Top Strike Announces First Quarter Financial Results

Top Strike Resources Corp. d.b.a. “Vencanna Ventures Inc.” (the “Corporation”) (CSE:VENI) is pleased to provide a summary of its financial results as of July 31, 2018.

Top Strike Resources Corp. d.b.a. “Vencanna Ventures Inc.” (the “Corporation”) (CSE:VENI) is pleased to provide a summary of its financial results as of July 31, 2018.

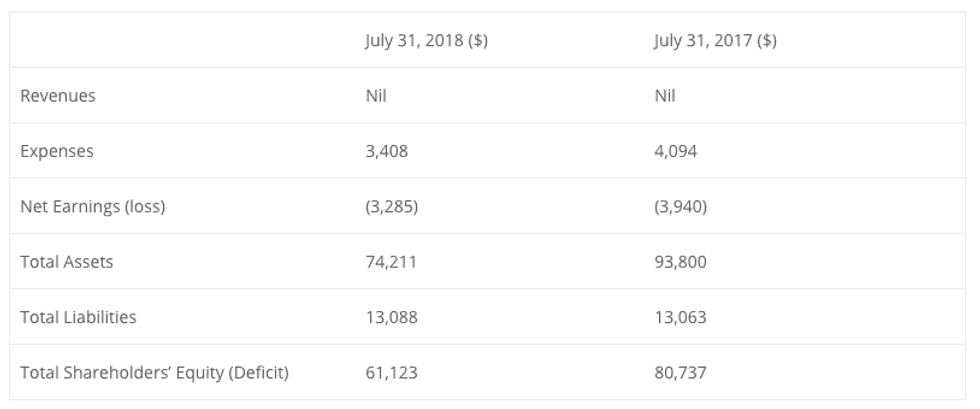

Selected financial information is outlined below and should be read in conjunction with the Corporation’s unaudited consolidated financial statements and management’s discussion and analysis for the three month period ended July 31, 2018, which are available on SEDAR at www.sedar.com.

Financial Highlights

The following table summarizes key financial highlights associated with the Corporation’s financial performance for the quarter ended July 31, 2018.

About Vencanna

On September 24, 2018, the Corporation announced the completion of a recapitalization financing, the appointment of a new management team and board of directors and commencement of trading on the Canadian Securities Exchange. The transactions have transitioned the Corporation from an oil and gas issuer to a merchant capital firm, rebranded as “Vencanna Ventures Inc.”. The recapitalized Corporation aims to be a go-to capital provider for early-stage global cannabis initiatives with an emphasis on state compliant opportunities in limited licensed jurisdictions in the United States. The Corporation looks to provide investors with a diversified, high-growth, cannabis investment strategy through strategic investments focused through-out the value chain (cultivation, processing and distribution, and including ancillary businesses).

For further information regarding this news release, please contact:

David McGorman

Chief Executive Officer and Director

Phone: (403) 351-1779

Jason Ewasuik

Vice President, Originations

Phone: (403) 992-9676

Top Strike Resources Corp.

Suite 300, 407 – 3rd Street S.W.

Calgary, AB T2P 4Z2

Source: vencanna.com