The Valens Company Reports Record Revenue And Profitable First Quarter Of Fiscal 2020

Valens GroWorks Corp. (TSXV: VLNS, OTCQX: VLNCF) reported its financial results for its first quarter, for the period ended February 29, 2020.

Valens GroWorks Corp. (TSXV: VLNS) (OTCQX: VLNCF) (the “Company”, “Valens” or “The Valens Company”), a global leader in the end-to-end development and manufacturing of innovative, cannabinoid-based products, is pleased to report its financial results for its first quarter, for the period ended February 29, 2020.

Key Financial Highlights of the First Quarter of 2020

- Revenue for the first quarter of 2020 increased to $32.0 million, a significant increase from $2.2 million in the first quarter of 2019.

- Revenue of $1.44 per gram of input in the first quarter of 2020, compared to $1.25 per gram of input in the fourth quarter of 2019.

- Gross profit increased to $18.1 million, or 56.6% of revenue, compared to $0.9 million, or 38.3% of revenue, in the first quarter of 2019.

- Adjusted EBITDA(1) was $14.3 million or 44.7% of revenue, for the first quarter of 2020, compared to negative adjusted EBITDA(1) of ($2.0 million) in the first quarter of 2019.

- Strong balance sheet with $44.3 million in cash and short-term investments and a net working capital position of $80.4 million as of February 29, 2020.

Corporate Highlights

The Company announced its corporate rebranding to ‘The Valens Company’, to further solidify its position as a global leader in the end-to-end development and manufacturing of cannabinoid-based products and better reflect the strategic vision of the business.

To align with the rebranding, the Company’s ticker symbol on the TSX Venture Exchange (“TSXV”) changed to ‘VLNS’ and its ticker symbol on the OTCQX changed to ‘VLNCF’.

The Valens Company also obtained eligibility from the Depository Trust Company (“DTC”) for its shares traded on the OTCQX, under the symbol ‘VLNCF’.

The Company received approval from the TSXV for its notice of intention to make a normal course issuer bid which allows the Company, over the 12 months from approval, to acquire up to 6,275,204 of its common shares in open market purchases. There are 127,709,952 common shares outstanding as of February 29, 2020.

Subsequent to the quarter end, the Company received conditional approval from the Toronto Stock Exchange (“TSX”) to up list from the TSXV to the TSX. The Valens Company has since received final approval to list its common shares on the TSX and will officially commence trading at the opening of the markets on April 16, 2020, under the trading symbol “VLNS.”

“The first quarter of fiscal 2020 was pivotal for The Valens Company as we hit many milestones, including posting continued quarter-over-quarter revenue growth and having oil-based cannabis 2.0 products hit the shelves in Canada amidst a challenging market backdrop. Throughout the quarter, we leveraged the flexibility of our extraction platform to help our customers navigate increasing market complexity while at the same time accelerating the scale-up of our white label capabilities. These efforts included launching a number of new product formats such as hydrocarbon-based offerings with the intention of bringing these high-demand products to customers at the beginning of the third quarter,” said Tyler Robson, CEO of The Valens Company. “In total, we saw a moderation in extraction volumes in the quarter as our customers continued to shift to smaller processing lots as a result of the slower roll-out of Cannabis 2.0 products in the broader market. Looking forward, we are starting to see some encouraging signs with respect to a return to larger extraction volumes into the back half of fiscal 2020. The first quarter also saw an increase in our revenue per gram of input which is directly related to our white label strategy and we expect this number to continue to increase throughout 2020 as this segment makes up a larger part of our revenue and overall business. This was the motivation for our rebrand to The Valens Company which represents much more than just a corporate name change, it signifies the evolution of our business into a leading cannabinoid-based product development and manufacturing company positioned to capitalize on the evolving industry on a global scale.”

“At this unprecedented time under the COVID-19 pandemic, we have taken a number of steps to ensure that the health and safety of our employees remains our top priority. Collectively, as a society, we are doing our best to navigate the uncertainty, and now more than ever, we are committed to remaining a trusted partner to our customers, consumers and communities as we work to support them as much as possible despite the challenging conditions,” concluded Mr. Robson.

Key Operating Highlights of the First Quarter 2020

19,962 kilograms of dried cannabis and hemp biomass was processed in the first quarter of 2020. During the quarter, Valens worked with a number of its clients to process white label products in preparation for the launch of edibles and concentrates for Cannabis 2.0. As a result, revenue-per-gram of input increased to $1.44/gram in the first quarter of 2020, compared to $1.25/gram in the fourth quarter of 2019 and $0.61/gram in the third quarter of 2019. Revenue-per-gram is expected to continue to increase throughout 2020 as product development and white label contracts continue to grow in number, and revenue from extraction contracts contributes to a lesser proportion of total revenue.

The Company has 25 SKUs across 5 different product lines in its development pipeline and expects this to continue to grow throughout 2020 to meet demand from its customers for Cannabis 2.0 products, including vape pens, edibles, concentrates, cannabis-infused beverages, topicals, tinctures, and capsules.

The Company announced a four-year extraction and white label agreement with Emerald Health Therapeutics Inc. with annual minimum quantities of 10,000 kilograms.

The Company entered an amended manufacturing and sales licence agreement with SōRSE Technology Corporation (“SōRSE”) which grants Valens an exclusive licence to use the proprietary SōRSE emulsion technology to produce, market, package, sell and distribute cannabis infused products in Canada, the United Kingdom, Europe, Australia and Mexico.

The Company entered into multi-year distillate and SōRSE emulsion supply agreement with large-scale confectionary company, Dynaleo Inc.

The Company also announced receipt of its first international purchase orders of white label products to customers in Australia. Based on the purchase orders received, the initial shipments will consist of three SKUs of tinctures, totaling over 3,000 units, and are expected to be shipped in the coming months, pending receipt of necessary import and export permits.

Valens entered into a multi-year manufacturing agreement with a Health Canada licensed party that provides the Company with additional licensed capacity to demand for white-label product development services. Under the terms of the agreement, an initial cGMP certified 5,000 square feet has been allocated to Valens operations with a total of up to 50,000 square feet being made available subject to the counter-party receiving the required Health Canada licence amendment.

Subsequent to the quarter end, the Company launched a line of cannabis-infused beverages, produced under a white label agreement with A1 Cannabis Company (a subsidiary of Iconic Brewing). The new line of beverages includes BASECAMP, a CBD-forward iced tea that sold out in its first week of release, and SUMMIT, a THC-forward citrus water. Both beverages are currently available in select retailers across Ontario.

Jeff Fallows, President of The Valens Company, said, “We are seeing challenges in the current market environment with several of our customers experiencing reduced workforces, temporary decreases in cultivation output, and a resulting reduction in demand for extraction services. Although retail demand for cannabis has surged during the COVID-19 pandemic and we are experiencing strong white label sales going into the second half of fiscal 2020, we are unable to predict the full impact these challenges will have on our second quarter financials. That being said, we continue to benefit from the flexibility of our platform, the quality of our output and the experience of our team in accessing opportunities both in the near and longer term. With a breadth of new products on the horizon, a white label platform that surpasses even the largest Canadian cannabis companies and a diversified customer base, we are well-positioned to adapt to ever-changing environments. Our strong cash position does not leave us complacent as our team looks to maximize capital allocation to generate the highest return on invested capital for our shareholders.”

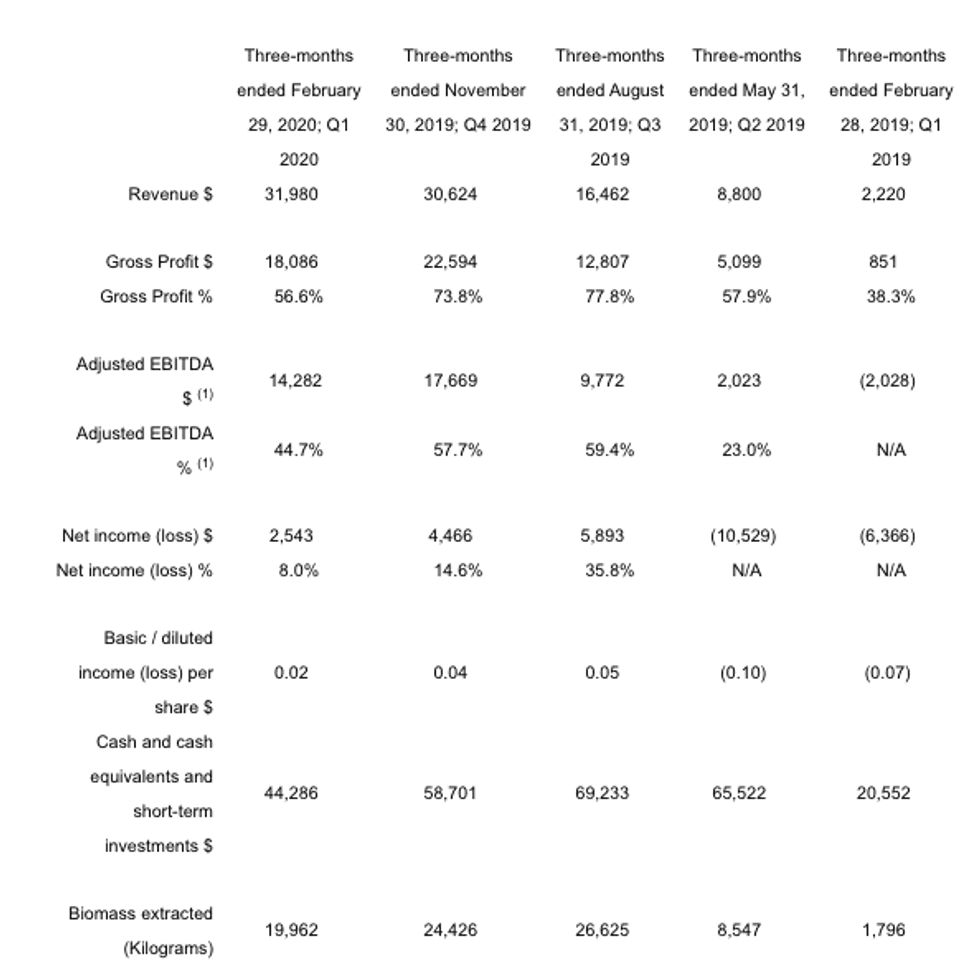

The following table of financial highlights is presented in thousands of Canadian dollars, except per share and biomass extracted amounts.

1 Adjusted EBITDA is a non-GAAP measure used by management that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. Management defines adjusted EBITDA as income (loss) and comprehensive income (loss) from operations, as reported, before interest, tax, depreciation and amortization, and adjusted for removing share-based payments, unrealized gains and losses from short term investments and other one-time and non-cash items including impairment losses. Management believes adjusted EBITDA is a useful financial metric to assess its operating performance on an adjusted basis as described above. See reconciliation of “Adjusted EBITDA (non-GAAP measure)” in the Company’s Management’s Discussion and Analysis for the period ended February 29, 2020 for additional information.

The management’s discussion and analysis for the period and the accompanying financial statements and notes are available under the Company’s profile on SEDAR at www.sedar.com.

Conference Call Details

The Company will host a conference call tomorrow, Wednesday, April 15, 2020, at 11:00 am Eastern Time / 8:00 am Pacific Time to discuss the financial results and business outlook.

Participant Dial-In Numbers:

Toll-Free: 1-877-407-0792

Toll / International: 1-201-689-8263

*Participants should request The Valens Company Earnings Call or provide confirmation code 13701091

The call will be webcast on the Valens Investor page of the Company website at https://thevalenscompany.com/investors/ or at this link. Please visit the website at least 15 minutes prior to the call to register, download, and install any necessary audio software. A replay of the call will be available on the Valens Investor page approximately two hours after the conference call has ended.

Tyler Robson, Chief Executive Officer, Chris Buysen, Chief Financial Officer, Jeff Fallows, President, and Everett Knight, Executive Vice President of Corporate Development and Capital Markets, will be conducting a question and answer session following the prepared remarks.

About The Valens Company

The Valens Company is a global leader in the end-to-end development and manufacturing of innovative, cannabinoid-based products. The Company is focused on being the partner of choice for leading Canadian and international cannabis brands by providing best-in-class, proprietary services including CO2, ethanol, hydrocarbon, solvent-less and terpene extraction, analytical testing, formulation and white label product development and manufacturing. Valens is the largest third-party extraction company in Canada with an annual capacity of 425,000 kg of dried cannabis and hemp biomass at our purpose-built facility in Kelowna, British Columbia which is in the process of becoming European Union (EU) Good Manufacturing Practices (GMP) compliant. The Valens Company currently offers a wide range of product formats, including tinctures, two-piece caps, soft gels, oral sprays and vape pens as well as beverages, concentrates, topicals, edibles, injectables, natural health products and has a strong pipeline of next generation products in development for future release. Finally, the Company’s wholly-owned subsidiary Valens Labs is a Health Canada licensed ISO 17025 accredited cannabis testing lab providing sector-leading analytical services and has partnered with Thermo Fisher Scientific to develop a Centre of Excellence in Plant-Based Science. The Company expects to formally change its name in due course. For more information, please visit https://thevalenscompany.com. The Company’s investor deck can be found specifically at https://thevalenscompany.com/investors/.

Notice regarding Forward Looking Statements

This news release contains certain “forward-looking statements” within the meaning of such statements under applicable securities law. Forward-looking statements are frequently characterized by words such as “anticipates”, “plan”, “continue”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed”, “positioned” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Various assumptions were used in drawing the conclusions or making the projections contained in the forward-looking statements throughout this news release. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

The TSXV or other regulatory authority has not reviewed, approved or disapproved the contents of this press release. We seek Safe Harbour.

Click here to connect with The Valens Company (TSXV:VLNS, OTCQX:VGWCF) for an Investor Presentation.