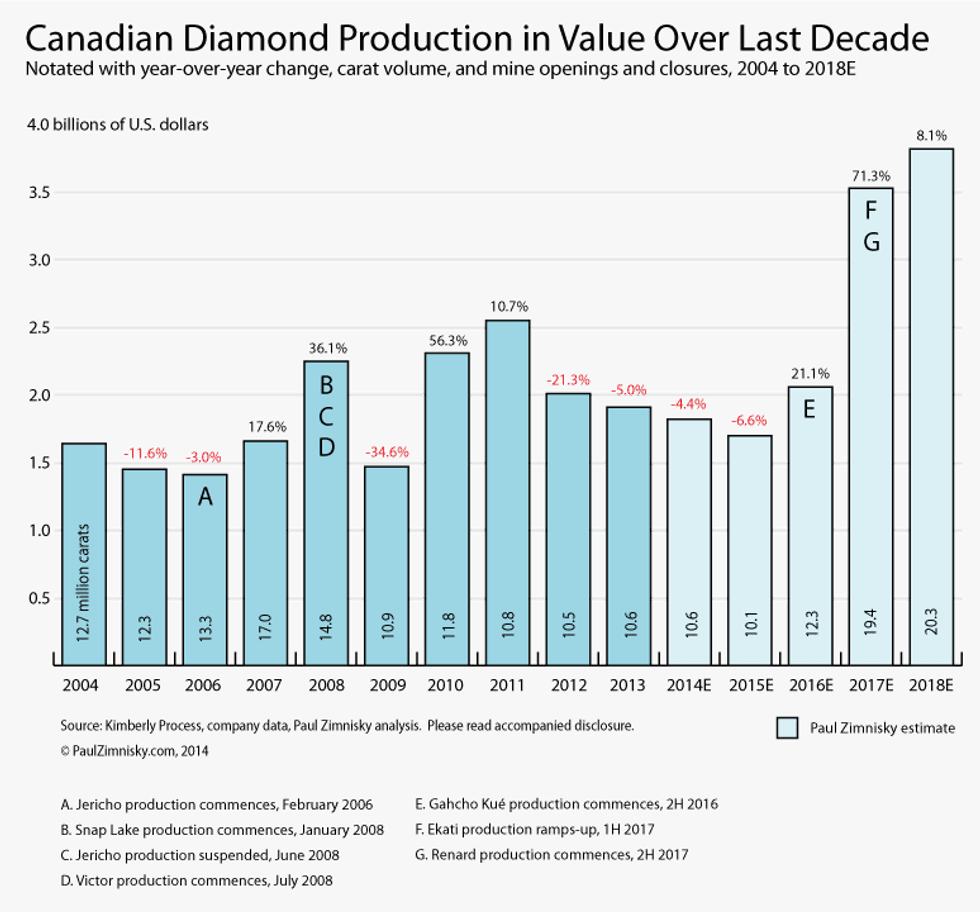

Canadian Diamond Production May Double in Next Four Years

In a recent report, independent diamond analyst and consultant Paul Zimnisky states that in four years, Canadian diamond production will likely “look significantly different than it does today.” Specifically, it may more than double.

In a recent report, independent diamond analyst and consultant Paul Zimnisky states that in four years, Canadian diamond production will likely “look significantly different than it does today.” Specifically, it may more than double.

Zimnisky states:

In July, Stornoway Diamonds (TSX: SWY) completed a C$964 million financing package to fund construction of Renard. In September, Mountain Province Diamonds (TSX: MPV) closed a C$100 million equity financing and is in the final stages of arranging US$370 million in debt to fund its portion of Gahcho Kué’s capital expenditure.

Canada currently represents an estimated 14.2% of the world diamond production in value, and 8.7% in carat volume. The two new mines, set to commence production in 2016/2017, are estimated to boost Canada’s global market share to 25.2% in value, and 15.1% in volume by 2018, which would give Canada the highest compound annual growth rate of production (20.2% in value and 17.4% in volume) among the worlds 8 largest diamond producing nations over the next 4 years.

The chart below illustrates that prediction: