Zinc One Announces Positive Initial Resource Estimate at Bongara Zinc Mine Project, Peru

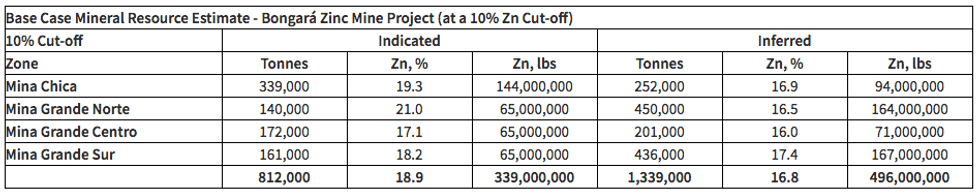

Indicated Resource of 812,000 tonnes at 18.9% Zn; Inferred Resource of 1,339,000 at 16.8% Zn

Zinc One Resources Inc. (TSXV:Z) (OTC Pink: ZZZOF) (FSE: RH33) (“Zinc One” or the “Company”) announces the first National Instrument 43-101 (“NI 43-101”) Mineral Resource estimate for its Bongará Zinc Mine project in north-central Peru. The estimate was prepared for the Company by Watts Griffis and McOuat Limited (“WGM”). A supporting NI 43-101 technical report will be available under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at www.zincone.com within 45 days of this release.

The estimate consists of an Indicated Mineral Resource of 812,000 tonnes averaging 18.9% Zn containing 339,000,000 lbs of Zn at a 10% Zn cut-off and an Inferred Mineral Resource of 1,339,000 tonnes averaging 16.8% Zn containing 496,000,000 lbs of Zn at a 10% Zn cut-off.

Greg Crowe, Director of Zinc One, stated, “This initial Mineral Resource estimate quantifies the amount of high-grade zinc in an area of known near-surface mineralization along a 1.4-kilometre trend. Further, geologic mapping and surface sampling confirms the potential of the larger Bongará Zinc Mine project to host additional significant zinc mineralization. Overall, the area of the new mineral resource estimate occupies only a small area along the strike of eight kilometres of prospective stratigraphy. In 2019, we plan to carry out additional drilling that includes upgrading the confidence level of the currently defined Inferred Mineral Resources and to expand the overall resource at nearby undrilled high-priority targets located between Mina Chica and Mina Grande Norte and northwest of Mina Chica at Campo Cielo.”

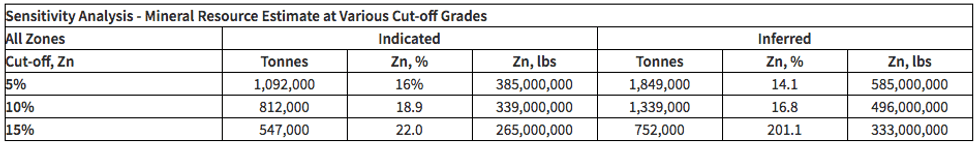

Key results from the Mineral Resource estimate at the Bongará Zinc Mine project in Peru can be summarized as follows:

Table 1.

Table 2.

Notes for Tables 1 and 2:

- The Mineral Resource Estimates in this disclosure were completed by Watts, Griffis and McOuat Limited (“WGM”), an independent firm of geological and mining consultants.

- The effective date of this mineral resource estimate is January 30, 2019 and includes all sampling results from drilling and test pitting to the end of 2018.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability but are required to have reasonable prospects for eventual economic extraction. The quantity and grade of reported Inferred Mineral Resources in this estimation are less certain in nature because the amount of exploration has been insufficient to provide the level of confidence necessary to classify them as an Indicated or Measured Mineral Resource. It is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

- The Mineral Resource estimates in this news release were estimated using current Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) standards, definitions and guidelines in accordance with Industry Best Practices.

- Mineral Resources were estimated using a cut-off grade of 10% Zn.

- Numbers may not add due to rounding. The Mineral Resource estimate was calculated using ordinary kriging methodology. A block model was constructed with block dimensions of 5 x 5 x 5 metres. Zn assays were capped at 40% Zn.

- A total of 748 drillholes and pits totalling 10,498 metres were in the database used for estimation. Only diamond drill holes were used for estimating Indicated Resources; diamond drill holes and pits were used for estimating Inferred Resources. The drill holes were drilled at various orientations. Drillhole spacing is approximately 25 to 30 metres in areas where resources are estimated. Details of the drill campaign are set out in various news releases from March 29, 2018 to November 15, 2018.

- A bulk density of 1.90 was applied using the geological block model density field.

The Bongará Zinc Mine project contains an 8-kilometre trend with known near-surface, high grade zinc mineralization. Very little systematic exploration has been completed along this trend, except for drilling at the Cristal Project (northwest end of the trend) that identified a body of high-grade zinc mineralization. This provides an exciting opportunity to discover zinc-rich deposits in future exploration campaigns.

The zinc mineralization at the Bongará Zinc Mine project is classified as a Mississippi Valley-type (“MVT”) deposit and is mostly hosted by strongly dolomitized brecciated limestones beds. The mineralization can also occur as tabular bodies with irregular boundaries, which is a characteristic of that mineralization encountered along the periphery of breccias, especially at Mina Chica. The original MVT sulphide mineralization has been oxidized and now occurs as hydrozincite (zinc-oxide mineral), smithsonite (zinc-carbonate mineral), hemimorphite (zinc-silicate mineral), and zinc-aluminum-iron silicates.

The former Bongará Mine operated during 2007-08, successfully producing zinc from this type of mineralization using a Waelz kiln for processing. The kiln does not require copious amounts of water and an electrical grid, and the waste product is slag that can be used as road material, among other things, thus precluding a permanent tailings storage facility and minimizing initial and sustaining capital outlays.

Qualified Persons

The technical content of this news release has been reviewed, verified and approved by Al Workman, P.Geo., senior geologist and Vice-President of WGM and John Reddick, P.Eng, senior WGM Associate resource modelling engineer, both Qualified Persons under National Instrument 43-101. WGM is an independent firm of consulting geologists and engineers that have visited the project regularly since 2014. WGM assisted Zinc One in designing, monitoring, and auditing its quality control program.

About Zinc One Resources Inc.

Zinc One’s key assets are the Bongará Zinc Mine Project and the Charlotte-Bongará Zinc Project in north-central Peru. The Bongará Zinc Mine Project was in production from 2007 to 2008 but was closed due to the Global Financial Crisis and the concurrent decrease in the zinc price. Past production included >20% zinc grades and recoveries over 90% from surface and near-surface zinc-oxide mineralization. High-grade, zinc-oxide mineralization is known to outcrop between the mined area and the Charlotte-Bongará and Cristal Project areas, which are over six kilometres to the north-northwest and where past drilling also intercepted various near-surface zones with high-grade zinc as well.

Additional Information

Monica Hamm

VP, Investor Relations

Zinc One Resources Inc.

Phone: (604) 683-0911

Email: mhamm@zincone.com

www.zincone.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Zinc One cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Zinc One’s limited operating history, its proposed exploration and development activities on the Bongará Zinc Oxide Mine Project and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Zinc One does not undertake to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.