Orezone Gold Announces Results of Annual and Special Meeting of Shareholders

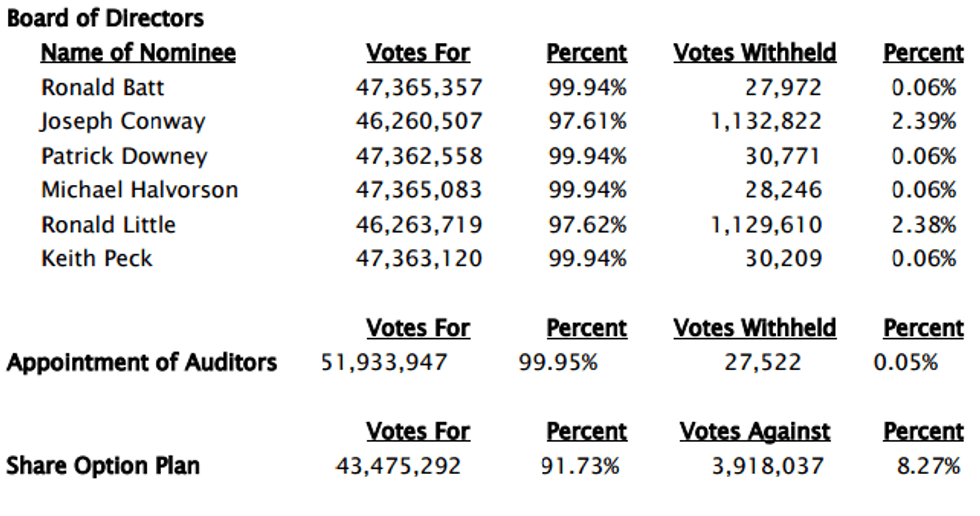

Orezone Gold Corp. (TSX:ORE) announced the results for the election of its board of directors, the appointment of auditors and re-approval of its share option plan, all of which were confirmed by show of hands at its Annual and Special Meeting of Shareholders. The company also filed its feasibility for the Bombore gold project in Burkina Faso. Results of the study were originally disclosed on April 28.

Results from the AGM:

Highlights of the feasibility study included a 24.4 percent after tax IRR, a 2.7 year payback period and all in sustaining costs of $678 per ounce of gold:

The study envisions a shallow open pit mining operation with a processing circuit that combines heap leaching and carbon-in-leach (CIL) without any grinding to process the soft and mostly free digging oxidized ores. The eleven-year mine plan, based on a mineral reserve using an US$1,100 gold price, is designed to deliver higher grade ore in the early years (0.88 g/t over the first eight years of production at a strip ratio of 1:1). Lower grade stockpiles will be processed in the final three years. The financial model with revenues based on a US$1,250 gold price, yields a robust 24.4% after tax internal rate of return to the Company (based on 90% ownership, 10% Gov’t) with a net present value of US$196 M at a 5% discount rate. Project payback is estimated at 2.7 years with all in sustaining costs averaging $678/oz. Initial capital is estimated at $250.0 M including contingencies, all working capital and a $10.5 M credit for gold revenues generated during the pre-production period. Capital costs include the mining fleet, a much larger water storage reservoir and higher resettlement costs than envisioned in the March 2014 Preliminary Economic Assessment (PEA). Sustaining capital is estimated at $75.2 M, taking into account the additional three years of mine life and higher resettlement costs than estimated in the PEA. Total reclamation and closure costs are estimated at $22.5 M including $8.7 M of heap rinsing costs expensed in year 12. “The results of the Study are compelling and the project benefits from size, location, low reagent consumption, rapid leaching kinetics and low all-in operating costs,” said Ron Little, CEO of Orezone. “Bomboré is one of the largest and most advanced undeveloped gold deposits in the region that lends itself to phased development. The initial 11 year phase requires less capital and has lower operating costs to process the shallow and softer oxidized ores. A second phase, at slightly higher gold prices (>US$1,400) could expand the standard CIL circuit with the addition of grinding to process the well-defined sulphide resource (73 Mt at 1.1 g/t for 2.6 Moz).

Click here to read the Orezone Gold Corp. (TSX:ORE) press release

Click here to see the Orezone Gold Corp. (TSX:ORE) profile.