Trevali Provides Mineral Reserves and Mineral Resources Update; Increases Consolidated M+I Zinc Resources 13 Percent year over year

Trevali Mining Corporation (TSX:TV) (BVL:TV; OTCQX:TREVF, Frankfurt:4TI) reports its Mineral Reserves and Mineral Resources statements as of December 31, 2018.

Trevali Mining Corporation (TSX:TV) (BVL:TV; OTCQX:TREVF, Frankfurt:4TI) reports its Mineral Reserves and Mineral Resources statements as of December 31, 2018.

HIGHLIGHTS

- Exploration successfully replaced and increased consolidated zinc Measured and Indicated Resources at all mine sites, with higher grades at Santander and Caribou:

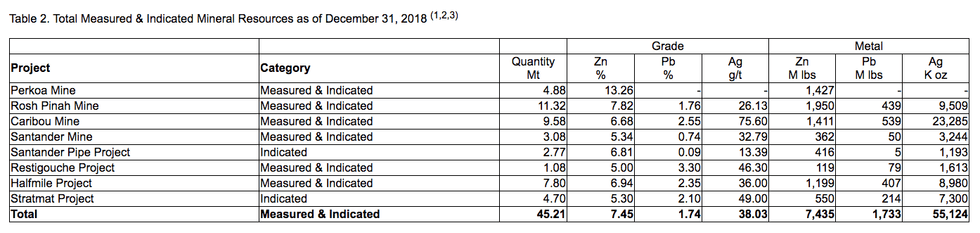

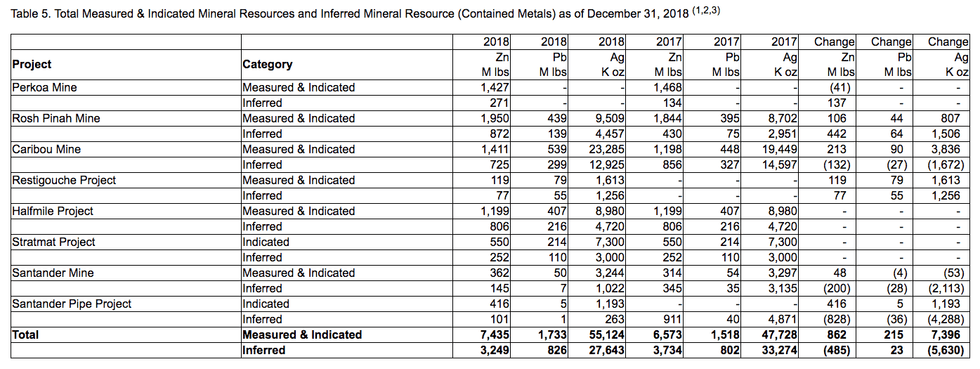

- Consolidated Measured and Indicated Mineral Resources increased to 7.4 billion pounds (3.4 million tonnes) of contained zinc, an increase of 13% over the prior year

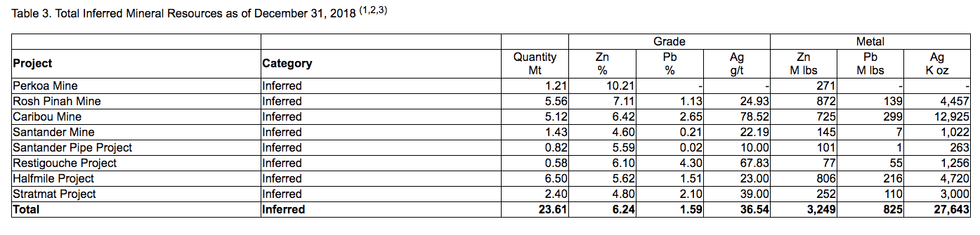

- Consolidated Inferred Mineral Resources comprise an additional 3.2 billion lbs (1.5 million tonnes) of contained zinc

- Consolidated lead and silver resources also increased:

- Consolidated Measured and Indicated Mineral Resources increased to 1.7 billion pounds (0.8 million tonnes) of contained lead and 55 million ounces of contained silver

- Consolidated Inferred Mineral Resources include an additional 0.8 billion lbs (0.4 million tonnes) of contained lead and 28 million ounces of contained silver

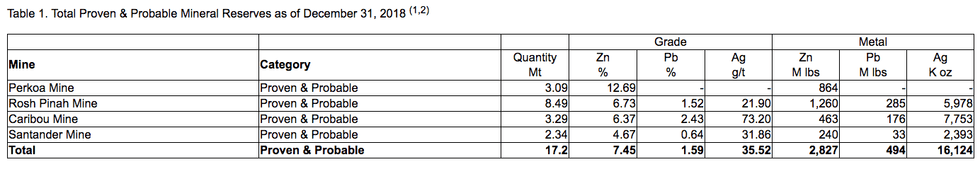

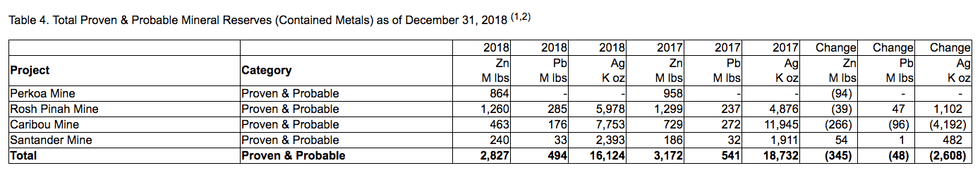

- Consolidated Proven and Probable Mineral Reserves are:

- 2.83 billion pounds (1.28 million tonnes) of contained zinc

- 494 million pounds (0.22 million tonnes) of contained lead

- 16.1 million ounces of contained silver

- Reserve tonnage increased at Santander and Rosh Pinah, while essentially remaining unchanged at Perkoa and decreasing at Caribou, where mine optimization studies are ongoing.

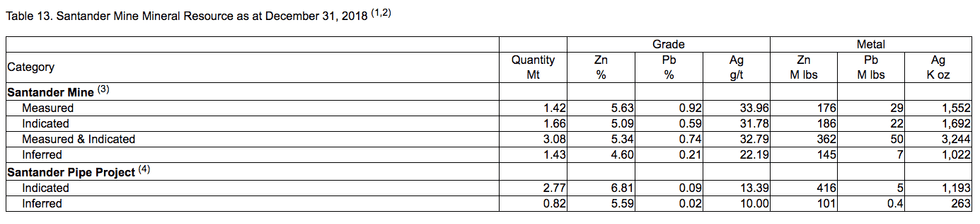

- Exploration drilling at the Santander Pipe target in Peru successfully delineated an indicated resource averaging 6.81% zinc, with mineralization contiguous and extending below the historic mine workings.

Consolidated Mineral Reserves and Mineral Resources statements are summarized in Tables 1 to 3 while Tables 4 and 5 provide a comparison to 2017 Mineral Reserves and Mineral Resources on a contained metal basis. Detailed breakdowns for each of the active mines (Perkoa, Rosh Pinah, Caribou and Santander) and projects (Restigouche, Halfmile, Stratmat and Santander Pipe) are provided by category on a grade-tonnage-contained metal basis by mine regions in the detailed section. Mineral Resources in this document are reported inclusive of Mineral Reserves.

| (1) | For additional detail respecting the Mineral Reserve contained zinc, lead and silver grades, see “Detailed Mineral Reserve and Mineral Resource Disclosure” and “Additional Information” within this news release. |

| (2) | The M lbs (million pounds) and K oz (thousand ounces) contained metals is the total Proven + Probable Mineral Reserve estimation of all the mines on a 100% basis. Trevali’s proportionate ownership interest pursuant to the applicable joint venture/option agreements is: Perkoa (90%); and Rosh Pinah (90%); Santander (100%); Caribou (100%). |

| (1) | For additional detail respecting the Mineral Resources contained zinc, lead and silver grades, see “Detailed Mineral Reserve and Mineral Resource Disclosure” and “Additional Information” within this news release. |

| (2) | All Mineral Resources referred to in this news release are inclusive of stated Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| (3) | The M lbs (million pounds) and K oz (thousand ounces) contained metals is the total Measured + Indicated Mineral Resource estimation of all mines and projects on a 100% basis. Trevali’s proportionate ownership interest pursuant to the applicable joint venture/option agreements is: Perkoa (90%); and Rosh Pinah (90%); Santander (100%); Caribou (100%). |

| (1) | For additional detail respecting the Mineral Resources contained zinc, lead and silver grades, see “Detailed Mineral Reserve and Mineral Resource Disclosure” and “Additional Information” within this news release. |

| (2) | All Mineral Resources referred to in this news release are inclusive of stated Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| (3) | The M lbs (million pounds) and K oz (thousand ounces) contained metals is the total Inferred Mineral Resource estimation of all mines and projects on a 100% basis. Trevali’s proportionate ownership interest pursuant to the applicable joint venture/option agreements is: Perkoa (90%); and Rosh Pinah (90%); Santander (100%); Caribou (100%). |

| (1) | For additional detail respecting the Mineral Reserve contained zinc, lead and silver grades, see “Detailed Mineral Reserve and Mineral Resource Disclosure” and “Additional Information” within this news release. |

| (2) | The M lbs (million pounds) and K oz (thousand ounces) contained metals is the Proven + Probable Mineral Reserve estimation of all the mines on a 100% basis. Trevali’s proportionate ownership interest pursuant to the applicable joint venture/option agreements is: Perkoa (90%); and Rosh Pinah (90%); Santander (100%); Caribou (100%). |

| (1) | For additional detail respecting the Mineral Resources contained zinc, lead and silver grades, see “Detailed Mineral Reserve and Mineral Resource Disclosure” and “Additional Information.” within this news release. |

| (2) | All Mineral Resources referred to in this news release are inclusive of stated Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| (3) | The M lbs (million pounds) and K oz (thousand ounces) contained metals is the total Measured + Indicated and Inferred Mineral Resource estimation of all the mines on a 100% basis. Trevali’s proportionate ownership interest pursuant to the applicable joint venture/option agreements is: Santander (100%); Caribou (100%); Perkoa (90%); and Rosh Pinah (90%). |

Detailed Mineral Reserve and Mineral Resource Disclosure:

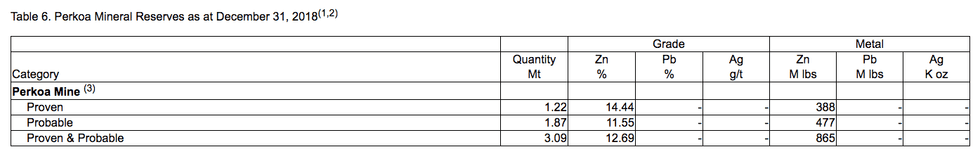

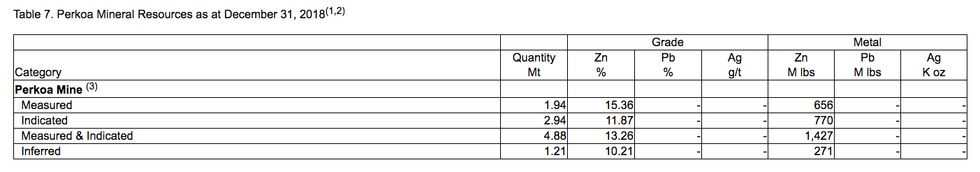

Perkoa Mine

The annual Mineral Reserve statement for the Perkoa mine utilized a net smelter return cut-off-value of US$100 per tonne while the Mineral Resources are disclosed using a 5% ZnEQ cut-off value. The 2018 Resource definition and exploration drilling programs replaced the 2018 mining depletion and maintained the rolling reserve replacement strategy, which it has successfully done since the acquisition of the asset. Measured and Indicated Mineral Resources tonnages remain fundamentally flat with grades decreasing modestly from 13.73% Zn to 13.26% Zn.

Regional exploration is ongoing and has successfully intersected two additional sulphide bearing (stringer – disseminated to narrow massive sulphide zones – non economic to date) VMS systems confirming that Perkoa is not an isolated occurrence. As a key focus in 2019, Trevali’s proven exploration group is using a multidisciplinary approach in this frontier VMS belt. There are currently four drill rigs active on the Perkoa property consisting of two diamond drill rigs, two air core drill rigs with real-time geochemical analysis and two ground geophysical teams screening the prospective Perkoa mine horizon.

| (1) | All Mineral Reserves have been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”). Numbers may not add due to rounding. The Mineral Reserve is shown at 100% ownership, Trevali holds a 90% joint venture interest in the Perkoa Mine. |

| (2) | The technical report entitled “Technical Report on the Perkoa Mine, Burkina Faso” dated April 12, 2018, is the current technical report for the Perkoa property. |

| (3) | The Perkoa Underground Mine Mineral Reserve estimate is reported based on planned stopes with a net smelter return cut-off grade of US$100/tonne, with metal prices of: US$1.13/lb zinc. The Perkoa Underground Mine Mineral Reserve estimate has been prepared by non-independent Mine engineering consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Professional Engineer Barbara Rose (P.Eng.), a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Ms. Rose is Principal Mine Engineer of the Company and accordingly, is not independent. |

| (1) | All Mineral Resources have been estimated in accordance with the CIM Definition Standards. Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Numbers may not add up due to rounding. The Mineral Resource is shown at 100% ownership, Trevali holds a 90% joint venture interest in the Perkoa Mine. |

| (2) | The technical report entitled “Technical Report on the Perkoa Mine, Burkina Faso” dated April 12, 2018, is the current technical report for the Perkoa property. |

| (3) | The Perkoa Underground Mine Mineral Resource estimate is reported based on zinc equivalent cut off grade of 5% ZnEQ with metal prices of: US$1.13/lb zinc. The Perkoa Underground Mine Mineral Resource estimate has been prepared by the mine geology department and non-independent Resource geology consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Yan Bourassa (P.Geo.), a Qualified Person as defined in NI 43-101. Mr. Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent. |

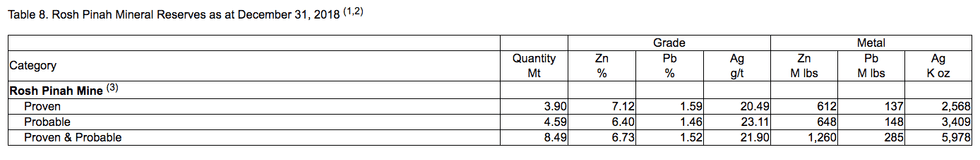

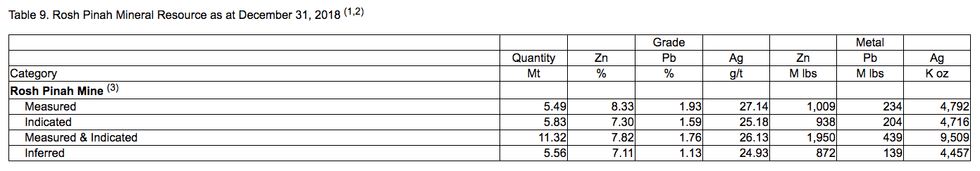

Rosh Pinah Mine

The conversion drilling program successfully replaced the 2018 mining depletion with tonnages for both Proven and Probable Mineral Reserves and Measured and Indicated Mineral Resources increasing in addition to mining depletion replacement. The Mineral Reserve zinc grade is modestly lower than 2017. The decline occurred primarily due to a combination of mining extracting higher than average Mineral Reserves grade tonnes in 2018, as well as a reduction of the NSR cut-off to $60/t from $66/t in 2017 allowing additional lower grade tonnes to be converted to Mineral Reserves. Rosh Pinah is a Tier 1 deposit on a grade – tonnage basis with the majority of zones, and in particular the Western Orefield, the largest zone discovered to date remaining open for expansion. Exploration in 2018 successfully targeted higher grade, metallurgically superior mineralization in the Western Orefield, which resulted in a significant increase in inferred tonnage and grades.

Rosh Pinah remains one of Trevali’s lowest cost operations. The Rosh Pinah 2.0 optimization and expansion study, which continues to advance with completion anticipated in the second half of 2019, is evaluating opportunities to reduce the unit cost structure of the mine, further positioning Rosh Pinah as a low-cost, long-life and core asset for Trevali.

| (1) | All Mineral Reserves have been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”). Numbers may not add due to rounding. The Mineral Reserve is shown at 100% ownership, Trevali holds a 90% joint venture interest in the Rosh Pinah Mine. |

| (2) | The technical report entitled “Technical Report on the Rosh Pinah Mine, Namibia” dated May 1, 2018, is the current technical report for the Rosh Pinah property. |

| (3) | The Rosh Pinah Underground Mine Mineral Reserve estimate is reported based on planned stopes with a net smelter return cut-off grade of US$60/tonne, with metal prices of: US$1.13/lb zinc. The Rosh Pinah Underground Mine Mineral Reserve estimate has been prepared by non-independent Mine engineering consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Professional Engineer Barbara Rose (P.Eng.), a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Ms. Rose is Principal Mine Engineer of the Company and accordingly, is not independent. |

| (1) | All Mineral Resources have been estimated in accordance with the CIM Definition Standards. Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Numbers may not add up due to rounding. The Mineral Resource is shown at 100% ownership, Trevali holds a 90% joint venture interest in the Rosh Pinah Mine. |

| (2) | The technical report entitled “Technical Report on the Rosh Pinah Mine, Namibia” dated May 1, 2018, is the current technical report for the Rosh Pinah property. |

| (3) | The Rosh Pinah Underground Mine Mineral Resource estimate is reported based on zinc equivalent cut off grade of 5% ZnEQ with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Rosh Pinah Underground Mine Mineral Resource estimate has been prepared by the mine geology department and non-independent Resource geology consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Yan Bourassa (P.Geo.), a Qualified Person as defined in NI 43-101. Mr. Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent. |

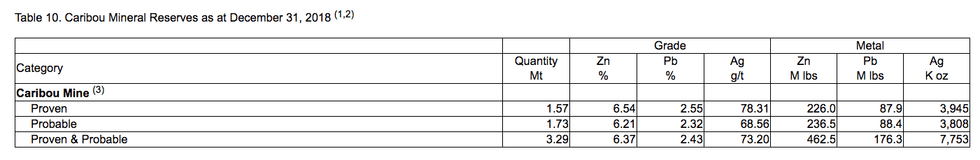

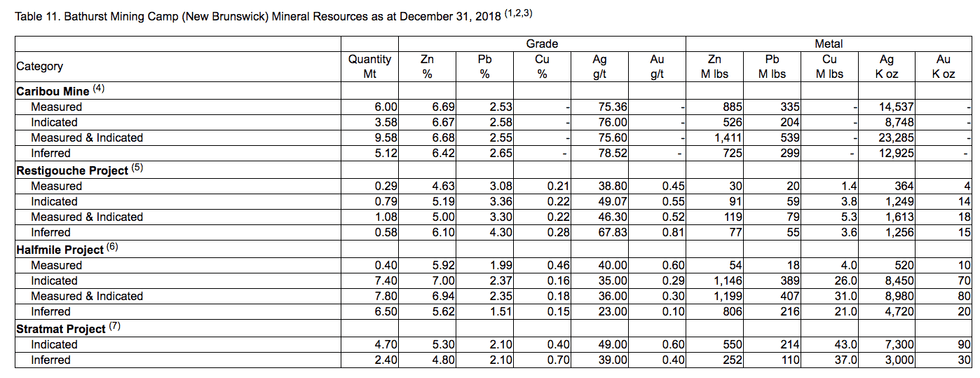

Caribou Mine – Bathurst Mining Camp Operations

The annual Mineral Reserve statement for the Caribou mine utilized a net smelter return cut-off-value of US$75 per tonne, an increase from the US$70 per tonne value used for the 2017 year-end disclosure. The cut-off increase reflects a year to year mining cost increase partly resulting from the implementation of cemented back fill and increased rehabilitation requirements. Proven and Probable Mineral Reserves tonnage decreased from 2017, as the sill pillar recovery was decreased due to recent changes observed in ground conditions and remnant areas have been excluded from reporting in 2018 while ongoing work is conducted to determine a safe, cost-effective mining methodology. Ongoing mine optimization studies will seek to redress this. The overall grade increased due to improved geological constraint and more selective mining. The Measured and Indicated Mineral Resources saw an increase in tonnage, grade and contained metal over the 2017 year-end Mineral disclosure and the deposit remains open for expansion. Additional studies remain on-going evaluating cost reduction opportunities at the mine with the aim of further converting Mineral Resource to Reserves.

After completing a detailed multi-disciplinary technical review of Murray Brook project, the Company decided to not pursue its option to acquire a 75% interest, electing to focus on continuing to unlock value from the operating Caribou mine and further evaluate other projects in the region.

| (1) | All Mineral Reserves have been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”). Numbers may not add due to rounding. |

| (2) | The technical report entitled “Technical Report on the Caribou Mine, Bathurst, New Brunswick, Canada” dated May 31, 2018, is the current technical report for the Caribou property. |

| (3) | The Caribou Underground Mine Mineral Reserve estimate is reported based on optimized stopes designed on an incremental net smelter return cut-off grade of US$75/tonne with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Caribou Underground Mine Mineral Reserve estimate has been prepared by non-independent Mine engineering consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Professional Engineer Barbara Rose (P.Eng.), a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Ms. Rose is Principal Mine Engineer of the Company and accordingly, is not independent. |

| (1) | All Mineral Resources have been estimated in accordance with the CIM Definition Standards. Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Numbers may not add up due to rounding. |

| (2) | The technical report entitled “Technical Report on the Caribou Mine, Bathurst, New Brunswick, Canada” dated May 31, 2018, is the current technical report for the Caribou property. |

| (3) | The technical report entitled “Technical Report on Preliminary Economic Assessment for the Halfmile-Stratmat Massive Sulphide Zinc-Lead-Silver Integrated Project Bathurst, New Brunswick, Canada” dated October 26, 2017, is the current technical report for the Halfmile-Stratmat property. |

| (4) | The Caribou Underground Mine Mineral Resource estimate is reported based on zinc equivalent cut off grade of 5% ZnEQ with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Caribou Underground Mine Mineral Resource estimate has been prepared by the mine geology department and non-independent technical consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Yan Bourassa (P.Geo.), a Qualified Person as defined in NI 43-101. Mr. Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent. |

| (5) | The Restigouche Underground Mine Mineral Resource estimate is reported based on zinc equivalent cut off grade of 3% ZnEQ with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Restigouche Underground Mine Mineral Resource estimate has been prepared by the exploration geology department and non-independent technical consultants to the company with an effective date of July 30, 2018, under the supervision of and approved by Yan Bourassa (P.Geo.), a Qualified Person as defined in NI 43-101. Mr. Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent. |

| (6) | The Halfmile Underground Project Mineral Resource estimate is reported based on zinc equivalent cut off grade of 5% ZnEQ with metal prices of: US$1.05/lb zinc, US$0.95/lb lead, US$20.00/oz silver, FX: US$/CAD$0.80. The Halfmile Underground Project Mineral Resource estimate was prepared and approved by Professional Geologist Gilles Arseneau (P.Geo.), a consultant with SRK Consulting (Canada) Inc., who is an Independent Qualified Person as defined in NI 43-101, with an effective date of October 26, 2017. |

| (7) | The Stratmat Underground Project Mineral Resource estimate is reported based on zinc equivalent cut off grade of 5% ZnEQ with metal prices of: US$1.00/lb zinc, US$1.00/lb lead, US$21.15/oz silver, FX: US$/CAD$0.85. The Stratmat Underground Project Mineral Resource estimate was prepared and approved by Professional Geologist Gilles Arseneau (P.Geo.), a consultant with SRK Consulting (Canada) Inc., who is an Independent Qualified Person as defined in NI 43-101, with an effective date of October 26, 2017. |

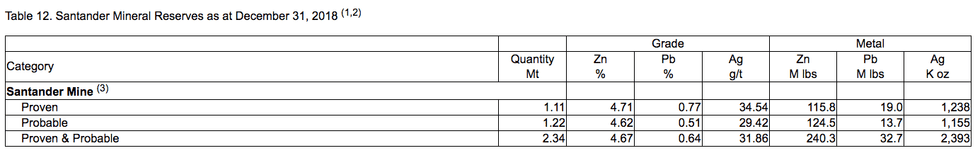

Santander Mine

The annual Mineral Reserve estimate at the Company’s Santander mine utilized a net smelter return cut-off-value of US$45 per tonne. The 2018 drill program successfully replaced mined inventory for the year with Proven and Probable Reserves and Measured and Indicated Mineral Resources increasing in tonnages, grade and contained metal. The 2018 drilling program at Santander mainly focused on replacing mining depletion, but a significant amount of drilling also targeted resource conversion at the Santander Pipe Project. The Santander Pipe drilling program successfully converted 2.77 million tonnes of Inferred Mineral Resources to Indicated Resources at a grade of 6.81% Zn for a total of 416 million pounds of contained zinc metal. The Santander Pipe will continue to be evaluated in 2019.

| (1) | All Mineral Reserves have been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definition Standards adopted by CIM Council on May 10, 2014 (the “CIM Definition Standards”). Numbers may not add due to rounding. |

| (2) | The technical report entitled “Mineral Reserve Estimation Technical Report for the Santander Zinc Mine, Province de Huaral, Perú” dated March 31, 2017, is the current technical report for the Santander property. |

| (3) | The Santander Magistral Underground Mine Mineral Reserve estimate is reported based on optimized stopes designed on an incremental net smelter return cut-off grade of US$45/tonne with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Santander Magistral Underground Mine Mineral Reserve estimate has been prepared by non-independent Mine engineering consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Professional Engineer Barbara Rose (P.Eng.), a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Ms. Rose is Principal Mine Engineer of the Company and accordingly, is not independent. |

| (1) | All Mineral Resources have been estimated in accordance with the CIM Definition Standards. Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Numbers may not add up due to rounding. |

| (2) | The technical report entitled “Mineral Reserve Estimation Technical Report for the Santander Zinc Mine, Province de Huaral, Perú” dated March 31, 2017, is the current technical report for the Santander property. |

| (3) | The Santander Magistral Underground Mine Mineral Resource estimate is reported based on net smelter return cut-off grade of US$40/tonne with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Santander Magistral Underground Mine Mineral Resource estimate has been prepared by the mine geology department and non-independent Resource geology consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Yan Bourassa (P.Geo.), a Qualified Person as defined in NI 43-101. Mr. Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent. |

| (4) | The Santander Pipe Underground Deposit Mineral Resource estimate is reported based on net smelter return cut-off grade of US$40/tonne with metal prices of: US$1.13/lb zinc, US$0.95/lb lead, US$14.50/oz silver. The Santander Pipe Underground Deposit Mineral Resource estimate has been prepared by the exploration geology department and non-independent Resource geology consultants to the company with an effective date of December 31, 2018, under the supervision of and approved by Yan Bourassa (P.Geo.), a Qualified Person as defined in NI 43-101. Mr. Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent. |

Qualified Persons and Technical Information

The Mineral Reserve and Mineral Resource estimates have been estimated and compiled in accordance with definitions and guidelines set out in the Definition Standards for Mineral Resources and Mineral Reserves adopted by the Canadian Institute of Mining, Metallurgy, and Petroleum and as required by Canada’s National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Mineral Reserve estimates reflect the Company’s reasonable expectation that all necessary permits and approvals will be obtained and maintained, mining dilution and mining recovery have been applied in estimating the Mineral Reserves.

The Mineral Reserves were prepared under the supervision of Barbara Rose, a Qualified Person as defined by NI 43-101. Barbara Rose (P.Eng.) is Principal Mine Engineer for the Company and is therefore not considered independent.

The Mineral Resource technical contents has been prepared by the Company’s technical personnel under the supervision of Yan Bourassa (M.Sc. P.Geo.), a Qualified Person as defined in NI 43-101. Yan Bourassa is Vice President Mineral Resources Management of the Company and accordingly, is not independent.

ABOUT TREVALI MINING CORPORATION

Trevali is a zinc-focused, base metals company with four mines: the 90% owned Perkoa mine in Burkina Faso, the 90% owned Rosh Pinah mine in Namibia, the wholly-owned Caribou mine in the Bathurst Mining Camp of northern New Brunswick in Canada, and the wholly-owned Santander mine in Peru.

The shares of Trevali are listed on the TSX (symbol TV), the OTCQX (symbol TREVF), the Lima Stock Exchange (symbol TV), and the Frankfurt Exchange (symbol 4TI). For further details on Trevali, readers are referred to the Company’s website (www.trevali.com) and to Canadian regulatory filings on SEDAR at www.sedar.com.

On Behalf of the Board of Directors of

TREVALI MINING CORPORATION

“Jessica McDonald” (signed)

Jessica McDonald, Chair

Contact Information:

Steve Stakiw, Vice President – Investor Relations and Corporate Communications

Email: sstakiw@trevali.com

Phone: (604) 488-1661 / Direct: (604) 638-5623

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of the Canadian securities legislation and “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time. Statements containing forward-looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results. Such forward-looking statements and information include, but are not limited to statements as to: the estimation of mineral reserves and mineral resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs and timing of development, potential operating efficiencies, costs of production, capital expenditures, success of mining operations, expectations regarding milling operations and metal production shortfalls, metal output and throughput rates, anticipated results of future exploration, expected costs of exploration, expected exploration programs and value adds, and forecast future metal prices.

These statements reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. If any assumptions are untrue, it could cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such statements. Assumptions have been made regarding, among other things, present and future business strategies and the environment in which the Company will operate in the future, including commodity prices, anticipated costs and ability to achieve goals.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to joint venture operations; fluctuations in spot and forward markets for silver, zinc, base metals and certain other commodities (such as natural gas, fuel oil and electricity); fluctuations in currency markets; risks related to the technological and operational nature of the Company’s business; changes in national and local government, legislation, taxation, controls or regulations and political or economic developments in Canada, the United States, Peru, Namibia, Burkina Faso, or other countries where the Company may carry on business in the future; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding); risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom the Company does business; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; employee relations; relationships with and claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses and permits and the presence of laws and regulations that may impose restrictions on mining; diminishing quantities or grades of mineral resources as properties are mined; global financial conditions; business opportunities that may be presented to, or pursued by, the Company; the Company’s ability to complete and successfully integrate acquisitions and to mitigate other business combination risks; challenges to, or difficulty in maintaining, the Company’s title to properties and continued ownership thereof; the actual results of current exploration activities, conclusions of economic evaluations, and changes in project parameters to deal with unanticipated economic or other factors; increased competition in the mining industry for properties, equipment, qualified personnel, and their costs, as well as those factors discussed in the section entitled “Risk Factors” in the Company’s most recently filed annual information form, which is available on the Company’s website (www.trevali.com) and filed under our profile on SEDAR (www.sedar.com). Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Notice to United States Investors

In accordance with applicable Canadian securities regulatory requirements, all mineral resource estimates of the Company disclosed or incorporated by reference in this news release have been prepared in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, classified in accordance with Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves Definitions and Guidelines”.

The Company uses the terms “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. While these terms are recognized and required by Canadian regulations, they are not recognized by the United States Securities and Exchange Commission. US investors are cautioned not to assume that any part or all of the material in these categories will ever be converted into reserves.

Click here to connect with Trevali Mining Corporation (TSX:TV) for an Investor Presentation.

Source: www.globenewswire.com