Aura Minerals Announces Updated PEA for Aranzazu Mine

Aura Minerals (TSX:ORA) has announced results of a preliminary economic assessment regarding the recommencement of operations at its Aranzazu copper mine in Mexico. The PEA included an updated resource estimate for the project.

Aura Minerals (TSX:ORA) has announced results of a preliminary economic assessment regarding the recommencement of operations at its Aranzazu copper mine in Mexico. The PEA included an updated resource estimate for the project.

As quoted in the press release, highlights of the report included:

- Conceptual mine production considering 3,090 tonnes per day (“tpd”) underground mine using a combination of longitudinal and transverse long hole mining methods for the majority of the deposit, with cut & fill in the upper levels of the deposit.

- NSR cut-off of US$55/t for potentially mineable resources estimated at 6,072,000 tonnes of Measured and Indicated resources at average grades of 1.64% Copper (“Cu”), 1.16 g/t Gold (“Au”) and 20.0 g/t Silver (“Ag”), plus 4,759,000 tonnes of Inferred resources at average grades of 1.66% Cu, 1.21 g/t Au and 20.7 g/t Ag.

- Preliminary mine re-design considering 30m stope heights which allows a reduction of development costs by approximately 40% compared to the old mine design.

- An annual process plant throughput rate of 1,050,000 tonnes producing an annual average of 63,460 tonnes of Copper Concentrate at 23% Cu grade, 11.6 g/t Au and 236 g/t Ag. This is equivalent to 10.3 years life-of-mine (“LOM”).

- Future process plant recoveries (supported by historical results and metallurgical testing) of:

- Copper at 84.0%

- Gold at 59.4%

- Silver at 70.3%

- Arsenic at 37.9%

- Total Operational Costs: US$47.9/t. As referenced, the average NSR values of the mineralization mined over the LOM is US$108.7/t. All-in Costs including sustaining development average US$ 57.7/t over the LOM.

- NSR calculation considers metal values as well as penalties associated with Arsenic content in the concentrate.

- Initial Capital Expenditure is US$28.3M during Year 1 and Year 2, which includes US$12.4M outstanding debt with Suppliers and Contractors.

- Total LOM CAPEX of US$119.2M.

- The project’s net present value (“NPV”) and internal rate of return (“IRR”) are US$103.1M and 81%, respectively, based on the following metal prices: US$3.00/Lb Cu, US$1,275.00/Oz Au and US$20.00/Oz Ag.

- Payback period after the start-up of the operation is three years.

- Average yearly EBITDA of US$47.6M with an average yearly undiscounted free cash flow of US$19.2M.

Aura also provided a sensitivity analysis for the recommencement of operations at the mine:

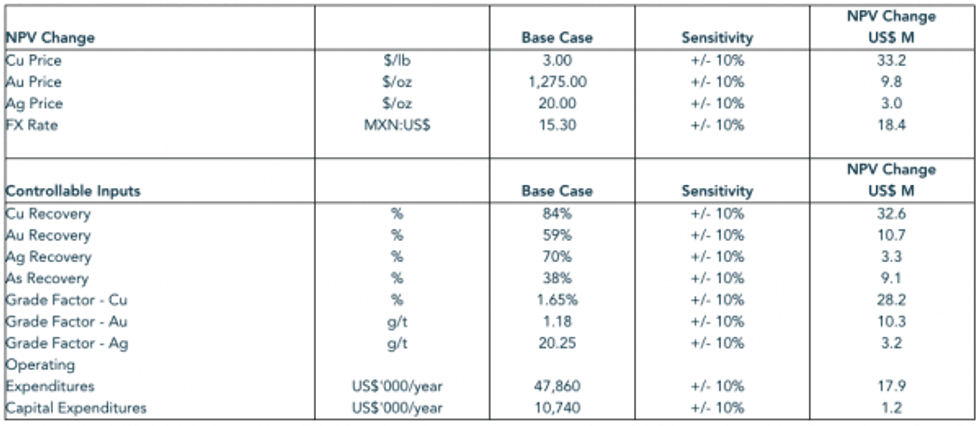

The sensitivity analysis shows the impact of the variation in non-controllable (market) and controllable (operations) assumptions upon the project NPV. The analysis has been performed for a +/-10% range in the key inputs.

Note that the sensitivities are run for each parameter independent of the others. Combining the variations in key assumptions will have a more marked impact on the economics of the project. Sensitivities have been run on the base case scenario only, and no change in mine plan or schedule has been assumed. The table below presents the results of the sensitivity analysis on the project NPV.

Of the controllable factors, copper — recovery or grade — has the greatest impact on the project NPV. A 10% change in one of those factors will impact the project NPV by approximately US$32.6M. Operating expenditure has the second highest impact on the project NPV, and a 10% change would impact the project NPV by approximately US$17.9M. Arsenic level in the concentrate also has a large effect on the project NPV with a 10% change impacting the NPV by approximately US$9.1M. These items — copper recovery and grade, operating expenditure and arsenic levels — will require particular attention in the feasibility stage to minimize their adverse impact on the project viability.

Aura president and CEO, Jim Bannantine, said:

We are very encouraged by the PEA and believe it will be indicative of the results of the feasibility level study which has commenced. A focus on the geotechnical aspects of the underground mine and a conservative approach to cut-off grade have combined to yield both lower capital expenditures and profitable result that should allow us to finance the restart of Aranzazu. These design parameters and focus are particularly important in today’s mining finance environment, and they will also leave the option open for future expansion.