New Research Reveals Repeal of Tick Test Driving Decline of Junior Mining Sector

Save Canadian Mining reveals Canadian mining companies contributed $2 billion less in economic activity since the repeal of the ‘tick test’ in 2012.

Research released today by advocacy group Save Canadian Mining (SCM) reveals Canadian mining companies contributed $2 billion less in economic activity since the repeal of the ‘tick test’ in 2012. The tick test was a 142-year-old trading safeguard that ensured investors could only “short” a stock if the price was on an upward trajectory.

“This new research shows a strong correlation between the repeal of the tick test regulation and the steady and widening decline of investment in Canada’s junior mining sector,” says Terry Lynch, founder and Executive Director of Save Canadian Mining. “Current investment regulations supporting predatory short selling on mining juniors is making it nearly impossible for our small businesses to succeed.”

Engaging the services of internationally respected mining research firm Murenbeeld & Co., SCM is hopeful these findings will help inform government and regulators about the situation facing junior mining companies across all capital markets.

The full Murenbeeld report (available to registered users at www.SaveCanadianMining.com) also revealed that:

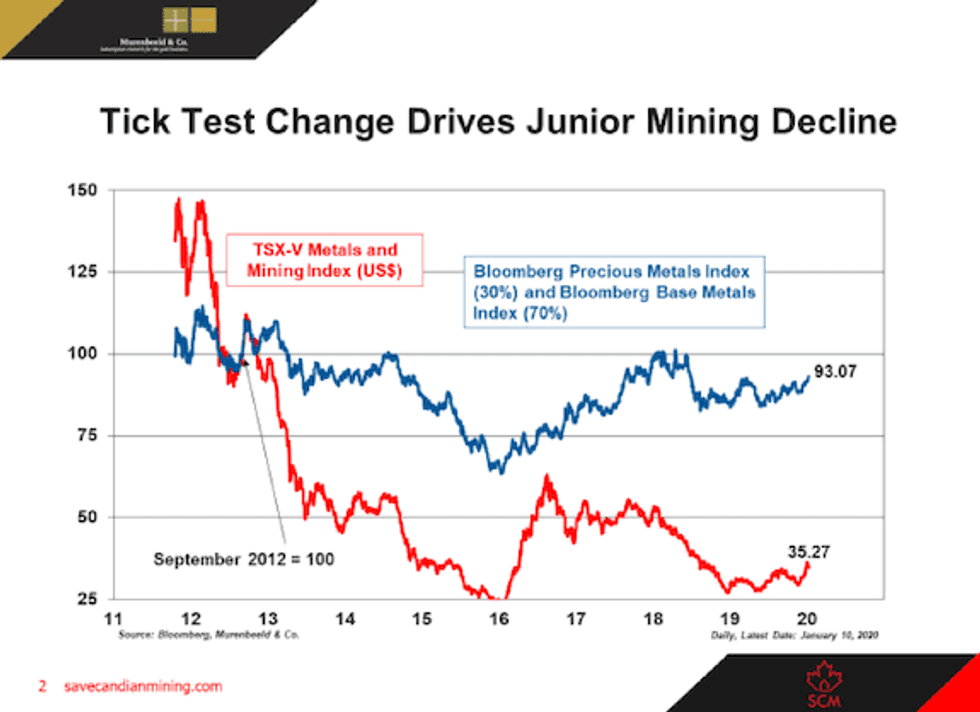

- Although market prices for mining stocks have historically traded above the commodity price index, since the tick test was removed in 2012 the trend has dramatically changed with stock prices now lagging commodity prices substantially. Stock prices would have to go up more than 2.5 times across the board to get to historical levels.

- The decline in mining investment is not linked with commodity prices. As of January 2020, there was a 60% gap between the metals and minerals index and the TSX Venture Exchange – the largest gap in at least 12 years.

- Since October 2012 when the tick test was removed, there has been a distinct decrease in issuers listing on the TSX and TSX Venture Exchange. The number of mining companies listing on the TSX and the TSX Venture Exchange recently reached its lowest number in 10 years.

- Equity capital raised by junior mining companies on the TSX Venture Exchange is a fraction of what was raised prior to 2012. During the recession of 2008-2009, equity raised by junior mining companies on the TSX Venture Exchange averaged $2.9 billion which represents 42% more than equity raised by the same sector in 2019.

- Between 2011 and 2018 there was a 62.5% drop in spending on local economic activity in Canada by Canadian mining companies.

“The research reveals a dire situation. We believe reinstating the tick test would have a dramatic turnaround effect not only for junior mining in this country, but for the whole mining industry and the communities that depend on it,” says Lynch.

Save Canadian Mining’s advocacy objective is endorsed by a number of organizations representing both the mining industry and the investment community. Among these supportive organizations are: The Ontario Mining Association, the Ontario Prospectors Association, Sprott Mining Inc., McEwen Mining Inc., Osisko Mining, The TSX Venture Exchange, and a number of junior mining companies.

About Save Canadian Mining

Save Canadian Mining is a not-for-profit, issue-based advocacy group representing the interests of Canada’s junior mining industry and the investment community. Founded in September 2019 by Terry Lynch, CEO of Chilean Metals Inc, Save Canadian Mining is committed to working with governments and agencies to amend regulations in capital markets to help generate investment in Canada’s junior mining industry. For more information visit savecanadianmining.com

About Murenbeeld & Co.

Since the 1980s Murenbeeld & Co. has delivered data driven insight to the world’s largest mining companies. Mining companies and asset managers use Murenbeeld & Co.’s work to inform decisions about capital allocation, treasury operations and business risk assessment. For more information visit www.Murenbeeld.com.

MEDIA CONTACT:

For more information or to schedule an interview, contact:

Katherine Clark

Beacon Strategic Communications

katherine@beaconcommunications.ca

416-453-3288