Molybdenum Outlook 2020: Demand to Pick Up, Supply to Grow

After a rocky year for metals, many investors are wondering what’s ahead for commodities. Learn more here about the molybdenum outlook.

Click here to read the latest molybdenum outlook.

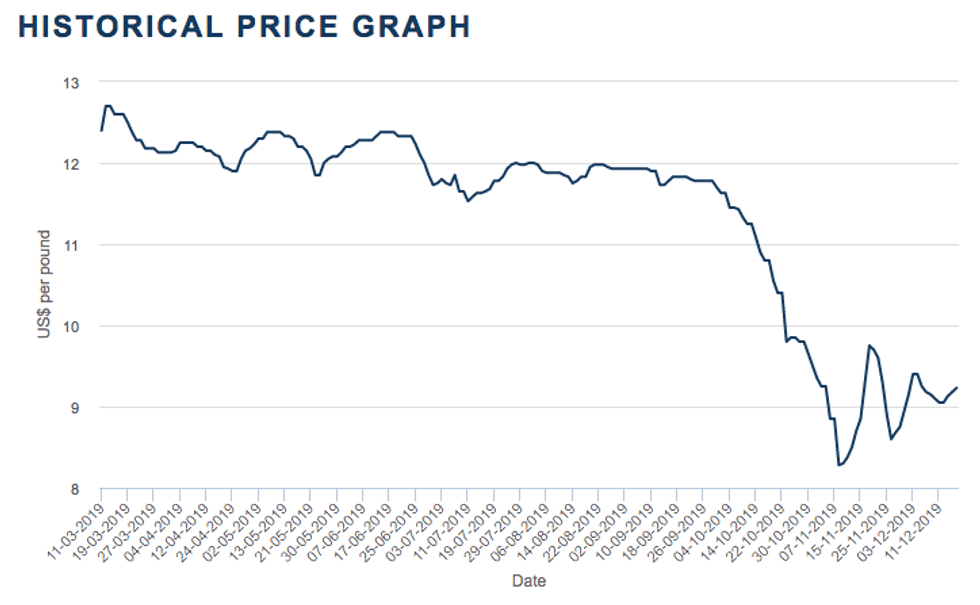

Molybdenum prices hit two year lows in Q4 2019, a decline that surprised many market watchers.

Weaker-than-expected demand and supply concerns have impacted the sector in the past 12 months.

With 2020 just around the corner, investors interested in the industrial metal are now wondering about the molybdenum outlook for next year. Here the Investing News Network looks back at the main trends in the sector and what’s ahead for molybdenum.

Molybdenum trends 2019: Price drop surprises experts

Looking back at the main trends for molybdenum in 2019, CRU Group analyst James Jeary pointed to prevailing demand softness in the space, which he said was related to weakness in the stainless steel sector and broader macroeconomic uncertainty.

Most molybdenum is used to produce steel products, with part of this consumption linked to the oil and gas sector, where molybdenum-bearing steels are used in drilling equipment and in oil refineries.

In the first half of the year, the expert also said there were supply concerns due to weaker-than-expected production in South America, particularly Chile. The country is the second largest producer after China, with output reaching 62,500 metric tons in 2018, according to the US Geological Survey.

CRU Group estimates that molybdenum output in Chile declined to a four year low of 27 million pounds in the second quarter of 2019 and rose to 30 million pounds in the third quarter. The market is forecast to remain balanced or see a small deficit.

“We expected the deficit to narrow compared to 2018 because of slowing demand growth and year-on-year growth in mine supply — and it has,” he said. “But the sustained demand weakness and low production in Chile in H1 has perhaps been more than expected at the beginning of the year.”

Similarly, Roskill Senior Analyst Olivier Masson said 2018 and 2019 were fairly different years for the molybdenum market.

“In 2018, mine supply grew very little, failing to keep up with rising demand,” he explained. “2019 was different: supply accelerated (at least on a year-to-date basis), but demand growth has slowed.”

He added that aside from weaker steel and stainless steel production growth, macro and trade concerns have also weighed down on demand.

“Mine supply is currently running slightly ahead of expectations, but it is the weakness of demand growth in 2019 that has been the surprise,” Masson said.

On the stainless steel side, year-to-date production has risen in China, but in the US and in the EU crude stainless steel production in 2019 has fallen year-to-date, which was a surprise for the expert.

Looking at the biggest news in the industry, analysts pointed to the price drop seen in recent months.

“Prior to that, prices had been slightly lower than in 2018, but the price weakness became far greater in October and again in November,” Masson said.

Chart via the London Metal Exchange.

Jeary said that molybdenum’s slide into single figures in October and November, followed by the volatility of the past few weeks, seems to have taken everyone by surprise.

“It seemed to be a combination of various things — reduced consumption by Chinese steel mills, persistently weak demand and destocking in Europe,” he added.

Molybdenum outlook 2020: Price recovery expected

Looking ahead, Jeary expects to see increased supply growth as new projects start production. “In terms of demand, (the market) should see some recovery from the weakness this year,” he said.

In 2020, Masson is also expecting to see stronger growth in output than in 2019.

“Demand growth should also pick up, with stainless steel production in the world (excluding) China expected to recover,” he said.

Looking at prices, Masson said they are likely to go into 2020 at a lower level than they were at the start of 2019. Although Roskill expects prices to recover from current levels, the firm also expects supply to grow in 2020, which could cap molybdenum price upside.

“However, any one sided change in supply or demand could lead to either an oversupply or undersupply, which could act as a significant lift or drag on prices,” he said. “If supply is materially different from what is expected, this could affect prices. The same price risk exists from demand-side developments.”

Jeary is also expecting prices to return to a level of stability after the recent volatility.

“(The) downside risk is that demand remains weak,” he said. “Something to keep an eye on is how Chuquicamata underground production progresses.”

He also suggested that investors to keep an eye on the oil price, which is usually a good indicator of longer-term demand for molybdenum.

FocusEconomics panelists project that molybdenum prices will gain ground next year thanks to a pickup in demand from the oil and gas and automotive industries. They see prices averaging US$22,941 per metric ton by the end of 2020 and US$22,389 ton by the end of 2021.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.