Successful Prospecting has added a silver lining to Kivalliq’s La Cinquante Uranium Project

Results from an extensive prospecting campaign (June until September 2011) over the 225,000 acre Angilak property in Nunavut Canada have identified numerous high-grade polymetallic mineral showings with some eyebrow-raising silver and uranium assays.

Results from an extensive prospecting campaign (June until September 2011) over the 225,000 acre Angilak property in Nunavut Canada have identified numerous high-grade polymetallic mineral showings with some eyebrow-raising silver and uranium assays.

In addition, Kivalliq Energy Corp (TSXV:KIV) continues to table promising drill results on the Blaze, Spark Pulse and Joule uranium targets, all situated within a 3 km radius of the Lac Cinquante deposit. The company has been highly successful at identifying numerous quality uranium targets near the main resource area. This bodes well for the company as it will need to at least double its resource base to be considered viable by the majors.

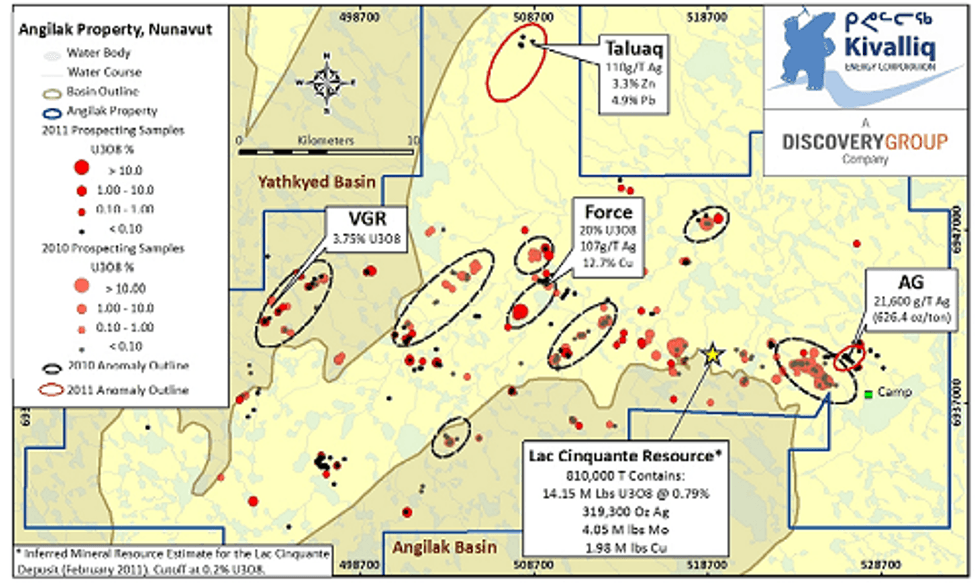

Three new promising targets were identified last summer via an aggressive prospecting program; the BIF Zone, the AG showing and the Taluaq zone.

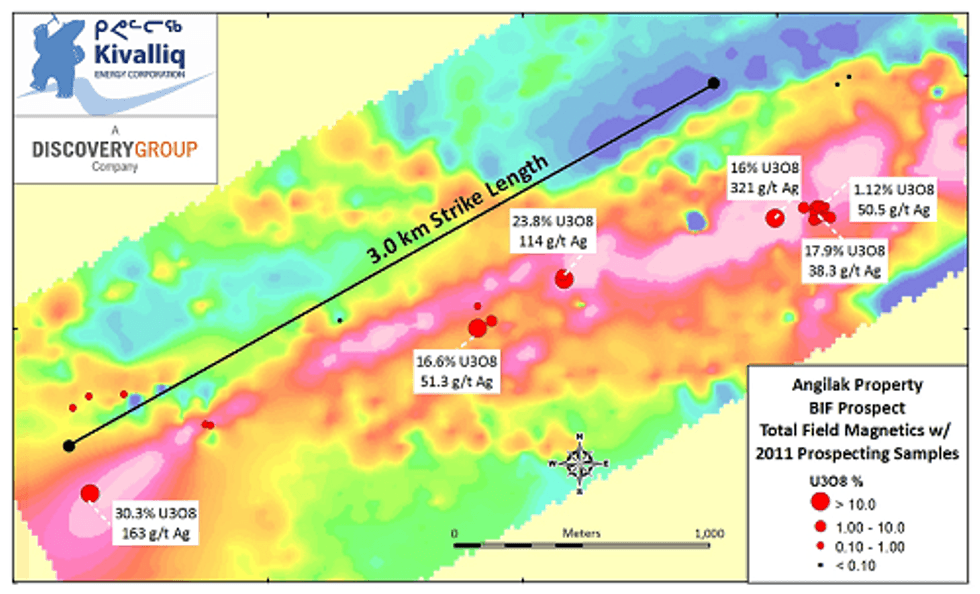

The BIF zone (10 km from Lac Cinquante): represents a 3 km long reactivated shear zone within a package of highly sheared volcano-sedimentary rocks and iron formation. Surface sampling of multiple thin veins in iron formation and boulders returned grades as high as 30.30% U3O8, 163.0 g/t silver, 5.16% copper and 22.90% lead. See Figure 1 below.

Figure 1 BIF Zone

The AG showing (7.5 km east of the Lac Cinquante resource): represents a series of carbonate and quartz veins within a sheared volcanic tuff unit. Surface sampling returned high grade silver as well as significant concentrations of copper, lead, and zinc. One sample assayed as high as 21,600 g/t silver (21.6 kg/tonne). The veins appear to be barren of uranium.

Taluaq zone (See figure 2) is a 2-by-10 km magnetic anomaly that is believed to represent a large syenitic intrusion that could have significant uranium and rare earth element potential. Prospecting resulted in the discovery of base metal mineralization in stockwork zones containing copper, lead, zinc and silver. No Uranium was identified but only a small portion of the anomaly was sampled.

Figure 2 Prospective Sites on Angiliak Property

Through its prospecting program Kivalliq was also able to extend the VGR target to the southwest and to a total strike length of 4 km. Sampling identified additional areas of alteration and uranium mineralization with values up to 3.75% U3O8. The area remains very prospective for unconformity-style uranium mineralization and is a high priority drill target for 2012.

Bottom Line

In addition to finding additional quality uranium targets, Kivalliq Energy has identified potentially significant polymetallic showings that host high grade silver and copper with other base metals. If this polymetallic mineralization is associated with uranium it could substantially improve the project economics.

Thomas Schuster, Analyst Bio:

With a degree in Geological Sciences from the University of Toronto, Thomas started his career in the 1990s as an exploration geologist in the famous Timmins mining camp in Northern Ontario. He then moved to Vancouver and took a position as staff Journalist at the well-known mining publication, The Northern Miner, reporting the merits and shortcomings of Canadian exploration and mining projects worldwide. This built a foundation for his later work as a Mining Analyst for the Toronto-based institutional investment firm, Fraser Mackenzie. Thomas is currently based in Vancouver working as an independent mining analyst.

Disclosure: No positions at time of writing.

Kivalliq Energy Corporation. is a client of Dig Media. Dig Media was paid a fee for the creation and dissemination of this commentary.

Click here to see the Kivalliq Energy Corp.(TSXV:KIV) profile on Uranium Investing News.