As the world moves towards green energy, what will happen to coal? Read on to learn what analysts see for the coal outlook in 2018.

While many countries are moving away from coal to cleaner fossil fuels, coal prices performed better than many expected in 2017.

Coal prices had a rocky start this year, but supply restrictions in China together with ongoing demand from emerging countries allowed prices to increase in the second half of the year.

But as the year comes to an end, what can investors expect in 2018? Read on to learn more about coal’s performance in 2017, as well as what analysts and market watchers had to say about the space and the coal outlook for next year.

Coal trends 2017: Prices better than expected

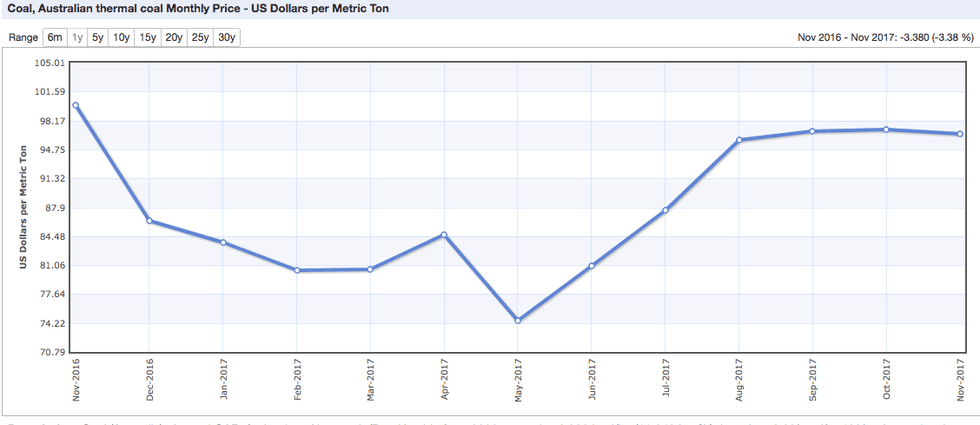

As mentioned, coal prices performed better than expected this year. As the chart below shows, the highest point of the year came in October, when coal was changing hands for $97.14 per metric ton. Meanwhile, the lowest point came in May, when prices touched $74.52.

Chart via IndexMundi.

“We expected price increases in 2017, but were surprised by how high they rose on the back of higher import demand than we expected in China,” said Andy Roberts, global thermal coal markets research director at Wood Mackenzie.

He mentioned Cyclone Debbie, which caused a big supply disruption, and China’s closure of induction furnaces as the biggest news in the space. In particular for thermal coal, “continued high seaborne prices on the back of ‘slows-to-return’ domestic production in China” was also a major trend in 2017.

“As China continued to wring the excess out of the coal industry, all while supporting domestic prices, a rebound in demand for coal-fired generation left some domestic customers in China looking for more coal,” he explained. Those circumstances lifted demand and as a result prices.

Looking over to metallurgical coal, the market also saw high prices driven by lower exports from Australia, lower production and greater import demand in China.

“[Prices came under pressure] as supply returned and China restricted steel production with its ‘2+26’ policy. Meanwhile, high prices also lifted US exports to high levels,” Roberts said.

Similarly, FocusEconomics analyst Edward Gardner said prices were on a downtrend at the start of 2017, following China’s lifting production restrictions at the end of 2016.

“Coal prices started to recover in June, however, due to supply disruptions in Australia and lower output elsewhere,” he noted. Prices have stabilized below the $100 mark in more recent months.

For Gardner, the biggest news in the coal industry was the ongoing shift away from coal towards more “environmentally-friendly fuels,” particularly in developed countries. “For instance, in the UK, coal represented about 40 percent of the energy mix in 2012, yet that had dropped to just 2 percent in the first six months of 2017,” Gardner said.

Coal outlook 2018: Supply and demand trends

Looking ahead to 2018, coal demand is expected to benefit from the increasing need for electricity in emerging economies. However, many other countries are also moving away from coal to green energy.

“If developing countries slow their usage of coal-generated electricity next year and opt for more environmentally friendly alternatives, possibly influenced by diplomatic initiatives such as the recently launched Powering Past Coal Alliance, this could put downward pressure on coal prices and become a concern for the market going forward,” Gardner said.

Looking over to supply, China’s environmental crackdown will be a key issue next year — in particular, whether the government will enforce tougher rules in order to fight pollution. China is the world’s top producer and consumer of coal.

“Next year, industry watchers will be monitoring production levels in China closely since the country accounts for the largest demand and supply of coal globally, leading the market on prices,” Gardner said.

Similarly, Roberts said domestic coal production in the Asian country could be crucial because if it grows, coal prices could fall. “Also, watch for continued consolidation in the coal industry, both on the producer side and on a larger scale with vertical integration in Asia,” he added.

In 2018, Roberts predicts that for thermal coal, seaborne demand will weaken in China and India, but there will be pockets of limited demand growth in Southeast Asia, especially in Vietnam.

“Indonesia will feel the brunt of declining demand as its exports decline. Meanwhile, modest declines at other exporters will counter increased exports from Australia and Colombia,” he explained.

Meanwhile, for met coal, “demand growth in India will compensate for slight decline elsewhere. Australia, Mozambique and Mongolia will boost supply as US exports fade,” Roberts said.

Coal outlook 2018: Key factors to watch

As 2017 comes to an end, investors interested in coal are wondering what’s ahead in the space. Gardner said one of the factors investors should keep an eye on is the corporate landscape.

“Key mining companies such as Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) reportedly looking to exit the industry completely, and many large investors themselves, such as Norway’s sovereign wealth fund, are already limiting their exposure to the industry for environmental and ethical reasons,” he added.

Roberts also mentioned Rio Tinto’s exit plans, as well as Glencore (LSE:GLEN). Industrial action at the company’s Australian operations could continue in 2018. “[Also, as always,] watch major Chinese coal producers for potential vertical integration activity,” he noted.

In terms of prices, Roberts expects thermal coal to fall on “increased supply availability with a growing risk of significant price drop.” Meanwhile, met coal prices will be under pressure, but China’s “2+26” policy, which aims to reduce pollution, could be a wild card that could add volatility.

Firms polled by FocusEconomics estimate that the average thermal coal price for 2018 will be $79.60. The most bullish forecast for the year comes from Investec (LSE:INVP), which is calling for a price of $92.50; meanwhile, BMO Capital Markets is the most bearish with a forecast of $70.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.