The Conversation (0)

Tempus Resources: Exploration in Established Gold Trends in Canada and Ecuador

Feb. 25, 2021 04:17AM PST

Precious Metals InvestingTempus Resources has launched its campaign on the Investing News Network.

Tempus Resources Ltd. (TSXV:TMRR,ASX:TMR) currently operates two exploration projects, one in each of the gold-rich jurisdictions of Ecuador and British Columbia, Canada.

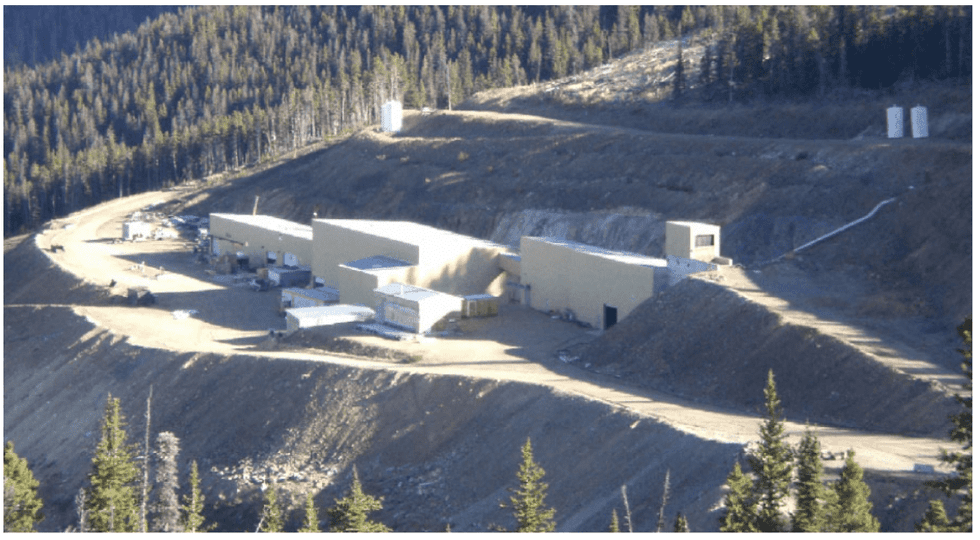

In British Columbia, Tempus’ flagship Blackdome-Elizabeth project is a past-producing, high-grade gold exploration project that hosts two separate mineralization styles. Historic gold production at Blackdome occurred between 1986 to 1991, with a total output of 330,000 tonnes milled at a head grade of 21.9 g/t Au for 231,547 gold ounces and 564,000 silver ounces.

Tempus Resources’ Company Highlights

- Tempus Resources is a gold exploration and development company focused on high-quality gold projects in Canada and Ecuador.

- Well-seasoned management team with the knowledge and expertise to bring projects from discovery through to production.

- The company’s flagship Blackdome-Elizabeth gold project in British Columbia hosts past production, known mineralization and existing infrastructure that can potentially fast-track the project to near-term production and cashflow for the company.

- The early-stage Zamora projects along the Cordillera del Condor copper-gold trend in Ecuador include the Rio Zarza and Valle del Tigre II prospects, which are highly prospective for both gold and copper porphyry deposits.

- The company completed a capital raising of AU$4 million in June 2020.

- Tempus’ diverse shareholder portfolio consists of dedicated management and financial institutions, including HSBC Custody Nominees.