Dunnedin Provides Update on Ongoing Drilling at Kahuna Project – First Kimberlites Drilled by Company

Dunnedin Ventures Inc. (TSXV:DVI) (the “Company” or “Dunnedin”) today provides an update on its ongoing 2018 drill program at its 100% owned Kahuna project, Nunavut.

Dunnedin Ventures Inc. (TSXV:DVI) (the “Company” or “Dunnedin”) today provides an update on its ongoing 2018 drill program at its 100% owned Kahuna project, Nunavut. The Company has drill-tested five of approximately 40 targets (13%), with potentially diamond-bearing kimberlite intercepted at two targets. Inclement weather limited drilling and confined operations to the vicinity of the Company’s newly constructed camp and the Company’s best kimberlite pipe-type targets with the highest associated diamond indicator minerals (“DIM”) have not yet been tested. Dunnedin plans to return the property in six to eight weeks to drill the remaining high priority targets.

Of the five targets drilled, two were high count DIM-in-till targets, both of which yielded significant extensions to the known high-grade diamond-bearing PST and 07KD-24 kimberlite dikes. Concentrated DIMs-in-tills were clearly associated with adjacent OhmMapper geophysical responses and new kimberlite intercepts, demonstrating the effectiveness of Dunnedin’s targeting methods.

Chris Taylor, Dunnedin’s CEO said, “During April drilling, we were able to show that our DIM-based exploration methods work. We confirmed that high concentrations of priority ranked DIMs correlate directly to new potentially diamond-bearing kimberlite in both areas where tested. Unusually poor weather only allowed us to test a handful of targets near our camp, and we are eager to drill our main DIM targets as soon as field conditions allow. Many of these are associated with kimberlite pipe-type geophysical signatures and large, high-count DIM trains that appear highly prospective for new diamond discoveries.”

Progress to date includes:

- Completion of 11 Rotary Air Blast (“RAB”) drill holes (plus two abandoned holes), of which eight contain kimberlite intercepts consistent with vertically dipping kimberlite dikes

- Approximately 400 kg of kimberlitic material has been shipped to CF Mineral Research Ltd. of Kelowna, BC for diamond and indicator mineral recovery

- Initial diamond recovery results are expected in approximately eight weeks

- A 20 person field camp was established south central to the Kahuna Property to support future exploration programs

- The OhmMapper geophysical technique was employed on the Kahuna property for the first time and, together with DIM-based exploration methods, appears to be a highly effective drill targeting technique

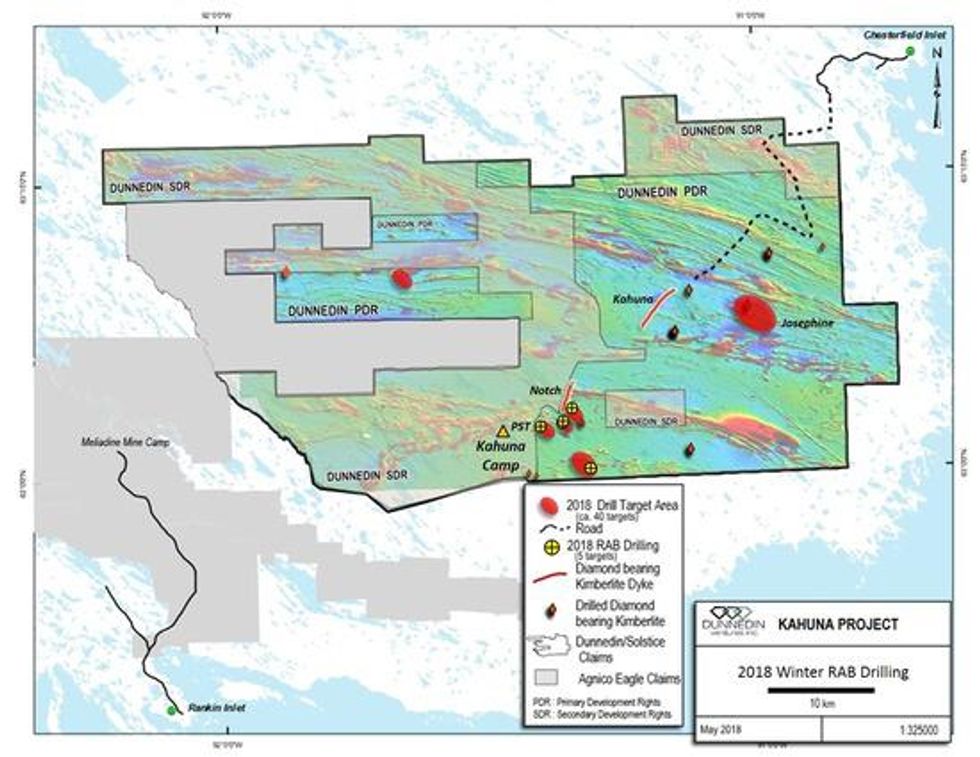

Figure 1: Dunnedin 2018 Drilling Update — 13% of targets drilled to date.

There are multiple targets in each target area.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3803/34568_a1525921948866_91.jpg

The first of the kimberlites drilled during the program is an on-strike extension to 07KD-24, an exceptionally diamond bearing kimberlite dike which historically returned over 305 diamonds including seven commercial-sized diamonds from a 2.2 kg sample. Five drill holes in two locations spaced 100 metres apart were completed across this target, details of which are provided below. The drilled strike length of this body is now 225 metres, and it remains open to extension along strike and down dip.

Drilling at the second kimberlite target successfully intercepted the along-strike continuation of the Company’s PST kimberlite dike, which previously returned an average sample grade of 4.02 carats per tonne from 2.03 tonnes (+0.85 mm), and high quality commercial sized diamonds during Dunnedin’s 2015-2017 work (see news release dated July 25, 2017). Three drill holes were completed across this target at one location. The PST kimberlite’s drilled strike length is now approximately 350 metres, and also remains open along strike and down dip.

Both PST and 07KD-24 appear to have greater strike extent than was apparent from past drilling and geophysical surveying. No resource has yet been calculated on either target.

Three strong magnetic highs with lower DIM-in-till counts were also tested and were determined to be caused by magnetic bedrock formations. Two of these contained significant intervals of silicified, sulphide-mineralized banded iron formation (“BIF”) and are prospective for gold mineralization similar to the adjacent Meliadine gold project of Agnico Eagle Mines Ltd. (TSX: AEM). DIMs at these targets were likely sourced from undiscovered nearby diamond-bearing kimberlites.

Table 1: Highlighted RAB Drill Intercepts

| Drill Hole | Target Type | Azimuth | Dip | From (m) | To (m) | Interval (m) | Description of rock chips |

| 18-RAB-001 | Mag High | 0 | 90 | 21.34 | 28.96 | 7.62 | Silica and sulphide bearing BIF |

| 18-RAB-002 | DIM | 300 | 60 | 51.82 | 54.86 | 3.05 | Kimberlite and gneiss (07KD-24) |

| 18-RAB-003 | DIM | 300 | 50 | 41.15 | 44.20 | 3.05 | Kimberlite and gneiss (07KD-24) |

| 18-RAB-004 | DIM | 300 | 70 | 65.53 | 73.15 | 7.62 | Kimberlite and gneiss (07KD-24) |

| 18-RAB-005 | Mag High | 0 | 90 | 3.05 | 45.72 | 42.67 | Silica and sulphide bearing BIF |

| 18-RAB-006 | Mag High | 0 | 90 | 4.57 | 38.10 | 33.53 | Mafic intrusive |

| 18-RAB-007 | DIM | 120 | 60 | 48.77 | 51.82 | 3.05 | Kimberlite and gneiss (PST) |

| 18-RAB-008 | DIM | 120 | 70 | 71.63 | 73.15 | 1.52 | Altered gneiss and kimberlite (PST) |

| 18-RAB-009 | DIM | 120 | 50 | 38.10 | 39.62 | 1.52 | Kimberlite and gneiss (PST) |

| 18-RAB-010 | DIM | 300 | 70 | 18.29 | 22.86 | 4.57 | Kimberlite and gneiss (07KD-24) |

| 18-RAB-011 | DIM | 300 | 80 | 68.58 | 73.15 | 4.57 | Kimberlite and gneiss (07KD-24) |

RAB drilling is an efficient way to evaluate shallow targets for diamond content (2018 holes ranged from 27.4 to 83.8 metres in length). The RAB method produces chips and fine material brought to surface by pressurized air, drilled in 1.5 metre intervals. As a result, geological contacts are not distinct and true widths of kimberlite are unknown at this time. Intercepts reported herein include kimberlite and country rock that may represent dilution by adjacent country rock, internal xenoliths or down—hole dilution caused by the RAB drilling process itself. Over the course of winter RAB drilling, the Company completed 801.6 metres in 11 drill holes (plus two lost holes). A summary of drilling is provided as Table 1.

OhmMapper Geophysical Surveying

The majority of kimberlites drilled at the Kahuna project have a range of magnetic low and moderate magnetic high responses. The diamond-bearing kimberlites drilled to date are typically moderate magnetic highs, and can be difficult to distinguish from background geology using only magnetic-based geophysical methods.

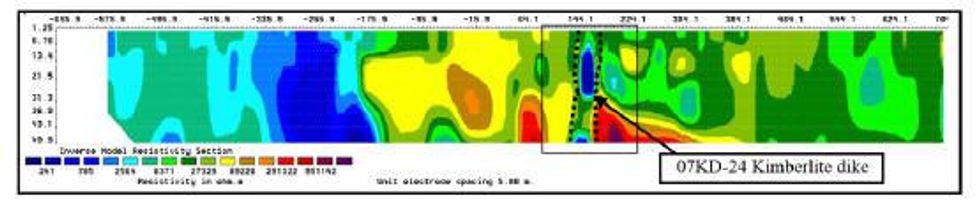

As part of the winter 2018 program, the Company evaluated ground electromagnetic responses in key target areas using the Geometrics OhmMapper Capacitive-Coupled Resistivity System, operated and post-processed by Aurora Geosciences. Survey results were highly successful at rapidly illuminating kimberlite dikes and associated alteration at depth. This technique has been used by other Canadian diamond explorers including Kennady Diamonds (recently merged with Mountain Province Diamonds; TSX: MPDV) as a primary drill hole targeting tool. It shows fine-scale resistivity contrasts in the shallow subsurface and was highly effective showing the location of the two potentially diamond-bearing kimberlites drilled by Dunnedin during this program, as shown in Figure 2.

The Company plans to complete additional Ohm Mapper surveys and test other ground electromagnetic methods in other priority areas. The combination of DIM-based target identification and resistivity-based ground geophysics appear to be very effective and complimentary methods of refining kimberlite targets for future drilling.

Figure 2: OhmMapper Section — Showing Resistivity Contrast Between Bedrock and Kimberlite

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/3803/34568_a1525921949194_64.jpg

Jeff Ward, P.Geo, Vice President Exploration and a Qualified Person under National Instrument 43-101, has reviewed and approved the technical information contained in this release.

For further information please contact Mr. Knox Henderson, Investor Relations, at 604-551-2360 or khenderson@dunnedinventures.com.

On behalf of the Board of Directors

Dunnedin Ventures Inc.

Chris Taylor

Chief Executive Officer

About the Kahuna Project

Dunnedin Ventures Inc. (TSXV: DVI) is a Vancouver-based company whose primary asset is the 100% owned, advanced-stage Kahuna Diamond Project in Nunavut which hosts a high-grade, near surface inferred diamond resource and numerous kimberlite pipe targets. The Company holds diamond interest in 1,664 km2 of mineral tenure located 26 kilometers northeast of Rankin Inlet and adjacent to Agnico Eagle’s Meliadine gold mine. To define and prioritize kimberlite pipe targets Dunnedin has evaluated an extensive historic data set and recovered diamonds and indicator minerals from a series of kimberlite and till samples over three seasons of field work. Working with advisor and shareholder Dr. Chuck Fipke, the Company has used the same till sampling and mineral screening protocols employed during Dr. Fipke’s discovery of Canada’s first diamond mine at Ekati, N.W.T., but improved by over 20 years of additional diamond data and experience. The Kahuna Diamond Project has an Inferred Resource Estimate of 3,987,000 tonnes at an average grade of 1.01 carats per tonne, totalling over 4 million carats of diamonds (+0.85 mm) (see news release dated March 31, 2015). The largest diamond recovered from the property to date is a 5.43 carat stone from the Kahuna dike which was a piece of a larger diamond that had been broken during the sample preparation process and was reconstructed as having an original size of 13.42 carats. Dunnedin is backed by a world-renowned team of diamond experts with decades of combined experience in Arctic exploration and capital markets strength.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Statements included in this announcement, including statements concerning our plans, intentions and expectations, which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements”. Forward-looking statements may be identified by words including “anticipates”, “believes”, “intends”, “estimates”, “expects” and similar expressions. The Company cautions readers that forward-looking statements, including without limitation those relating to the Company’s future operations and business prospects, are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, except as required by applicable securities laws.

Click here to connect with Dunnedin Ventures Inc. (TSXV:DVI) for an Investor Presentation.

Source: www.newsfilecorp.com