holder, and holds a Bachelor of Arts from the University of Western Ontario.