New Age Metals Provides an Update on the Platinum Group Metals (PGM) and Lithium Divisions

New Age Metals Inc. (NAM) (TSXV:NAM; OTC:NMTLF; FSE:P7J.F) Harry Barr, Chairman & CEO, stated; We are pleased to update our shareholders and interested parties as to our ongoing activities in both our PGM and Lithium divisions. Specifically, give a progress update on the River Valley Project Preliminary Economic Assessment (PEA).

New Age Metals Inc. (NAM) (TSXV:NAM; OTC:NMTLF; FSE:P7J.F) Harry Barr, Chairman & CEO, stated; We are pleased to update our shareholders and interested parties as to our ongoing activities in both our PGM and Lithium divisions. Specifically, give a progress update on the River Valley Project Preliminary Economic Assessment (PEA). Exploration and development plans for both PGM and Lithium divisions in 2019, highlight the current PGM market and particularly Palladium price trends, and finally reviewing our corporate awareness program for 2019.”

River Valley PGM Project Goals & Objectives

During the next year the company’s exploration & development objectives are as follows:

- Complete the re-stated resource calculation (Q1 2019);

- Complete the Projects first economic study, PEA (Q2 2019);

- Solicit a strategic partner to aid in further exploration and development of the Project;

- Complete surface exploration on additional target areas based on recommendations of the updated 43-101 and the 2017/2018 geophysics (slated for Q3-Q4 2019);

- Conduct 5000 metre drill program focusing in the northern portion of the Project;

- Our corporate mandate is to build a series of open pits (bulk mining) over the 16 kilometers of mineralization. We will concentrate on site and ship concentrates to Sudbury.

River Valley PGM Project Goals & Objectives

NAM commissioned both P&E Mining Consultants (P&E) and DRA Americas (DRA) to complete the Project’s first economic study, a Preliminary Economic Assessment (PEA) in August 2018. The study is underway and expected to be released at the previously stated time of June 2019. Thus far we can report the following:

– Resource calculation updated for recent trailing average metal price increase by P&E.

– Preliminary mining, processing and G&A costs determined by P&E and DRA.

– Preliminary process plant recoveries determined by DRA.

– Initial pit optimizations complete by P&E.

– Recently commenced exploring open pit phasing sequence by P&E.

– Commenced geotechnical pit slope review by MDEng.

The objective of the PEA would be to create a mine plan, mine schedule, a capital cost estimate, and operating cost estimate incorporated into a financial model to provide total cash flow, net present value (NPV), and internal rate of return (IRR).

Platinum Group Metal Prices & Performance

Palladium (Pd) has thus far, been a shining star in terms of commodities in 2019 and we expect the supporting fundamentals to contribute to escalating prices. Most recently the price of Pd, our primary metal at River Valley, has hit an all-time high price of over $1,500 USD per oz. There are various reasons why this price movement has occurred and more to suggest that Pd price may continue to rise. First, there are continued supply deficits forecasted for Pd and in 2019 alone it is expected to be an estimated 615,000 ounces. It is also worthwhile to note the possibility of supply disruptions in South Africa, which provides the majority of the Pd supply. Next, according to SFA Oxford, the allowable limits of carbon monoxide (CO) and hydrocarbon (HC) from gasoline passenger vehicles in China will be reduced by 60% by 2025 (SFA Oxford, 2019). Pd is the metal which reduces both CO and HC and therefore we can expect increased Pd loadings in all gasoline passenger vehicles to successfully meet these limits. The Chinese emission standard story tends itself to the increase in Pd demand to grow by 500,000 ounces by 2021. To summarize, the Palladium fundamentals and forecasts align well with the timeline for development of our River Valley Project.

Recently the World Platinum Investment Council forecasted a deficit in Platinum production for the next 5 consecutive years. Palladium for the 10 years from 2008-2017, has averaged 21.5% per annum while Gold averaged only 5.8% per annum over that same period. Both Platinum and Palladium, (outside of their extensive uses in catalytic converters which convert harmful gasses from hydrocarbon emissions into less harmful substances in vehicles), are considered precious metals, like Gold and are seen as a store of value.

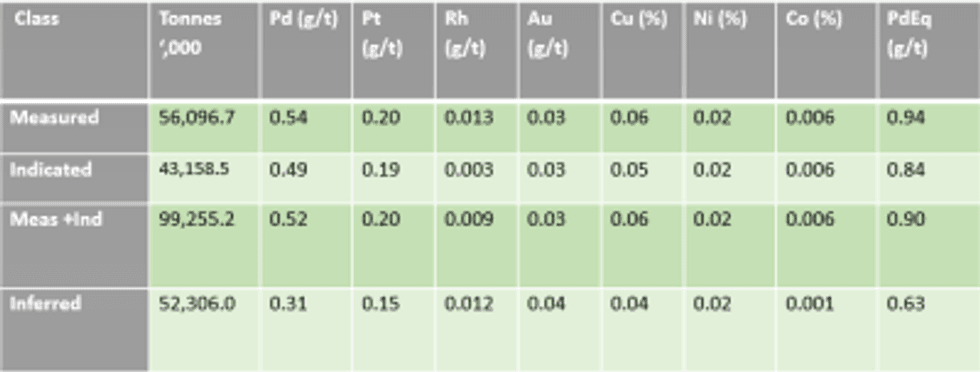

2019 Mineral Resource Update

On January 9, 2019 NAM filed its latest Mineral Resource Estimate on the River Valley Project. The May 2018 Resource Estimate presented a global mineral inventory. The January 2019 Resource presents a pit constrained mineral resource that shows reasonable prospects for eventual economic extraction. The results of the updated Mineral Resource Estimate are tabulated in Table 1 below (0.35 g/t PdEq open pit and 2.0 g.t PdEq underground cut-off). This 43-101 Technical Report is available on SEDAR.

Table 1: Results from the amended NI 43-101 Mineral Resource Estimate.

Click Image To View Full Size

| Class | PGM + Au (oz) | PdEq (oz) | PtEq (oz) |

| Measured | 1,394,000 | 1,701,000 | 1,701,000 |

| Indicated | 983,000 | 1,166,000 | 1,166,000 |

| Meas +Ind | 2,377,000 | 2,867,000 | 2,867,000 |

| Inferred | 841,000 | 1,059,000 | 1,059,000 |

Notes:

- CIM definition standards were followed for the Mineral Resource Estimate.

- The 2018 Mineral Resource models used Ordinary Kriging grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids.

- A base cut-off grade of 0.35 g/t PdEq was used for reporting Mineral Resources in a constrained pit and 2.00 g/t PdEq was used for reporting the Mineral Resources under the pit.

- Palladium Equivalent (PdEq) calculated using (US$): $950/oz Pd, $950/oz Pt, $1,275/oz Au, $1500/oz Rh, $2.75/lb Cu, $5.25/lb Ni, $36/lb Co.

- Numbers may not add exactly due to rounding.

- Mineral Resources that are not Mineral Reserves do not have economic viability

7. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

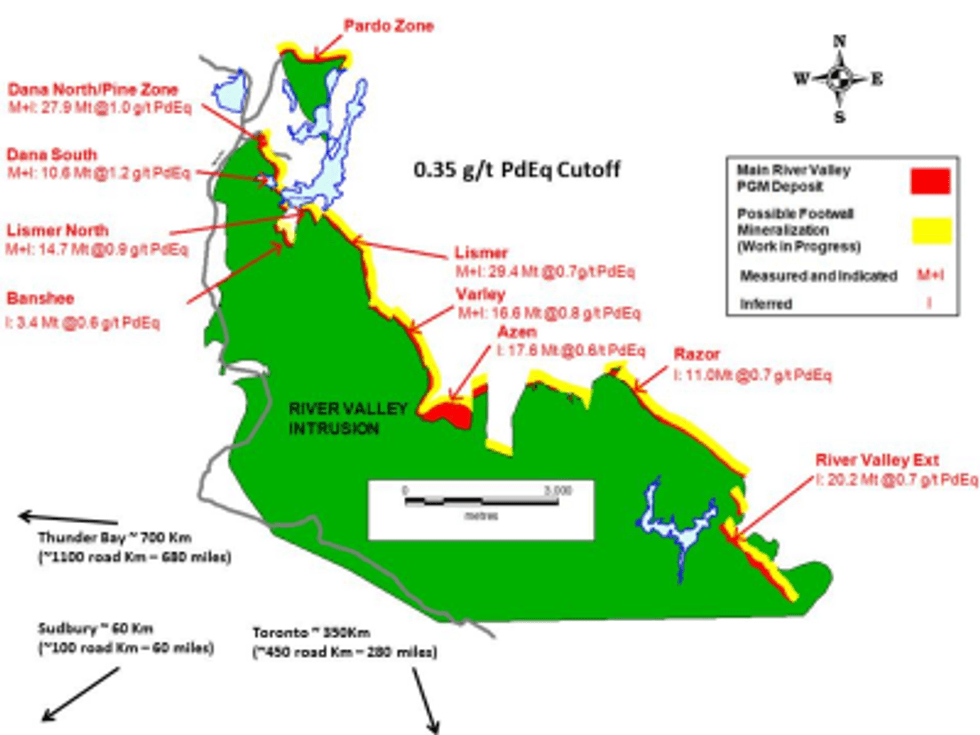

This stated resource will closely relate to the resource that will be reported in the upcoming PEA slated to be completed in Q2 2019. See Figure 1 which shows the mineral resource reported in each area of the River Valley Project.

Click Image To View Full Size

Figure 1: The Yellow Band represents the footwall potential area of the River Valley Deposit based on the results of the Pine Zone where footwall mineralization was noted to extend 150 metres eastward from the Pine Zone/ T3 main deposit. At present the only area that has confirmed footwall mineralization is in the Pine Zone (defined from 2015 to 2017 drilling). Geophysics and exploration are in progress to test other areas of the Deposit. Management’s specific focus is to outline a sufficient potentially economic Mineral Resource in the northern portion of the Project, and subsequently develop a series of open pits (bulk mining), crush, and concentrate on site, and ship the concentrates to Sudbury for metallurgical extraction.

2019 Exploration Plan for River Valley PGM Project

To date an approximate 160,441 metres (481,323 feet) in 710 drill holes have been conducted by the company as operator on the River Valley Project. Several independent 43-101 compliant resource estimates have previously been generated for the deposit through the exploration and development phases. The River Valley Deposit’s present resource, with approximately 2.9M PdEq ounces in Measured Plus Indicated mineral resources and near-surface mineralization, covers a total of 16 kilometers of strike. The company continues to explore and enhance the River Valley PGM Deposit.

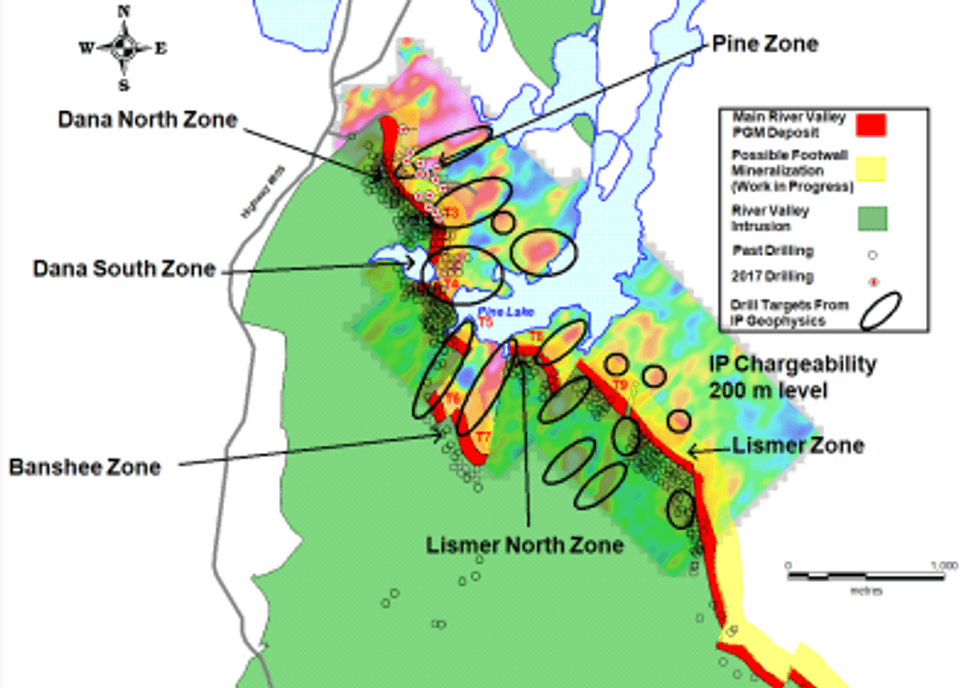

After the ground proofing and surface exploration program conducted in Summer 2018 which followed up on the most recent induced polarization survey by Abitibi, NAM management has designed a 5000 metre drill programs to test the new geophysical anomalies. See Figure 2 below which shows these new geophysical anomalies and potential targets for the next stage of drilling at River Valley superimposed over the upper 4 kilometres of the project map.

Click Image To View Full Size

Figure 2: Northern portion of the project with superimposed 2018 merged IP at -100 level. Retrieved from River Valley Geophysical review by Geoscience North (Alan King, P. Geo., M.Sc.)

2019 Exploration Plans for Lithium Division

The Company has eight pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. In 2018 NAM conducted surface exploration programs on our Lithman East, Lithman North, Lithium One and Lithium Two projects. The programs consisted of reviewing, characterising and sampling all of the known surface pegmatites. Samples were taken from the Eagle and FD5 pegmatites on Lithium Two and returned results of up to 3.8% Li2O. On Lithium One, samples were taken from the known Silverleaf and Annie pegmatites and not only returned significant Li20 assays of up to 4.1% but heightened levels of Rubidium Oxide (Rb2O).

In 2019, the Company plans to drill on both Lithium One and Lithium Two. Drill permits have been applied for and the company is awaiting approval from the province.

Conferences This Quarter

In late January, our Chairman & CEO Harry Barr travelled to South Africa and attended two 1-2-1 style conferences with over 40 booked meetings with mine finance companies, major mine companies, institutions, stock brokers, and high net worth individuals. The trip was very successful and we are currently following up on several new opportunities that were generated from these meetings. In the meantime, the company is preparing for the upcoming PDAC 2019 (March 3 to 6). The company has secured a meeting place and is currently organizing meetings with parties interested in our PGM and Lithium divisions.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

For further information on New Age Metals, please contact Anthony Ghitter, Business Development at 613-659-2773, or info@newagemetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Source: www.thenewswire.com