Medallion Resources Ltd. (TSXV:MDL, OTCQX:MLLOF) announced a 2016 company update to shareholders which summarized 2015 and what is on the horizon for 2016.

Medallion Resources Ltd. (TSXV:MDL, OTCQX:MLLOF) announced a 2016 company update to shareholders which summarized 2015 and what is on the horizon for 2016.

As quoted in the announcement:

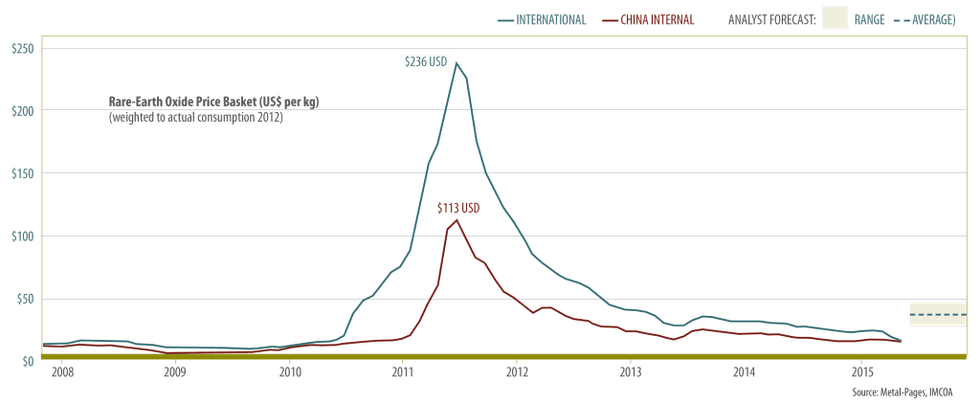

In 2015 one very notable casualty was Molycorp Inc. – the big gorilla outside of China. Molycorp entered Chapter 11 bankruptcy protection in June 2015, a decision spurred by years of losses and attempting to restart at huge scale amid declining REE prices. The Mt. Pass mine and related operations have now been placed on “care and maintenance” and would not be expected to be restarted for many years.

Medallion is looking towards a better landscape for REEs in 2016, and there were a few signs last year which inspired confidence. As last year closed we began to see what looks to be a stabilization of rare earth prices, while the other major producer Lynas Corp – now the only major new producer outside of China in three decades – entered full production. In addition, the Chinese government continues to direct its large state-owned mining companies to buy up, aggregate and manage the industry. This should allow for tighter control over illegal mining which will likely support firmer prices in the future. Importantly, strategic buyers are still keenly interested in ensuring they have long term supplies

While other REE players have fallen prey to the bear market in 2015, Medallion has seen it through – and is now in a much-reduced field. Our limited capital resources in 2015 meant focused efforts: in the past year we made excellent progress in our metallurgical flowsheet testing, and potential customers have shown interest in the rare-earth concentrate samples which we have produced during our tests.

As we enter 2016, we are looking to further advance discussions with both potential jurisdictions and potential customers as we move towards our goal of a North American pilot plant. This project will enable us to not only provide a showcase of our methods to potential investors and customers, but will also help us to fine-tune our process for commercial production. The REE sector is still recovering as we enter the New Year, but Medallion’s strong business plan – which is recognized for its low capital and low operating costs – gives us reassurance that we will be able to continue moving towards our goals, regardless of the vagaries of the market.

Connect with Medallion Resources Ltd. (TSXV:MDL, OTCQX:MLLOF) to receive an Investor Presentation.