Analyst Commentary: Kivalliq Almost Doubles Resource at Lac Cinquante in Nunavut and Still has Room to Grow

We first brought Kivalliq Energy (TSXV:KIV) and its Lac Cinquante Uranium resource to your attention in late August 2011 and again in early October when KIV hit an all time low of $0.21 ($25.8 million Market Capitalization). With the recent news of the company’s significant resource expansion, Kivalliq is now trading at $0.48 (at press time) with a market capitalization of $59.1 million.

We first brought Kivalliq Energy (TSXV:KIV) and its Lac Cinquante Uranium resource to your attention in late August 2011 and again in early October when KIV hit an all time low of $0.21 ($25.8 million Market Capitalization). With the recent news of the company’s significant resource expansion, Kivalliq is now trading at $0.48 (at press time) with a market capitalization of $59.1 million.

Over the past 6 months we have followed the company’s consistent success with the drill bit and watched as Kivalliq steadily expanded the strike extent of its Lac Cinquante resource as well as delineated the Western and Eastern extensions. This work has now come to fruition and the company has officially increased its resources by a whopping 92%.

On the back of this resource expansion, Kivalliq just announced a $7M non-brokered private placement with sophisticated global resource investors, which strengthens the company’s financial position.

The original resource contained 14.15 million lbs of in situ uranium hosted within 810,000 tonnes averaging 0.79% U3O8 (or 17.5 lbs uranium per tonne).

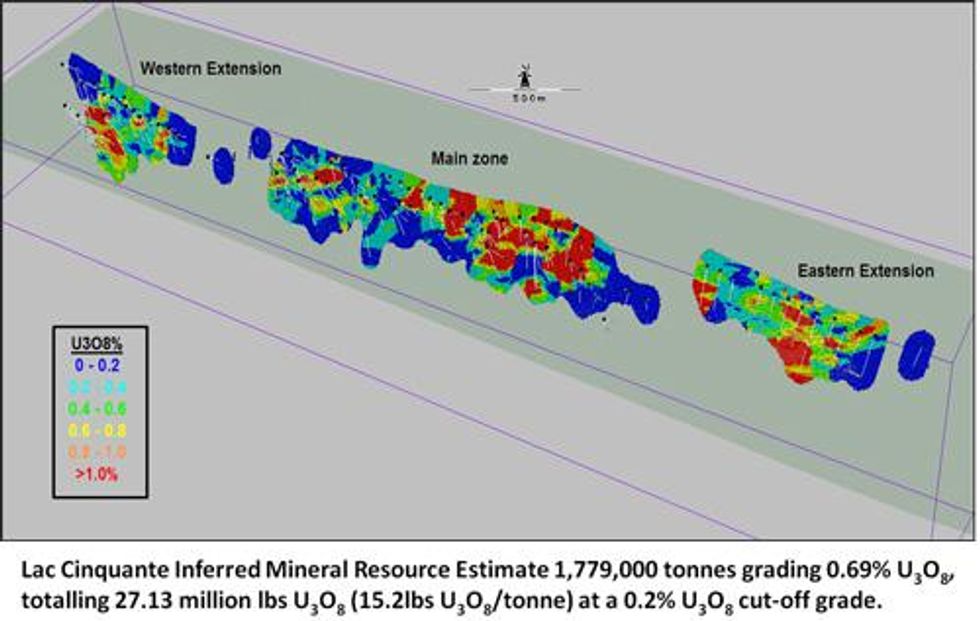

The newly updated resource now contains 27.13 million lbs of Uranium hosted within 1.8 million tonnes grading 0.69% U3O8, s (or 15.2 lbs U3O8/tonne). Both resources used a 0.2% U3O8 cut-off grade. Please refer to figure below to see U3O8 grade distribution.

As a comparison, Areva is currently in the permitting phase of its bulk-tonnage low-grade Kiggavik uranium deposit (127 million lbs U3O8 with an average grade of 0.55% U3O8). The deposit lies just 214 km north of Lac Cinquante.

In this remote region of Canada, major uranium producers like Areva or Cameco will most likely need to see at least 30 to 40 million lbs of contained uranium in a near surface resource to consider Kivalliq Energy as a potential takeover candidate. With a 27.13 million pound near surface uranium resource on its books, Kivalliq should definitely start to garner some serious attention from the majors.

As a bonus, the la Cinquante resource also contains significant quantities of silver, molybdenum and copper which can potentially improve mine economics if these minerals are recoverable (refer to resource table below for details).

Zone | Tonnes (T x 1000) | U3O8 (%) | Ag (g/t) | Mo (%) | Cu (%) | U3O8 (Mlbs) | Ag (oz x 1000) | Mo (Mlbs) | Cu (Mlbs) |

Main | 923 | 0.79 | 13.3 | 0.22 | 0.15 | 16.06 | 393.0 | 4.57 | 3.13 |

Western Extension | 598 | 0.57 | 19.0 | 0.04 | 0.38 | 7.54 | 365.4 | 0.59 | 4.97 |

Eastern Extension | 258 | 0.62 | 20.8 | 0.18 | 0.32 | 3.53 | 172.8 | 1.02 | 1.82 |

Total | 1779 | 0.69 | 16.3 | 0.16 | 0.25 | 27.13 | 931.1 | 6.17 | 9.92 |

Additional Expansion Potential

Kivalliq reports that the Lac Cinquante resource still remains open for expansion along strike to the east and west as well as to depth. The company also recently tabled promising drill results on the Blaze, Spark, Pulse and Joule uranium targets, all situated within a 3 km radius of the Lac Cinquante deposit.

Kivalliq has consistently been successful at identifying quality uranium targets near the main resource area.

Through its aggressive prospecting program Kivalliq was also able to extend the VGR target to the southwest and to a total strike length of 4 km. Sampling identified additional areas of alteration and uranium mineralization with values up to 3.75% U3O8. The area remains very prospective for unconformity-style uranium mineralization and is a high priority drill target for 2012.

In addition, three brand new targets were identified last summer; the BIF Zone, the AG showing and the Taluaq zone. These are all worthy of aggressive follow up work.

KIV Strengthens Team

This project has attracted Dale Wallster to join the Board of Directors of Kivalliq. Dale’s claim to fame is the fact that he and his team are widely credited for the discovery of Hathor’s Roughrider deposit. In January 2012, Hathor became a wholly-owned subsidiary of Rio Tinto as part of a C$650 million acquisition.

Bottom Line

- KIV has almost doubled its uranium resource without losing too much grade (currently equivalent to 15.2 lbs per tonne). The uranium price at press time was US$51.75 per lb.

- The company has excellent potential to continue to expand its resource making it more attractive to the majors.

- KIV has attracted Dale Wallster to its Board who will undoubtedly bring extensive experience as well as a following of successful Hathor investors.

- There is a significant looming supply deficit in uranium and the commodity price should continue to rise, spurring investors to look for the most promising companies in which to invest.

Thomas Schuster, Analyst Bio:

With a degree in Geological Sciences from the University of Toronto, Thomas started his career in the 1990s as an exploration geologist in the famous Timmins mining camp in Northern Ontario. He then moved to Vancouver and took a position as staff Journalist at the well-known mining publication, The Northern Miner, reporting the merits and shortcomings of Canadian exploration and mining projects worldwide. This built a foundation for his later work as a Mining Analyst for the Toronto-based institutional investment firm, Fraser Mackenzie. Thomas is currently based in Vancouver working as an independent mining analyst.

Disclosure: No positions at time of writing.

Kivalliq Energy Corporation is a client of Dig Media. Dig Media was paid a fee for the creation and dissemination of this commentary.

92% Increase to 27.13 Million lbs Uranium at Lac Cinquante

A 92% increase in the Lac Cinquante resource has been announced by Kivalliq Energy Corporation (TSXV:KIV). An Inferred Mineral Resource Estimate of 1,779,000 tonnes grading 0.69% U3O8, totalling 27.13 million lbs U3O8(15.2 lbs U3O8/tonne) at a 0.2% U3O8 cut-off grade has been reported. The Inferred Mineral Resource from the 2010 estimate for the the Lac Cinquante uranium deposit is primarily attributed to the addition of two new zones: the Eastern and Western Extensions, situated near surface, adjacent to and along strike of the Lac Cinquante Main Zone resource.

Read the full article: “92% Increase to 27.13 Million lbs Uranium at Lac Cinquante”

$7.4 Million Financing Announced by Kivalliq Energy

A non-brokered private placement financing to raise CDN$7,410,000 was announced by Kivalliq Energy Corporation (TSXV:KIV).

Read the full article: “$7.4 Million Financing Announced by Kivalliq Energy”

Click here to see the Kivalliq Energy Corp.(TSXV:KIV) profile on Uranium Investing News.