Foran Files Technical Report for McIlvenna Bay Resource

Foran Files Technical Report for McIlvenna Bay Resource

Foran Mining Corporation (TSXV:FOM) (“Foran” or the “Company”) is pleased to announce that it has filed a National Instrument 43-101 (“NI 43-101”) technical report (the “Report”) for the recent revised resource estimate for the Company’s 100%-owned McIlvenna Bay Deposit (“McIlvenna Bay” or the “Deposit”) located in east-central Saskatchewan. McIlvenna Bay is one of the largest, undeveloped volcanogenic massive sulphide (“VMS”) deposits in Canada.

The report entitled “Technical Report for the 2019 Mineral Resource Estimate on the McIlvenna Bay Project, Saskatchewan, Canada” has been filed on SEDAR and is also available on the Company’s website at www.foranmining.com/properties/mcilvenna-bay/.

The 2019 McIlvenna Bay Resource Estimate (“2019 Resource Estimate”) represents a significant milestone for the Company as it progresses with a Feasibility Study for potential development of the Deposit. The 2019 Resource Estimate was released on May 28th, 2019 and the reader is referred to the Company’s News Release and/or the Report for detailed information on the Deposit and latest resource estimate.

Highlights of the 2019 Resource Estimate Include:

- Indicated resources increase by 65% to 22.95 million tonnes

- Additional inferred resources of 11.15 million tonnes

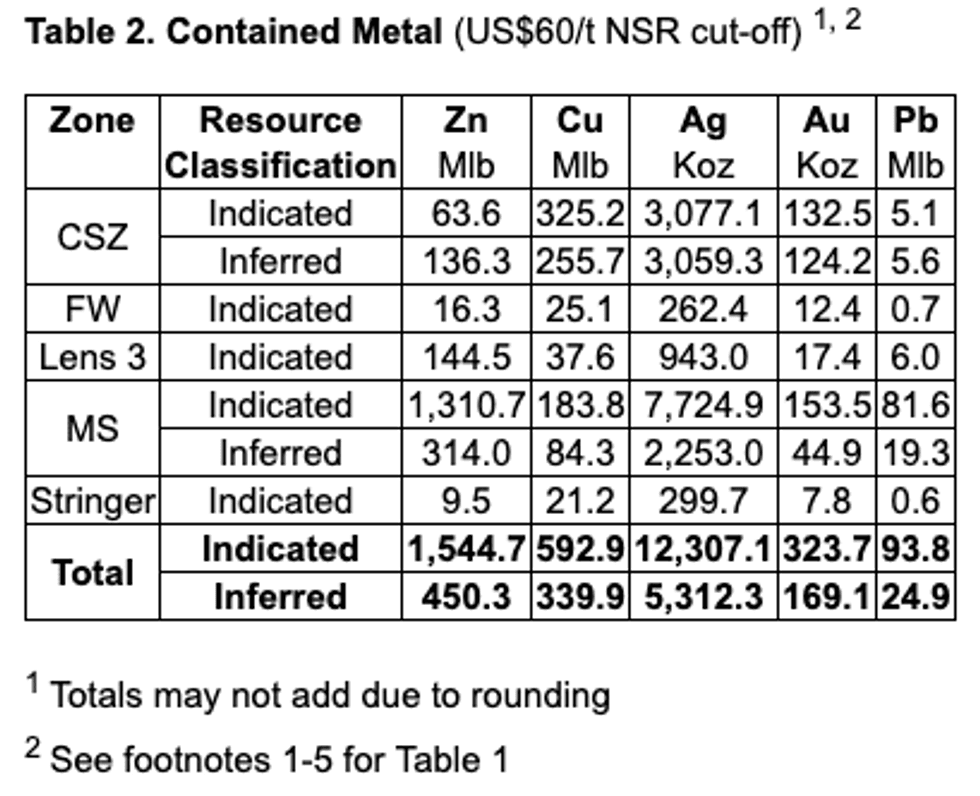

- Contained metals (indicated): 1.5 billion lbs Zn / 590 million lbs Cu

- Contained metals (inferred): 450 million lbs Zn / 340 million lbs Cu

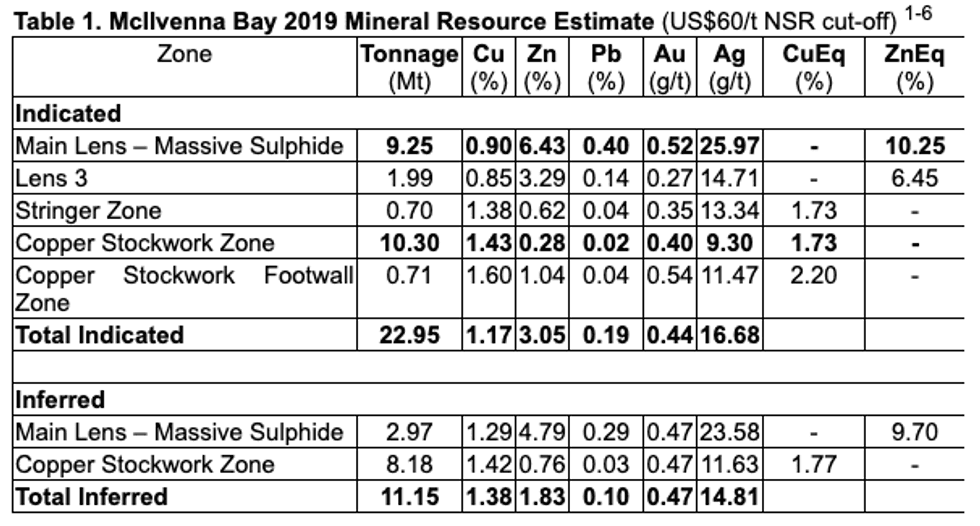

- The 2019 Resource Estimate will be used to support the upcoming Feasibility Study, expected in Q4 2019. The mineral resource estimate was audited and verified by Mr. William Lewis, P.Geo. of Micon International Limited (“Micon”), independent of Foran and a Qualified Person as defined within NI43-101. The 2019 Resource Estimate is summarized in Table 1.Indicated resources have increased 65%, from 13.9 million tonnes (“Mt”) to 22.95Mt (compared to previous 2013 resource) (see Table 1)

- Grading 1.17% copper, 3.05% zinc, 0.19% lead, 0.44 grams per tonne (“g/t”) gold and 16.68 g/t silver

- Contains 1.5 billion pounds Zn and 590 million pounds Cu (see Table 2)

- Inferred resources are now 11.15Mt

- Grading 1.38% copper, 1.83% zinc, 0.10 % lead, 0.47 g/t gold and 14.81 g/t silver

- Contains 450 million pounds Zn and 340 million pounds Cu

- Significant increase of contained metals within the Deposit compared to previous 2013 resource

- 89% increase in zinc, 52% increase in copper, 48% increase in gold and 61% increase in silver in the indicated category

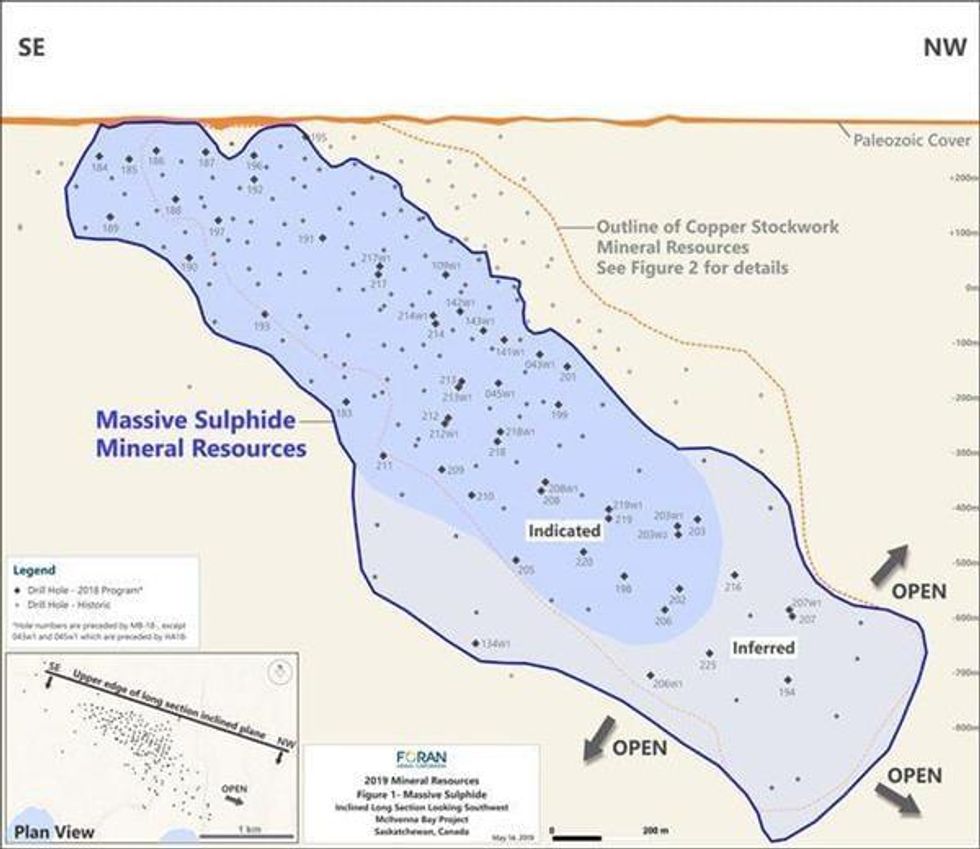

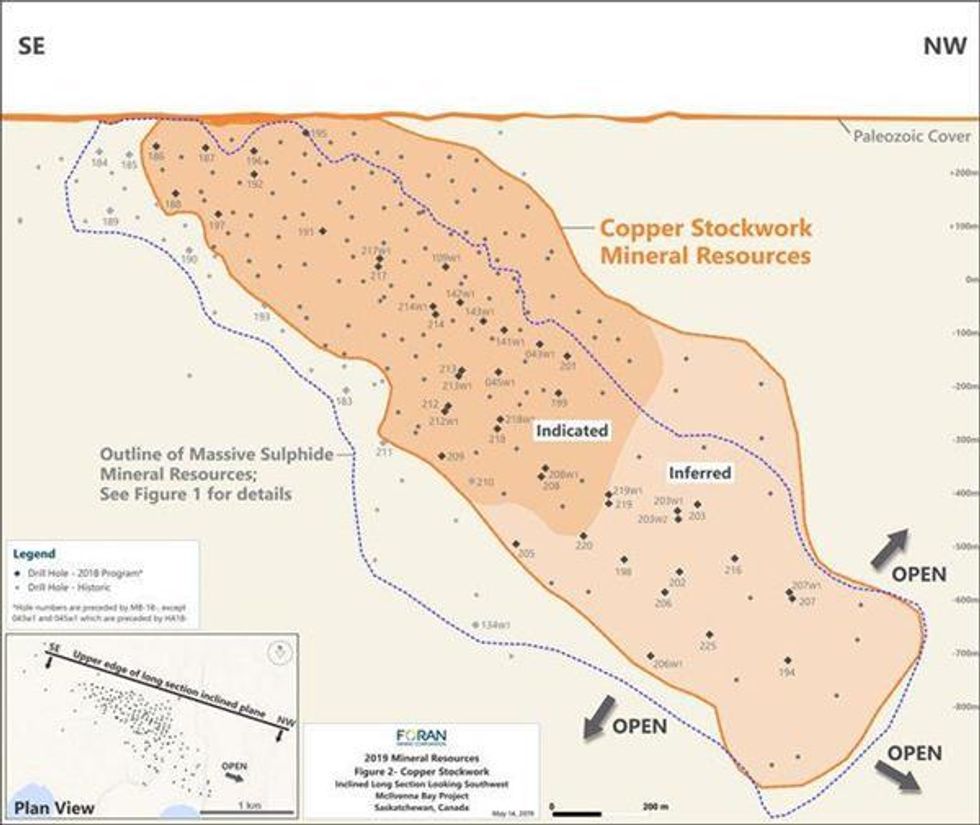

- The Deposit resources are defined by:

- over 115,000 metres (“m”) of drilling in 239 holes

- includes over 27,000m of infill and expansion drilling completed in 64 drill holes since the last resource update in 2013

- Main Lens massive sulphide (“Main Lens”) and adjacent Copper Stockwork Zone (“CSZ”) together have an average combined thickness of 17.6m through the Deposit

- Deposit starts at the paleosurface (~25m below surface) and extends down-plunge approximately 2km, and

- The Deposit is open, with potential to further increase the size of the resource with additional drilling.

The 2019 Resource Estimate will be used to support the upcoming Feasibility Study, expected in Q4 2019. The mineral resource estimate was audited and verified by Mr. William Lewis, P.Geo. of Micon International Limited (“Micon”), independent of Foran and a Qualified Person as defined within NI43-101. The 2019 Resource Estimate is summarized in Table 1.

1 Effective date May 7, 2019; CIM definitions were followed for Mineral Resources; CuEq = copper equivalent; ZnEq = zinc equivalent; NSR = Net Smelter Return.

2 The base case mineral resource is estimated based on 239 diamond drill holes and a NSR cut-off grade of US$60/t. NSR grades were calculated and high-grade caps were applied as per the discussion in Estimation Methodology and Parameters below and include provisions for metallurgical recovery and estimates of current shipping terms and smelter rates for similar concentrates. Metal prices used are US$3.30/lb. Cu, US$1.25/lb. Zn, US$1.00/lb. Pb, US$1,310/oz. Au, and US$16.20/oz. Ag. Specific gravity was interpolated for each block based on measurements taken from core specimens.

3 Mr. William Lewis, P.Geo., of Micon, has reviewed and verified this mineral resource estimate. Mr. Lewis is independent of Foran and is a “Qualified Person” within the meaning of NI 43-101.

4 Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, marketing or other issues.

5 CuEq and ZnEq values were calculated from the NSR values for the zones using a factor of $55.71 per % Cu for the CSZ and a factor of $46.69 per % Cu and $15.10 per % Zn for all other zones.

6A sensitivity table is provided in Table 3 below which demonstrates the variation in tonnage and grade for the deposit at different NSR cut-offs.

The 2019 Resource Estimate builds on and supersedes the previous comprehensive NI 43-101 mineral resource estimate for the Deposit which was announced by the Company on March 27, 2013 (the “2013 Resource”). The 2019 Resource Estimate is estimated using long-term metal price projections of US$3.30/lb. for copper, US$1.25/lb. for zinc, US$1.00/lb. for lead, US$1,310/oz. for gold and US$16.20/oz. for silver. The base case uses a US$60/t NSR cut-off using provisions for metallurgical recoveries, smelter payables, refining costs, freight, and applicable royalties, consistent with the cut-off used for the 2013 Resource.

Contained Metal

There has been substantial growth in the Deposit since the 2013 Resource was issued. This is demonstrated by the large increase in contained metal in the Deposit, including an 89% increase in contained Zn, a 52% increase in contained Cu, a 61% increase in contained Ag and a 48% increase in contained Au in the indicated category which equates to over 1.5 billion pounds of zinc, almost 600 million pounds of copper, over 12 million ounces of silver and over 300,000 ounces of gold. See Table 2 below outlining the contained metal in the 2019 Resource Estimate.

2 See footnotes 1-5 for Table 1

Quality Assurance and Quality Control

For drilling conducted by Foran and its consultants since 2011, an independent QA/QC protocol, consisting of blanks, standards, and duplicates introduced into the sample stream for each batch of samples processed by the laboratory and the results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. Sample analysis was performed by TSL Laboratories Ltd. (“TSL”) in Saskatoon, Saskatchewan. TSL is a CAN-P-1579, CAN-P-4E (ISO/IEC 17025:2005) accredited laboratory and independent of Foran.

Micon reviewed the QA/QC reports from these programs and noted that there were no issues that arose which would affect confidence with the assay data. Micon considers the sampling method appropriate for the deposit type, adequate security measures were maintained, and samples should be representative of the mineralization.

Prior to Micon initiating its audit of resource estimation, Foran completed a program of validation and verification of the historic drill hole database which was included in this resource estimate. This work included: re-surveying the locations of historic drill hole collars on the ground, downhole directional surveys of as many historic drill holes as possible utilizing a Gyro tool to verify downhole survey data, re-building of the historic assay database from original assay certificates, additional sampling of gaps in mineralized zones (shouldering) where required to better represent the mineralizing system and a re-interpretation of the geology and ore zones in the Deposit.

About Foran Mining

Foran is a copper-zinc exploration and development company with projects located along the Flin Flon Greenstone Belt. The McIlvenna Bay Project, Foran’s flagship asset located within the Hanson Lake District, sits just 65 kilometres from Flin Flon, Manitoba and is part of the world class Flin Flon Greenstone belt that extends from Snow Lake, Manitoba, through Flin Flon to Foran’s ground in eastern Saskatchewan, a distance of over 225 kilometres.

McIlvenna Bay is the largest undeveloped VMS deposit in the region. This world class Metallogenic Belt is host to 29 past and present producing mines, including Hudbay Minerals Inc.’s 777 and Lalor operations. The Company recently completed a large resource definition and infill drilling program in preparation for producing a feasibility study on the McIlvenna Bay Deposit.

On December 4, 2017, Foran announced the execution of a Technical Services Agreement with Glencore Canada Corporation (“Glencore”). Glencore has agreed to provide technical expertise and advice in order to advance the McIlvenna Bay Deposit to feasibility in exchange for an off-take agreement on the metals and minerals produced from the Deposit.

William Lewis, P.Geo. of Micon and a Qualified Person within the meaning of NI43-101, has reviewed and approved the 2019 Resource Estimate information in this release. Mr. Roger March, P. Geo., Vice President Exploration for Foran, is the Qualified Person for all technical information in this news release, excluding the 2019 Resource Estimate. Mr. March has reviewed and approved the technical information in this release.

Foran trades on the TSX.V under the symbol “FOM”.

For Additional Information Please Contact Foran Mining Corporation:

| Patrick Soares | ||

| President & CEO | ||

| 409 Granville Street, Suite 904 | ||

| Vancouver, BC, Canada, V6C 1T2 | ||

| ir@foranmining.com |

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Forward Looking Statements

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, Foran’s objectives, goals or future plans, statements regarding the Technical Services Agreement and, if a feasibility study will suggest an economically viable project, estimation of mineral resources, exploration results, and potential mineralization. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, work performed under the Technical Services Agreement related to preparation of a feasibility study, the failure of such study to suggest an economically viable project, failure to convert estimated mineral resources to reserves, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry, and those risks set out in Foran’s public documents filed on SEDAR. Although Foran believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Foran disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Click here to connect with Foran Mining Corporation (TSXV:FOM) for an Investor Presentation.

Source: www.globenewswire.com