Gensource Potash Article: Disruption In Potash Production – Revisiting a Stale Sector

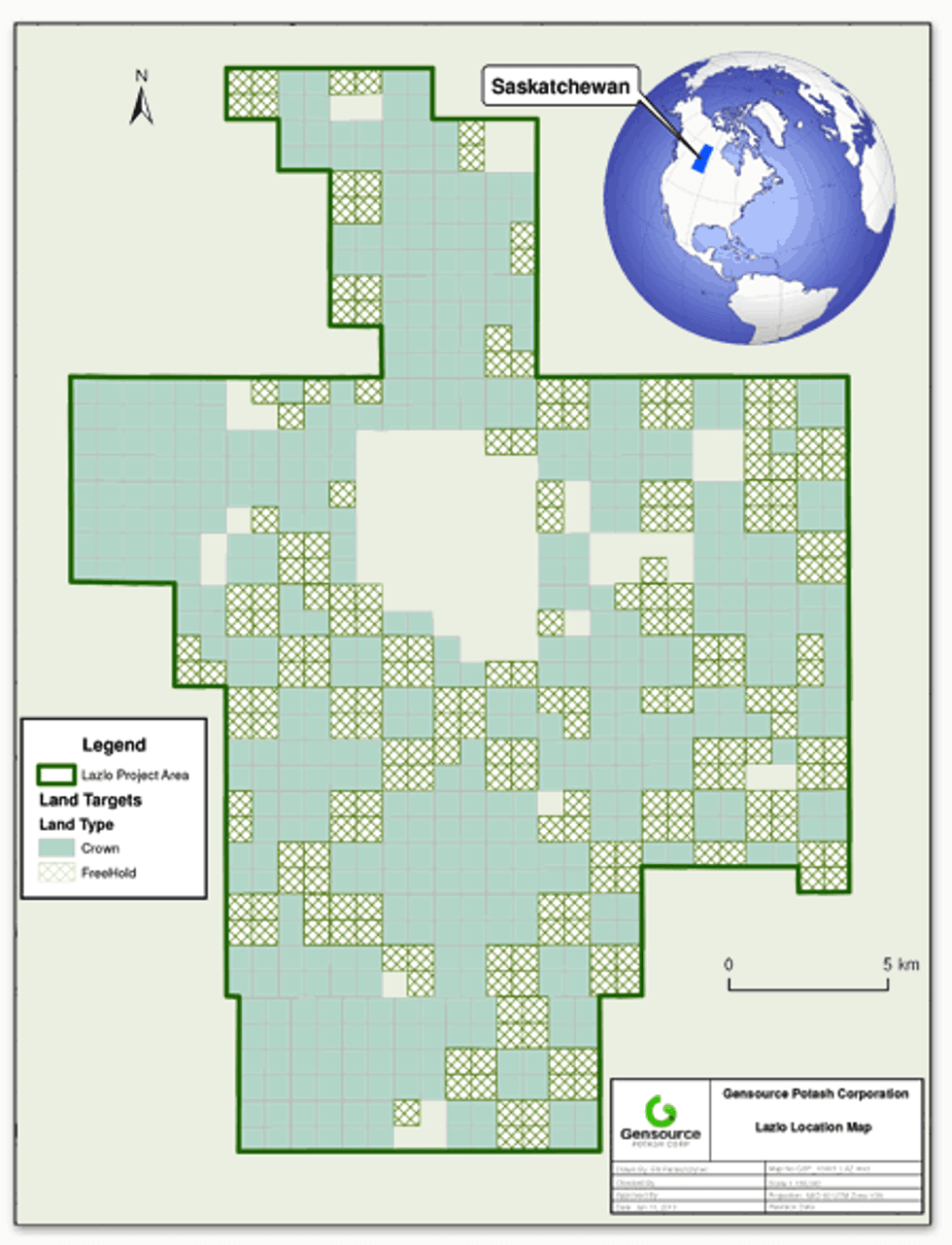

A recent article by Palisade Research titled “Disruption In Potash Production – Revisiting a Stale Sector” highlighted Gensource Potash Corporation (TSXV:GSP) and their Lazlo Project, located in potash-rich central Saskatchewan.

A recent article by Palisade Research titled “Disruption In Potash Production – Revisiting a Stale Sector” highlighted Gensource Potash Corporation (TSXV:GSP) and their Lazlo Project, located in potash-rich central Saskatchewan.

As quoted from the article:

During our research, we came across Gensource Potash Corp (TSXV:GSP), a small potash company headed by Mike Ferguson, the man behind the development of Potash One’s Legacy Project, which was eventually acquired by K+S in 2010 for $427 million.

One of the first things we review when we look at exploration and development companies is the quality of the management team. Mike alone brings enough pedigree to give Gensource Potash Corp serious credibility in the marketplace; however, the company also recently brought aboard the rock star of potash (if there is one…), Dr. Mark Stauffer. We will leave it to you to do a quick google search on him, but his most recent accolade was serving as the Chairman of Allana Potash Corp, which was acquired by fertilizer giant ICL for $110 million.

Mike Ferguson knows what it takes to work hard and develop a potash project in the traditional sense, and understands that it is near impossible in these markets to do so. However, Mike and his team are bringing a new technology to the fore, which could revolutionize the way potash is mined and extracted. This new technology, which is already proven and has been used in the United States, substantially decreases the amount of capital needed to develop a potash deposit, and gives Gensource the latitude to target smaller deposits that would normally be considered uneconomic.

Gensource’s Lazlo Project and Business Plan

For all of the reasons mentioned above, capex for selective dissolution potash projects is a fraction of conventional mining and solution mining.

Gensource’s 100%-owned Lazlo Project has conditions that are perfect for selective dissolution. The property sits in the Davidson Sub-Basin, where the Legacy Project is located – obviously an area that Mike and his team are intimately familiar with. The Lazlo Area can support several projects, but Gensource’s initial project will have a design capacity of 250,000 tonnes per annum. Once a plant site is built, ‘satellite’ deposits can be easily integrated into the project at a fraction of start-up costs, meaning the company will be able to expand operations using existing cash flow.

Gensource is currently working on defining a formal 43-101, which will be backed into an internal ‘scoping’ study for a prefeasibility study in January 2016. First production is slated for the end of 2017, at a conservative price tag of $65 million.

Of special importance is the fact that Gensource has already secured an off-take agreement for 150,000 of the planned 250,000 tonnes per annum of production. This has boosted the company’s profile and attracted the notice of the larger players, but unfortunately it has not yet resulted in liquidity infusion. Our expectation is that the company, as it progresses through its studies, will garner more and more attention. At present, however, the company has a market capitalization of just C$8.4 million and is still an excellent, undervalued contrarian play.

Connect with Gensource Potash Corporation (TSXV:GSP) to receive an Investor Kit