Prophecy Development Releases Inferred Mineral Resource Estimate for Paca

Prophecy Development Corp. (TSX:PCY,OTCQX:PRPCF) released an independent NI 43-101 mineral resource estimate for the Paca deposit, located at its Bolivia-based Pulacayo silver-zinc-lead project.

Prophecy Development Corp. (TSX:PCY,OTCQX:PRPCF) released an independent NI 43-101 mineral resource estimate for the Paca deposit, located at its Bolivia-based Pulacayo silver-zinc-lead project.

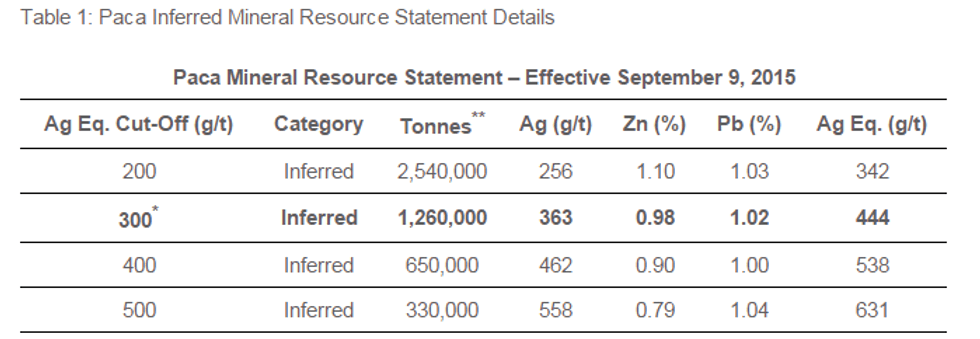

The inferred mineral resource is as follows:

Notes

- Raw silver assays were capped at 1,050 g/t, raw lead assays were capped at 5% and raw zinc assays were capped at 5%.

- Silver equivalent Ag Eq. (g/t) = Ag (g/t) + (Pb% * (US$0.94/lb. Pb/14.583 Troy oz./lb./US$16.50 per Troy oz. Ag.)*10,000) + (Zn% * (US$1.00/lb. Zn/14.583 Troy oz./lb./US$16.50 per Troy oz. Ag.)*10,000; 100% metal recoveries are assumed based on lack of comprehensive metallurgical results.

- Metal prices used in the silver equivalent calculation are US$16.50/Troy oz. Ag, US$0.94/lb Pb and US$1.00/lb. Zn and reflect those used in the June 16, 2015 Pulacayo mineral resource estimate by Mercator.

- Metal grades were interpolated within wireframed, three dimensional solids using Geovia-Surpac Ver. 6.7 software and inverse distance squared interpolation methods. Block size is 5m (X) by 5m (Z) by 2.5m (Y). Historic mine void space was removed from the model prior to reporting of resources.

- The block density factor of 2.26 reflects the average value of 799 density measurements.

- The mineral resource is considered to have reasonable expectation for economic development using underground mining methods based on the deposit history, resource amount and metal grades, current metal pricing and comparison to broadly comparable deposits elsewhere

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- *The resource estimate cut-off value is 300 g/t Ag Eq. and resource estimate values are presented in bold type.

- **Tonnes are rounded to nearest 10,000.

The press release also states:

The resource estimate is based on results of 97 diamond drill holes and 1 reverse circulation drill hole totaling 18,160 meters completed between 2002 and 2007. Verification and validation checks on the sampling method, sample shipment documentation and analytical data were carried out by Mercator in support of the current resource estimate and Prophecy independently carried out additional database checks with satisfactory results. Review of available quality control and quality assurance program results that include analyses for duplicate, blank, certified reference material and third party check sample materials was also performed by Mercator with acceptable results. The methods and assumptions used to interpolate metal grade including variography, search ellipse orientation and dimensions, drill hole density, and geological interpretation are considered reasonable for this type of epithermal mineral deposit. Block model results were compared to assay composites and ordinary kriging results and all show acceptable correlation to the underlying data.

Click here to read the full Prophecy Development Corp. (TSX:PCY,OTCQX:PRPCF) press release.